CNBC’s Jim Cramer discussed market manipulation on Tuesday and advised investors to get their money out of cryptocurrency while they still can.

“I want you to be able to protect yourself from scams that are designed to fake you out and part you from your money,” Cramer said. “I view this as actually my job now, because how can we make money together if you’re just going to lose it in these scams and schemes?”

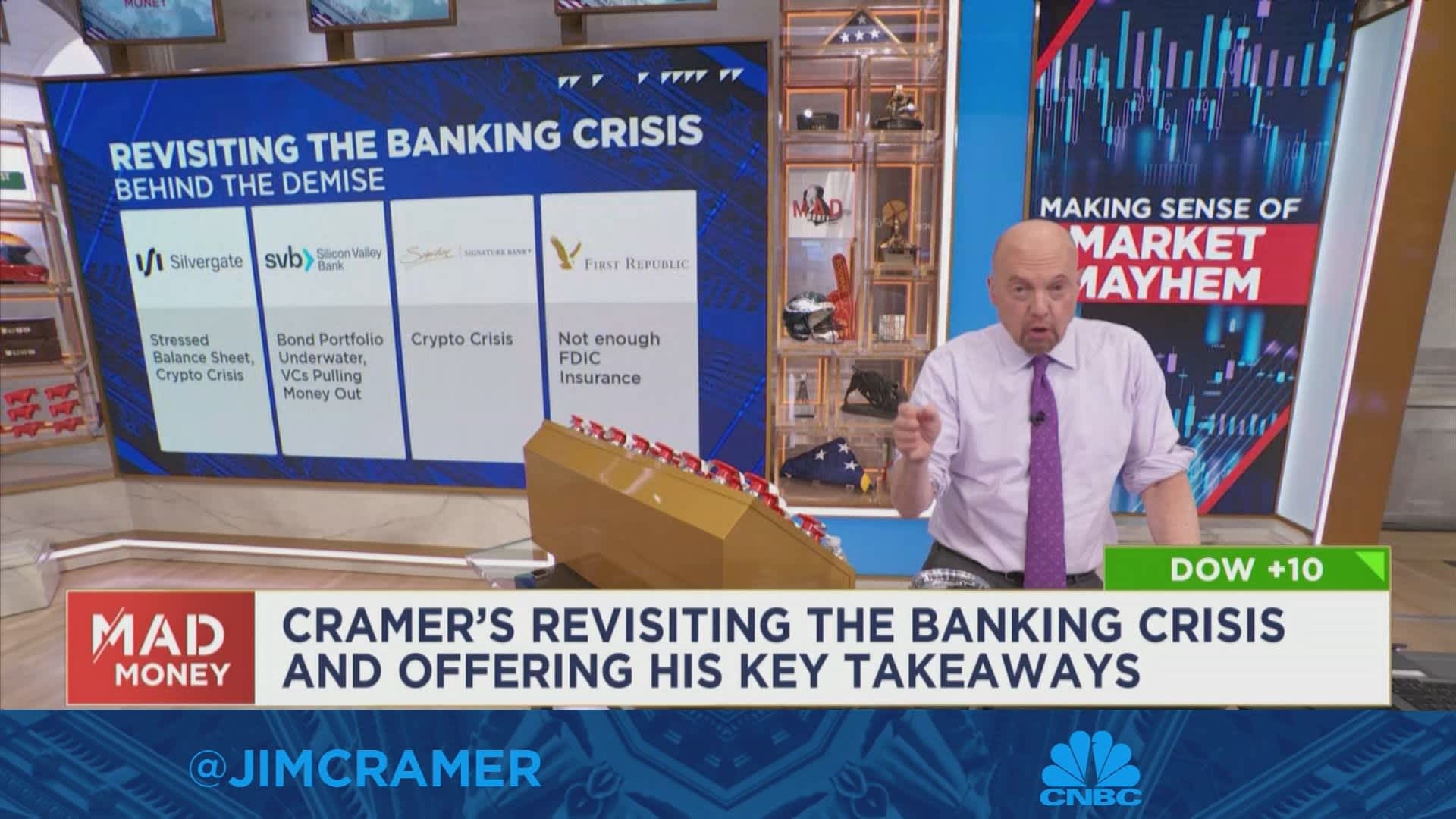

Cramer detailed the recent banking mini-crisis that tanked entities including Silvergate, Silicon Valley Bank, Signature Bank and First Republic, which all went under for a myriad of reasons. However, in the the wake of their demise, hedge funds made the big bucks by shorting.

“It was actually child’s play for the shorts. [Hedge funds] made tons of money,” Cramer said. “Sadly, they also vanquished the regional banks’ shareholders, and they’re all going to make it much harder for credit to come by, even as they enriched their wealthy clients doing so.”

But unlike the banks, Cramer said, at this point, he believes cryptocurrencies are primarily scams. He described crypto platforms as “poppycock” and sad that if you still have your money locked in with them, you’re just a fool.

“Now, what do you do if you’re involved with these kinds of outfits? The same thing you should’ve done with the SPACs or the IPOs that were bad or the meme stocks a year and a half ago: get out now,” Cramer said. “Go buy T-bills. I’m not kidding. Just do that.”

Cramer echoed SEC Chair Gary Gensler, emphasizing that platforms like Binance are as lawful as the wild west and stressing that it’s possible to lose everything because there are no regulations.

“Sometimes, you get stocks that are manipulated lower like the regional banks, then you get assets that are manipulated higher on bogus exchanges, like a huge chunk of the crypto ecosystem. Both are an affront,” Cramer said. “You’re never going to get any credence on Mad Money when you do this stuff to our viewers. I am after you, and I’m not done. I’m getting started.”