It has been a very confusing week for investors as the Trump administration continues to deliver mixed messages on the state of trade relations with China. Friday’s moves in the stock market highlight how difficult it has been for Wall Street to navigate through the conflicting headlines.

On Friday morning, National Economic Council Director Larry Kudlow told CNBC’s “Squawk on the Street” that President Donald Trump would consider extending the current 90-day truce between the U.S. and China if progress was made in the ongoing talks. China and the U.S. agreed over the weekend to a 90-day cease-fire to their ongoing trade spat.

Kudlow’s comments sent the S&P 500, along with the Dow Jones Industrial Average, to its high of the day.

But Peter Navarro, a trade advisor to Trump, told CNN shortly after Kudlow’s interview that the president would “simply raise” tariffs on billions of dollars worth of Chinese goods if no deal is reached during the cease-fire.

Subsequently, the S&P 500 erased the gains that followed Kudlow’s comments and dropped more than 2 percent, wiping out its gains for the year.

WATCH: Time Capsule: Trump’s casino company IPO in 1995…and eventual bankruptcy

Friday is not the first time this week that confusion around the administration’s trade messages has added fuel to an already volatile market. Earlier this week, administration officials disagreed on when the 90-day truce would start. Trump later said on Twitter the grace period began Saturday, when he and Chinese President Xi Jinping agreed to halt additional tariffs.

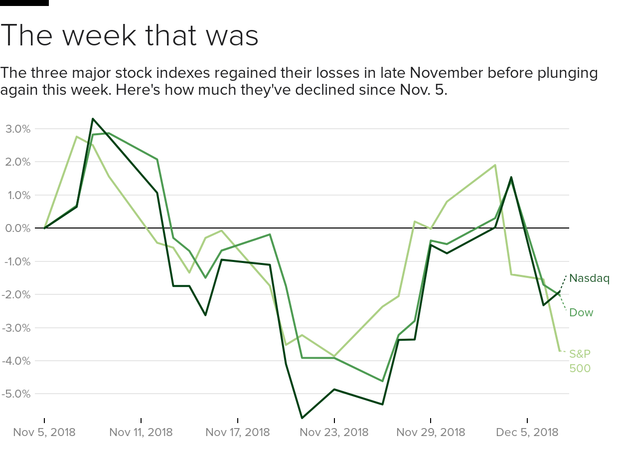

This uncertainty around trade, coupled with fears about a potential slowdown in economic growth, sent equities down sharply this week. The S&P 500 and Dow are down more than 4 percent for the week.

The market will continue to stay volatile until investors get some clarity on trade, said Art Hogan, chief market strategist at B. Riley FBR. “Everything hinges on where we stand with China and that’s unknowable for a while.”

—CNBC’s Patti Domm contributed to this report.