A jumble of changes are coming to the tax code, with many of them set to begin on New Year’s Day — Monday.

The bill makes cuts and adds exemptions to individual, corporate and international taxes, but only a few are permanent. Here’s what you need to know about when the changes go into effect — and for how long.

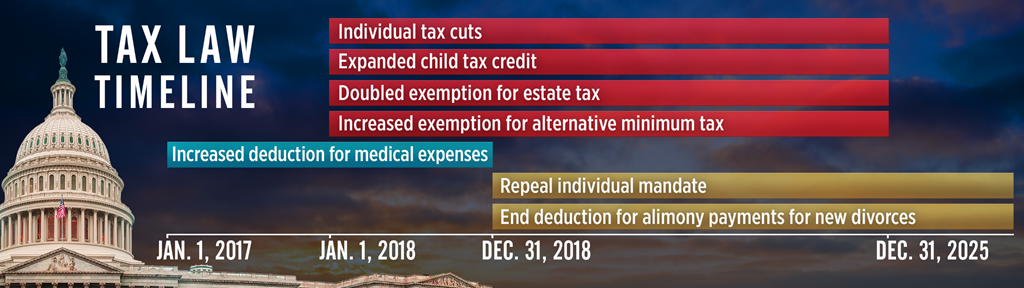

Four changes to the individual tax code go into effect on Monday but expire at the end of 2025: individual tax cuts, the expanded child tax credit, a doubled exemption for estate taxes and an increased exemption for the alternative minimum tax.

A retroactive increased deduction for medical expenses applies for a two-year period, from the beginning of 2017 to the end of 2018.

Beginning permanently in 2019 are the end to deductions for alimony payments for new divorces and the repeal of the individual mandate for Obamacare.

The business world will see the corporate tax rate drop permanently to 21 percent, from 35 percent, beginning Monday.

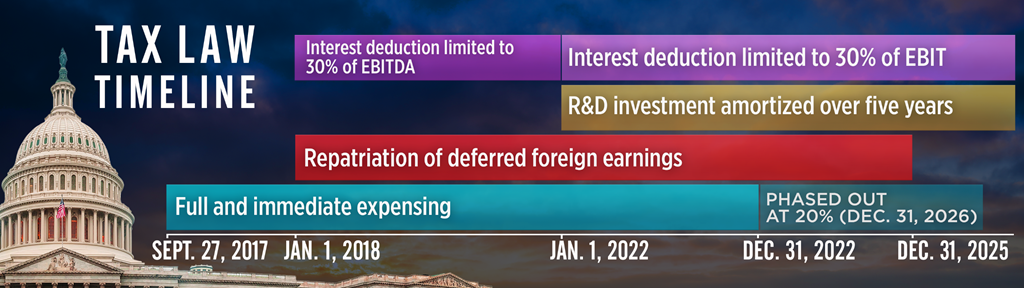

Additionally, starting in 2018 interest deductions will be limited to 30 percent of earnings before interest, taxes, depreciation and amortization. And starting in 2022, the 30 percent in interest deductions will no longer include depreciation or amortization expenses. Under the current rules, companies can deduct 100 percent of interest payments from taxable earnings.

Retroactive from Sept. 27 and extending to the end of 2022 is a period of full and immediate expensing — an allowance for businesses to deduct the cost from assets acquired instantly. That will be phased out, at a 20 percent reduction per year, until it ends in 2026.

Lastly, research and development investments may be written off for five years, effective beginning in 2022, and a tax credit will be available from 2018 to the end of 2019 for businesses providing paid family and medical leave.

Beginning next year, corporations may bring back overseas earnings taxed at 5 percent. In 2019, that rate will jump to 10 percent, before rising a final time to 12.5 percent in 2026.

— CNBC’s Ylan Mui contributed to this report.