Call it blockbuster gains.

Disney gained more than 4% Thursday after Morgan Stanley raised its target on the stock to $160 per share — about 17% higher than current levels — based on potential growth from the new Disney+ streaming service.

Shares of the media giant are pacing for their best first half of the year in almost two decades, gaining 29% year to date — handily outperforming the S&P’s 16% rise. The stock is trading within 1% of its April all-time high, but two experts say there’s still upside ahead.

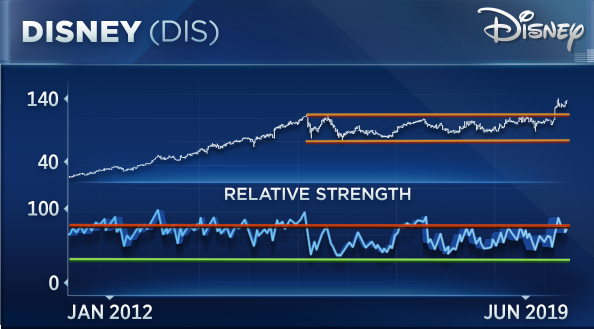

Miller Tabak’s Matt Maley argues that the stock chart suggests the start of a bullish uptrend. After years of trading in a sideways range, the stock finally broke out in April thanks to strong first-quarter earnings. The stock then dipped in May, along with the broader market, but made a “higher low,” meaning that it didn’t fall all the way back to its former level. This, according to Maley, is a “nice breakout” and an indication that an even bigger rally could be next.

For some time it seemed the Street’s consensus view was that Netflix could do no wrong — it was the media name to be reckoned with, especially as Disney grappled with a slowdown in ESPN subscribers. Now, the tables may have turned.

“You talk about the streaming situation where people are saying buy Disney and sell Netflix on a fundamental basis. Well on a technical basis that may be a very good trade indeed because Netflix is testing its 200-day moving average to the downside, ” Maley said Thursday on CNBC’s “Trading Nation.”

Netflix’s 200-day moving average — a key technical indicator — has been a “very important support” level this year, Maley said, adding that a move below it could be “quite negative” for the stock. “If people are looking to lighten up a little bit on their FANG stocks, selling Netflix and going into Disney should be a good play,” he said.

He did note that while Disney looks good for the long term, the swift surge might signal “a little bit of a breather” on a near-term basis before it breaks out to a new high.

In his bullish note, Morgan Stanley analyst Benjamin Swinburne focused on Disney+ as an upside catalyst for the stock, but Chantico Global Advisors’ Gina Sanchez says the new streaming service is just one of the reasons she likes the name. Specifically, she believes the company has significant brand value and “pricing power.”

“The move recently really was predicated on this Disney+ issue and the fact that they’re broadening into streaming, and that’s definitely an addition. But remember that the properties that they already own are incredibly valuable,” Sanchez said.

Theme parks have been a significant investment for the company — the new Star Wars-themed park opened its doors just a few weeks ago — and Sanchez argues that the company will continue to reap the rewards given the parks’ popularity and by extension the company’s pricing power.

“They continue to up the price for the full experience at the parks; 157 million guests are driving $20 million worth of revenue, and they have continually upped that and they haven’t seen any response in the numbers, meaning they have tremendous pricing power there,” she said.

The Mouse House has already had a smash hit this year in Marvel’s “Avengers: Endgame,” and an upcoming slate of film releases includes remakes of “Aladdin” and “The Lion King.”

“They are one of the most valuable brands out there, so I would say that there’s still more to come given the expenditures they’ve made and the investments they’ve made across the entire brand, not just the streaming space,” Sanchez said.

Disney+ will cost $6.99 per month, and is expected to launch in November.