The only price dropping as fast as new streaming subscription deals from Disney and Apple is the stock price of streaming giant Netflix.

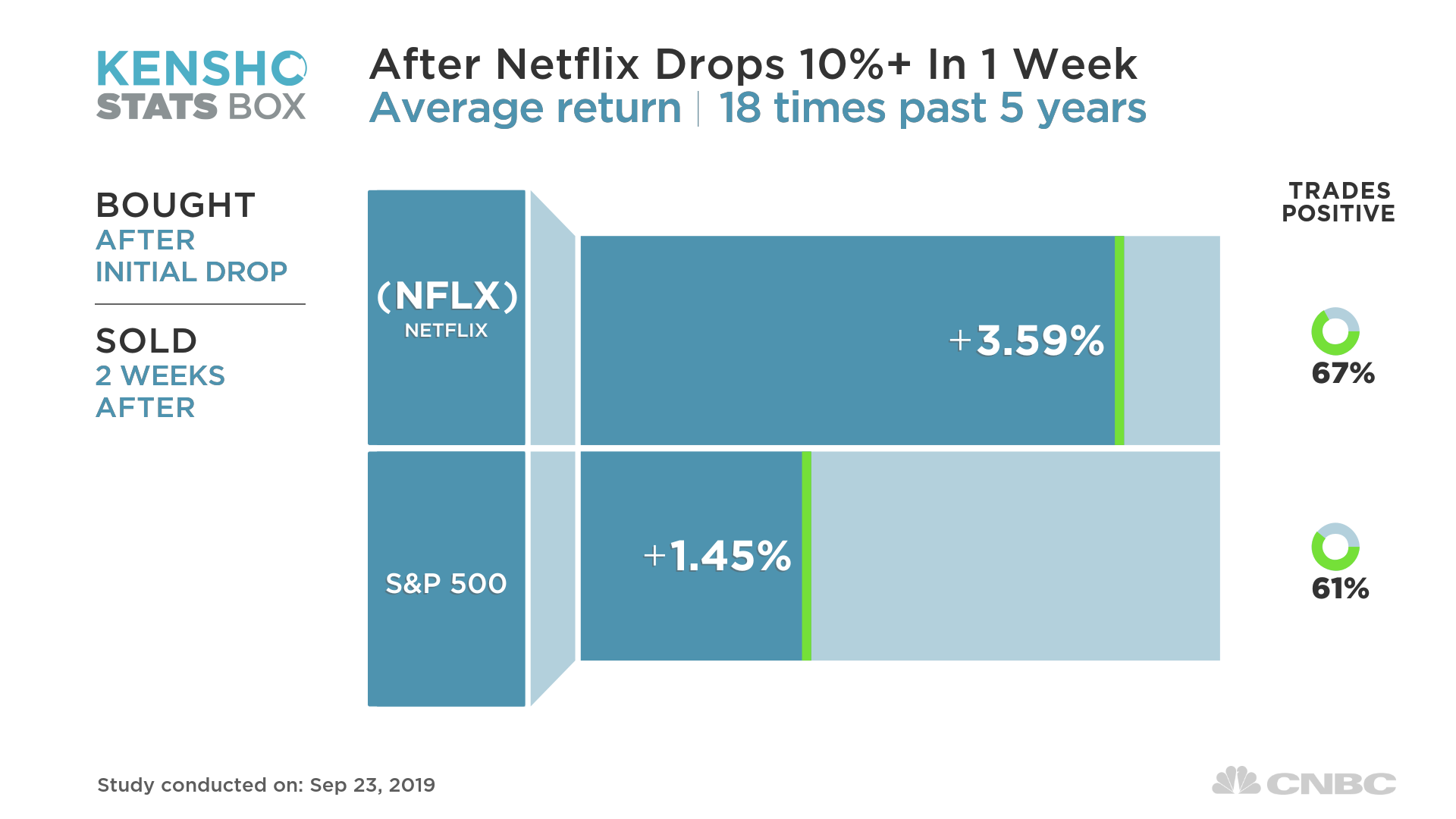

But there’s reason to believe the next trading move in Netflix could be a short-term rally, according to a CNBC analysis of hedge fund analytics tool Kensho.

After gaining as much as 46% this year, the stock has tumbled, last week dropping 10% and erasing all of the gains Netflix had made in 2019. Over the past five years, the stock has had similar, double-digit losses on 18 other occasions. Two weeks after similar drops, the streaming giant tends to rebound. It gains an average of 3.6% — more than double the return of the S&P 500 during that time period — and trades positively 67% of the time, according to Kensho data.

Apple is offering its new streaming service for $4.99 (or one-year free with the purchase of a new iPhone). Disney+ will offer high-definition streaming as part of its standard $6.99 plan. Netflix’s basic plan in the U.S. starts at $8.99 per month.

But it is not just the intensification in the streaming war that has Wall Street on edge.

Pivotal Research Group cut its price target on Netflix shares by nearly a third on Tuesday, to $350 from $515, warning that much higher than expected costs to license content will add to the new competitive pressures. Bernstein had cuts its price target on Netflix by 20%, to $230, last week.

Concerns about free cash flow and slowing of subscriber growth could also lead to weak third quarter earnings, according to Pivotal. And KeyBanc Capital Markets wrote in a note on Monday that even if Netflix turns in a good earnings report in October, competitive pressures will likely outweigh any potential for an sustained earnings rally.

Barclays put its bearish take in the most simple terms, calling the stock “very expensive” and arguing the streaming giant would need to grow its subscribers by at least 5x to justify its current valuation.

“The Q2 miss, coupled with the upcoming Disney+ launch in the US (and Apple as well, and more to come), has come together to make investors reevaluate their confidence in Netflix’s subs and pricing growth,” Bernstein analyst Todd Juenger wrote in a note, adding that “investors are increasingly asking us: ‘where is the floor?'”

The analysis provided by CNBC’s Jim Cramer on “Squawk on the Street” on Tuesday was the most brutal: “Netflix has become an open sore to this market.”