Our goal here at Credible Operations, Inc., NMLS Number 1681276, referred to as “Credible” below, is to give you the tools and confidence you need to improve your finances. Although we do promote products from our partner lenders who compensate us for our services, all opinions are our own.

How much you can get in student loans depends on factors such as your dependency status, student status, and the student loan type. (Shutterstock)

The amount you can borrow in student loans is generally limited. These limits depend on the type of loans you take out, whether you’re a dependent, and other factors.

No matter what your limit is, it’s best to only borrow what you truly need. You should also exhaust your federal loan options first, before turning to private loans, as federal student aid comes with certain benefits and protections.

Credible lets you compare private student loan rates from multiple lenders, all in one place.

How much can you get in federal student loans?

The amount you can borrow in federal loans depends on a few factors, including your dependency status, your academic year, and whether you’re an undergraduate or graduate student.

It also depends on the type of federal student loan you take out. The three main types of federal loans are:

- Direct Subsidized Loans — Undergraduate students who demonstrate financial need typically qualify for this type of loan. The U.S. Department of Education pays the interest on Direct Subsidized Loans, as long as you meet the eligibility requirements.

- Direct Unsubsidized Loans — Available to both undergraduate and graduate students, these loans aren’t based on financial need. Borrowers are responsible for paying all accrued interest. Your school’s financial aid office determines how much you can borrow — this amount is based on your cost of attendance and any other financial aid you receive.

- Direct PLUS Loans — Parents of dependent undergraduate students, as well as graduate and professional students, can take advantage of these loans for expenses that aren’t covered by other types of financial aid. You’ll need to go through a credit check, and your loan limit is your cost of attendance minus any other financial aid you receive.

Borrowing limits for dependent undergraduate students

You’re considered a dependent undergraduate student if you still receive some sort of financial support from your parents. If you hit either your annual or total borrowing limit and your parents don’t qualify for a PLUS Loan, the higher federal student loan limits for independent undergraduate students apply to you.

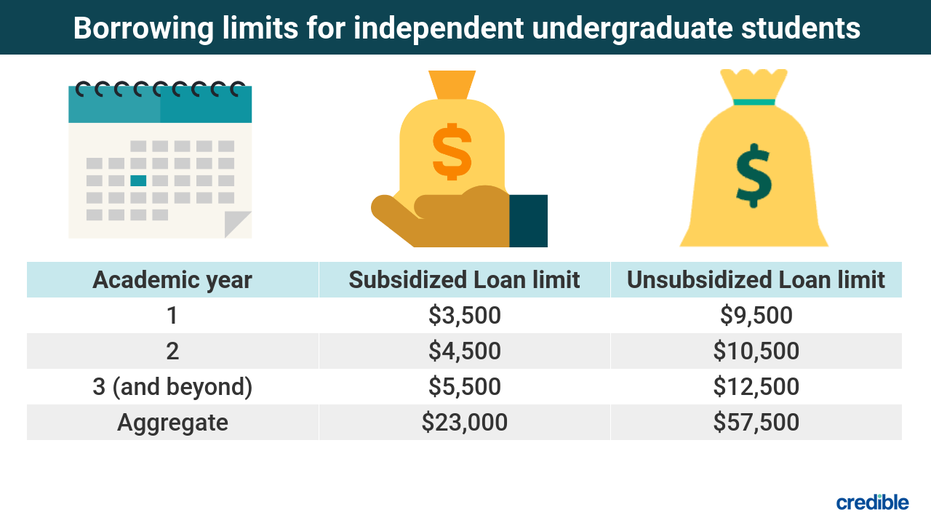

Borrowing limits for independent undergraduate students

An independent undergraduate student is someone who doesn’t have the financial support of their parents and meets at least one of the following criteria:

- At least 24 years old

- Married

- A veteran

- A member of the armed forces

- An orphan or a ward of the court

- Has legal dependents other than their spouse

- An emancipated minor

- Homeless or at risk of becoming homeless

If you’re independent of your parents, you can borrow a bit more compared to dependent students.

