Over the past six months, the stock market has gone from inconsolable to imperturbable.

From October through December, every upbeat fundamental trend or would-be positive catalyst was ignored or mocked by a seller-dominated market that dropped just about 20 percent from high to low over three months.

Third-quarter earnings up 20 percent? Cute, but old news, the market answered. Corporate buyback window re-opens in November? Not a factor, they’ll have to buy them lower. Mid-term elections “always” followed by gains? Not this time. December “never” the worst month of a year? Just watch.

The market simply had to go lower, and lower still, to exhaust the determined liquidation and price in the end-of-cycle anxieties before any bullish inputs found traction.

Flash to this year, when it’s the cautious or ominous headlines and signals that are being shrugged off.

Dramatic market lows after a bad correction are usually “retested” within several weeks, you say? Nope, the S&P 500 is up 23 percent in three-and-a-half months with little more than a 3 percent pullback along the way. Earnings forecasts have been slashed by the most in years, and are now posing 4 percent drop for the first quarter? Stocks are apparently looking ahead, and the more-stable-earning sectors have led the upside. Global growth is near stall speed? Sure, but look at those dovish central banks and the “green shoots” in China.

Does this mean the market simply has to go higher, and higher, in order for the downbeat factors to challenge the rally, in a mirror image of last year?

Could well be the case. The S&P 500 is less than a 1.5-percent chip shot from matching its record high set in September, so it would be perverse if the bulls didn’t make a closer run at it before too long.

To state what should be obvious: Markets that ignore bad news and turn stubborn investor caution into the best start to a year in 21 years, as this one has, are strong and should get the benefit of the doubt unless and until a routine pullback proves something more than that.

After all, the S&P is simply at levels it first reached some 15 months ago in the furious, giddy rally following the big 2017 corporate tax cut — and markets that reclaim a new high after more than a year going sideways in a jagged range can be said to have formed some kind of base, as happened from 2015-2016.

Credit conditions are steady, Treasury yields are helpfully off their lows — all consistent with equities remaining well-supported.

The stock market likes nothing better than a Federal Reserve that’s more dovish than domestic economic conditions seem to warrant, which is what we seem to have, based on the way the U.S. job market has remained strong and the first-quarter stutter-step in GDP growth could turn out quite modest.

But given the firmer data, how much incremental dovishness can be expected, White House calls for a half-percent rate cut notwithstanding?

Maybe we’ll see, and perhaps Fed forbearance, a firm economy and a budding tech-darling IPO boom will push the mood from cautious optimism to outright exuberance. Even a stunted, equivocal version of the 1999 market would make for meaningful upside, if not of the most durable kind.

Even so, this sturdy, methodical rally is due for at least a rest as it generates just enough cautionary counterpoints to keep in place a decent worry wall for the indexes to climb.

At this point there are signs that the rally is falling short on measures of momentum and breadth, and the case can be made that the risk-reward setup isn’t terribly compelling in the near term

For one thing, the index is simply stretched to the upper end of its recent trend. This chart including the Bollinger band channel lines show this, though it doesn’t say if the index might overshoot, go flat or pull back.

Craig Johnson, technical strategist at Piper Jaffray, noted Friday that the number of S&P 500 stocks making new four-week highs had receded to 22 percent, from well above 30 percent back in February. That’s arguably a modest divergence with an S&P 500 clicking to greasy year-to-date highs.

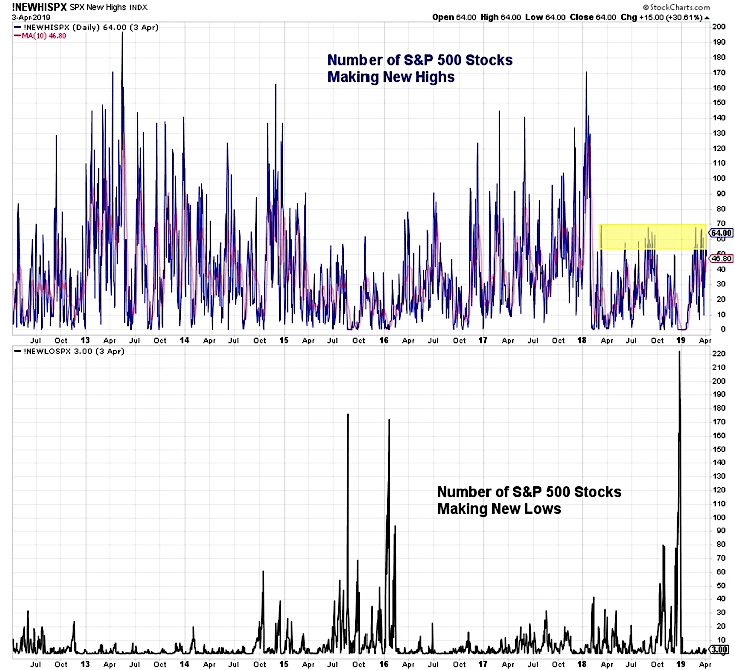

In a related point, Willie Delwiche of Robert W. Baird, cites this chart showing the number of S&P 500 names making new 52-week highs has been riding in the 50-70 range lately, below the amount one might expect for an index nearing a high itself, if this move is the start of a longer, stronger uptrend.

Along a similar line, one could quibble that cyclical and risk-appetite indicators such as the Dow Jones Transportation Average and the small-cap Russell 2000 are 7 and 9 percent, respectively, off their 2018 highs.

These market segments have no magical predictive powers, of course, but their underperformance says a bit about the character of this market: resilient and resourceful in rotating toward more reliable mega-cap growth and defensive sectors, feeding off low bond yields and solicitous central banks — taking what the conditions give.

And last week did see better data allowing industrials and banks to make upside progress relative to the broad market, allowing at least for the chance that investors are looking ahead to firmer growth and the eventual revival in earnings

A chance, for sure. Yet entering earnings season, we have the benchmark perched near a high and forward valuations pushing the upper end of their five-year range even as earnings forecasts are flattered by sharp projected upturn from mid-year through early 2020.

Offsetting sell-the-news and buy-the-beat reactions tend to make for noisy sideways choppiness during earnings season. A decent test for investors’ willingness to accept a staticky message from companies in a market that so far in 2019 has been tuning out most bad news.