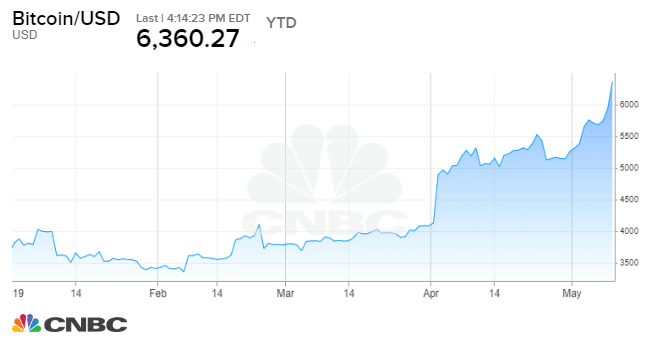

Bitcoin far outperformed major U.S. markets this week.

The world’s largest cryptocurrency climbed as high as $6,426.83 on Friday, bringing its one-week gains to more than 12%. Bitcoin is now up 70% since the start of this year.

Earlier this week, the cryptocurrency hit the $6,000 level for the first time since mid-November. It still struggles to rebound anywhere near its all-time high of $20,000, reached in late 2017.

Meanwhile, U.S. markets recovered from their Friday lows, but the S&P 500 still suffered its worst week of the year. Both the Dow Jones Industrial Average and S&P 500 fell more than 2% this week, while the Nasdaq dropped 3%.

Brian Kelly, founder and CEO of BKCM, pointed to recent institutional interest in crypto trading from major institutions. Fidelity Investments plans to allow customers to buy and sell cryptocurrencies, Bloomberg reported earlier this week.

“While many investors have flocked to Coinbase over the last few years, we still anticipate a large amount of pent-up demand from retail investors,” Kelly said. “A word of caution, timing the flows from these retail behemoths may prove to be tricky.”

Kelly said many investors were burned by multiple false alarms about approval of a bitcoin exchange traded fund, or ETF. In this case, “market participants do not appear to be pricing in the impact of the two largest retail brokerage firms offering cryptocurrency trading,” he said.

Still, the trading environment comes with potential landmines for retail investors. This week, hackers stole 7,000 bitcoin, worth more than $40 million, from one of the world’s largest cryptocurrency exchanges, Binance.

Jeff Dorman, chief investment officer at Los Angeles-based digital asset manager Arca said, despite the bad news, bitcoin hasn’t found equilibrium yet.

“This rally has sustained because the positive events surrounding crypto have outweighed the negative risks for months,” Dorman said. “More importantly, the negatives are largely one-off ‘black swan’ type events that create tail risk but are not persistent, whereas the positives are long-term game changing events that lead to sustained growth.”

Bitcoin is still a divisive topic among its believers and skeptics. Economist Nouriel Roubini, known for predicting the financial crisis, called cryptocurrencies the “mother and father of all bubbles” at the SALT 2019 conference in Las Vegas. Roubini was debating bitcoin bull and former hedge fund manager Michael Novogratz, who called it “a small miracle.”

WATCH: Bitcoin’s back above $6K, but one trader says the bounce won’t HODL