Borrowing limits for graduate students

Your borrowing limits are higher if you’re a graduate student, since you’re also considered an independent student. But your total borrowing limit includes the amount you’ve already borrowed for your undergraduate studies.

- Annual Unsubsidized Loan limit — $20,500

- Total Subsidized Loan limit — $65,500

- Aggregate loan limit — $138,500

Borrowing limits for Direct PLUS Loans

Direct PLUS Loans are best for parent borrowers or graduate students who need additional financial aid to fill in tuition gaps. They’re a good fit for those who have already hit the aggregate or annual limits on Direct Subsidized or Unsubsidized Loans, or parents who want the benefits of federal student loans, like income-driven repayment plans.

Unlike other types of federal loans, PLUS Loans have no limits — the maximum you can borrow is your school’s cost of attendance minus any other financial aid you’ve received.

Since PLUS Loans have higher interest rates than other types of Direct Loans, it’s best to max out any Direct Unsubsidized and Subsidized Loan limits first. Keep in mind that you’ll need to go through a credit check as part of the application process.

Federal student loan benefits

Federal student loans are generally easier to qualify for as a student, since they don’t require a credit check or a cosigner to take out a loan.

In addition, the fixed interest rates on federal loans tend to be lower than the rates on private student loans, which could save you thousands — if not more — over the life of your loan. And if you take out a Direct Subsidized Loan, the U.S. Department of Education pays your interest until you graduate (while enrolled at least half-time), and for the first six months after you leave school. Private loans generally don’t offer this benefit.

One of the biggest benefits of federal student loans is their repayment plans. If you’re struggling to make loan payments, you can sign up for an income-driven repayment plan, where your monthly payment is adjusted based on your income. You may also qualify for student loan forgiveness, a benefit that private student loans aren’t eligible for.

If you need to take out private student loans, visit Credible to compare private student loan rates from various lenders in minutes.

How much can you get in private student loans?

Private student loan limits vary by lender, but the maximum amount you can borrow is generally your school’s cost of attendance.

If you have low or limited credit history, you’ll likely need a cosigner, since private student loan lenders require a credit check and other financial details (such as your income) as part of your application.

The following eight Credible partner lenders offer private student loans.

Ascent

- Minimum loan amount: $2,001

- Maximum loan amount: $200,000

Citizens Bank

- Minimum loan amount: $1,000

- Maximum loan amount: 100% of school-certified cost of attendance

College Ave

- Minimum loan amount: $1,000

- Maximum loan amount: 100% of school-certified cost of attendance (minus other financial aid)

Custom Choice

- Minimum loan amount: $1,000

- Maximum loan amount: $180,000

EDvestinU

- Minimum loan amount: $1,000

- Maximum loan amount: $200,000

INvestEd

- Minimum loan amount: $1,001

- Maximum loan amount: 100% of school-certified cost of attendance (minus other financial aid)

MEFA

- Minimum loan amount: $1,500

- Maximum loan amount: 100% of school-certified cost of attendance (minus other financial aid)

Sallie Mae

- Minimum loan amount: $1,000

- Maximum loan amount: 100% of school-certified cost of attendance

How much should you borrow?

You should only borrow what you truly need to pay for your tuition and other educational expenses. Borrowing more means you’re responsible for a higher loan balance and the interest charges that come with it. To determine what amount to borrow, estimate how much you think you’ll need to cover all your expenses, including tuition, housing, meal plans, books, and supplies.

Remember, it’s always best to exhaust your federal loan options first. That’s because federal student loans offer benefits and protections that private student loan lenders typically don’t.

Once you’ve maxed out all your federal loan options, you may want to consider private student loans to help you fill in any financial gaps. When choosing a private lender, consider features beyond just the borrowing limit to ensure your loan is the best fit for you. Shop around and compare rates and terms, and find out what you may qualify for before signing on the dotted line.

With Credible, you can compare private student loan rates without affecting your credit.