Sundar Pichai, CEO, Alphabet

Lluis Gene | AFP | Getty Images

Alphabet reported 11% revenue growth in the third quarter, as a rebound in advertising pushed expansion into double digits for the first time in over a year. The shares dropped about 5% in extended trading as the cloud business missed analysts’ estimates.

Here are the results.

- Earnings per share: $1.55 per share vs. $1.45 per share expected by LSEG, formerly known as Refinitiv.

- Revenue: $76.69 billion vs. $75.97 billion expected by LSEG, formerly known as Refinitiv.

The company also reported the following numbers:

- YouTube advertising revenue: $7.95 billion vs. $7.81 billion expected, according to StreetAccount

- Google Cloud revenue: $8.41 billion vs. $8.64 billion, according to StreetAccount

- Traffic acquisition costs: $12.64 billion vs. $12.63 billion, according to StreetAccount

The double-digit increase in revenue comes after four quarters of single-digit expansion. Google’s core advertising weakened due to economic softening last year and increased competition from TikTok.

For the third quarter, the company reported advertising revenue of $59.65 billion, up from $54.48 billion a year ago. YouTube advertising revenue beat analyst expectations, reporting $7.95 billion.

Cloud revenue came in below estimates at $8.41 billion, missing the mark by more than $20 million.

Alphabet’s cloud unit has been a key area of investment as the company tries to catch Amazon Web Services and Microsoft Azure. The business is becoming even more important with the emergence of generative artificial intelligence, because more companies are turning to the public cloud to run hefty workloads.

Even though the unit disappointed, cloud still grew 22% from a year earlier, double the rate of expansion for the company as a whole. The business also swung to an operating profit of $266 million after losing $440 million in the same period a year earlier.

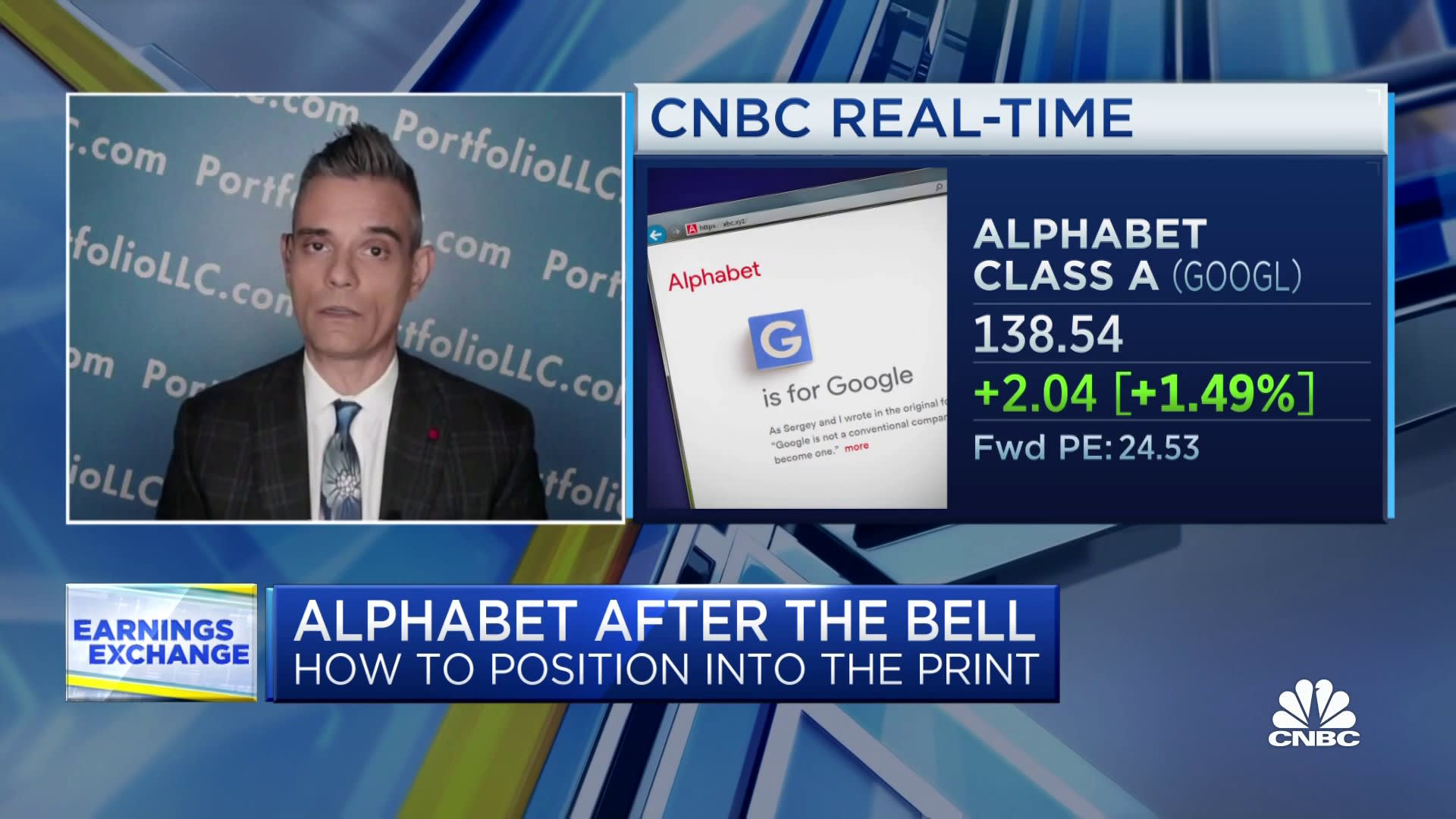

“If you want this stock to keep going higher, you’ve got to have cloud become more profitable,” said Lee Munson, chief investment officer of Portfolio Wealth Advisors, in an interview on Tuesday with CNBC’s Kelly Evans. “It’s a third-rate cloud platform. We need to see it make money.”

Following the launch late last year of OpenAI’s ChatGPT chatbot, Google has been racing to add generative AI technology to more products and is testing it within core search. Generative AI, which provides more creative and thorough answers to simple text queries, could potentially have a major effect on Google’s search — and ads — business if people alter how they look for information online.

Other Bets, which includes the Waymo self-driving car business and the Verily life sciences unit, reported revenue of $297 million, up from $208 million the year prior. However, it reported a loss of $1.19 billion, narrowing slightly from $1.23 billion the prior year.

Much of Google’s year so far has been highlighted by cost cuts after years of unbridled growth. In January, the company announced it was cutting 12,000 jobs, affecting roughly 6% of its full-time workforce. Last month, the company eliminated hundreds of positions from its recruiting organization.

During the third quarter, Google made focused layoffs in various business organizations within the company. An estimated 40 to 45 workers in the news division lost their jobs. The company also laid off more employees from its self-driving car unit Waymo, which recently announced an expansion of its driverless ride-sharing service.

WATCH: Google Cloud must become more profitable for stock to keep going higher