Emerging markets are proving one of the victims of an escalating Sino-U.S. trade conflict. The EEM emerging markets ETF stumbled out of the gate in August, falling 1.5 percent, and pushing closer to bear market territory.

Todd Gordon, founder of TradingAnalysis.com, sees more pain coming to the group.

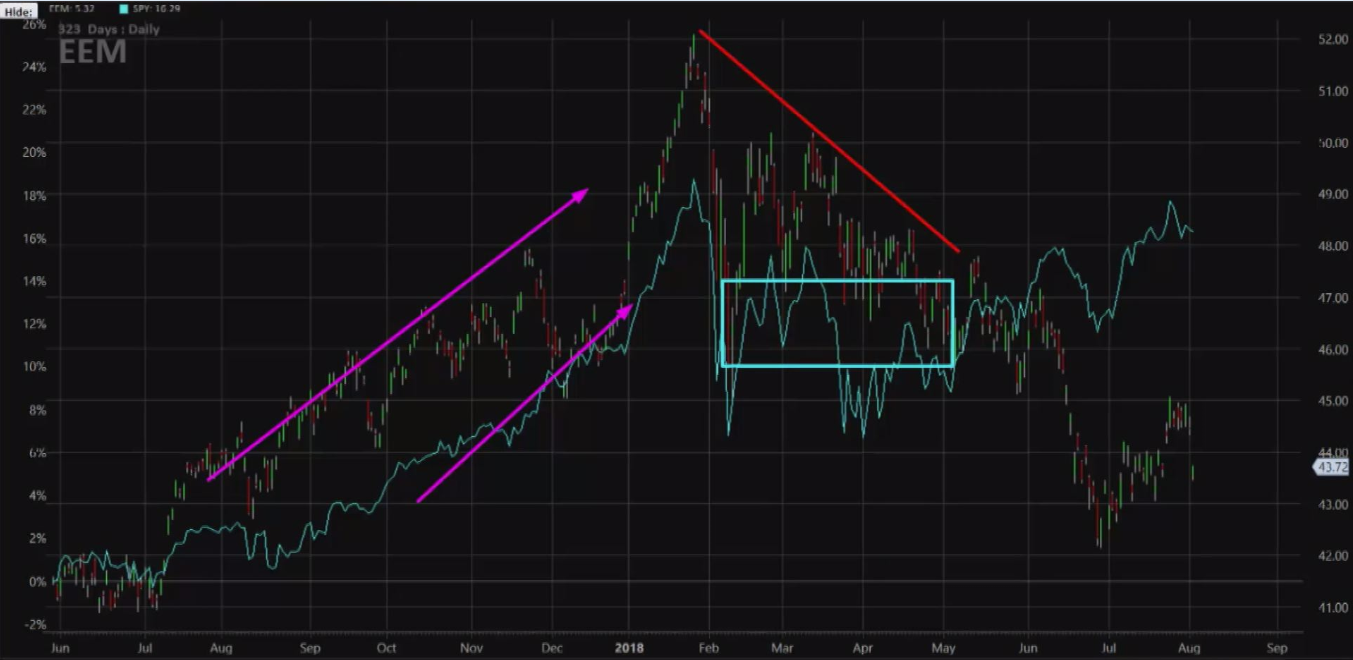

Emerging markets began the year tightly correlated with the S&P 500, said Gordon. That relationship began to deteriorate in April as trade tensions started to ratchet higher. Since then, the S&P 500 has drifted back toward record levels, while the EEM ETF has fallen to lows not seen in a year.

The EEM ETF is now flashing bearish signals, he said. It is currently in a solid downtrend after tumbling more than 5 percent in June, its worst month since February. Gordon sees it now setting up for another leg lower as its charts form a corrective pattern.

Use this weakness to take advantage of the continued push lower, said Gordon. He bought the September monthly 43 put and sold the 41 put for a total of 44 cents. If the EEM ETF ends below $41 on Sept. 21, Gordon would have made a profit of $156. If it closes above $43, he loses $44 per options spread he paid for the trade.

The trade: Gordon is suggesting buying the September monthly 43/41 put spread in EEM for about $44 per options spread.

Bottom line: Gordon sees EEM falling below $41 on Sept. 21 expiration.