President Donald Trump‘s election led to a boom in the stock market and a resulting surge of money into the investment funds.

In fact, since the Republican’s victory — Wednesday will mark the one-year anniversary — assets under management for mutual and exchange-traded funds surged about 16 percent, or $2.9 trillion, to $21.1 trillion, according to figures Thomson Reuters released Tuesday.

That total combines inflows and returns, which have been substantial. The Dow industrials are up 29 percent over the past 12 months, while the broader S&P 500 is 21.6 percent higher.

“Performance has been the primary contributor to asset accretion since the 2016 presidential election,” Thomson Reuters said in an analysis.

Investors have flocked to funds of almost all stripes since the Trump election, though the balance in absolute cash flow has been to passive funds. While mutual funds, most of which are passively managed, still have far more assets than mostly passively managed exchange-traded funds, the gap is closing.

Since Sept 30, 2016, passive funds have taken in just shy of $686 billion against just $5.2 billion net for active. However, the breakdown is more nuanced, with actively managed bond funds still popular, while investors looking for stock-focused funds prefer passive.

Active managers have done a little better this year in terms of attracting capital as stock pickers are enjoying their best year since the financial crisis. Some 55 percent large-cap managers are beating their index benchmarks year to date through October, according to Bank of America Merrill Lynch.

In terms of total asset gains, counting inflows plus performance in both ETFs and mutual funds, the equity side has done best, with a $2 trillion gain that has boosted total assets by 21.6 percent. Mixed assets are next, with a 19.6 percent gain, while bond funds have seen assets increase by 11 percent to $4.2 trillion.

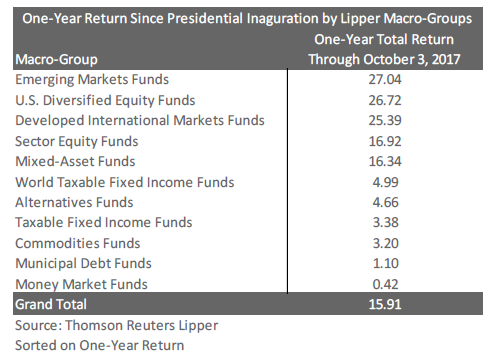

Isolating for returns, emerging market funds gained 27 percent in the one-year period through Oct. 3 while diversified equity funds were next at 26.7 percent and developed international markets funds were third with a gain of 25.4 percent.

Money market funds were at the bottom with returns of 0.4 percent while municipal debt gained just 1.1 percent.

Specifically in Lipper fund categories, equity leverage were the best performers, returning 51.7 percent, while dedicated short bias performed worst, with a loss of 28.4 percent.

WATCH: Trump takes a victory lap for the stock market.