About 44 million Americans with student debt must soon start repaying their student loans, a change that could impose a financial strain on many households after a three and a half year hiatus. Interest will start accruing on education loans on Friday, with payments set to resume in October.

The student loan reprieve began in March of 2020 as part of a series of pandemic-related measures geared toward keeping households financially stable as COVID-19 shut down the economy. Since then, the pause had been extended several times, but Congress earlier this year blocked additional extensions.

The resumption of loan repayments may not only be confusing to people who had been paying off their balances prior to the pandemic, but also to young professionals who are among the four years of graduating classes who earned their degrees during the health crisis. About 20% of borrowers are those who graduated from college during the pandemic and will be new to loan repayments, noted Robert Farrington, founder of The College Investor, a personal finance site for millennials.

Despite again being on the hook for their school loans, only about half of all borrowers know how much they’ll owe when repayments start up again, according to a recent survey from U.S. News & World Report. That makes it essential to prepare, experts told CBS MoneyWatch.

“Definitely be proactive and make sure you are all ready to make those payments,” said Michael Kitchen, higher education and student loan repayment expert at LendingTree. “There have been a lot changes over that period — maybe you’ve moved and your servicer has changed — so just get in front of it if you can.”

Here’s what to know about resuming your student loan payments.

When does interest start accruing on student loans?

Student loan interest will begin accruing again on Friday, September 1, according to the Department of Education.

When are student loan payments due?

Payments will be due starting in October, federal officials said. You should receive a billing statement or other notice at least 21 days prior to the bill’s due date. If you don’t receive a billing notice by 21 days prior to the due date, contact your student loan servicer, the Education Department said.

How do I find out who my loan servicer is?

Some loan servicers have changed during the pandemic, which means that the entity that handled your loan prior to March 2020 might not be the company that you’ll be dealing with starting in October. (Some of the changes are listed by the Education Department at this site; for instance, Navient ended its servicing contract in 2021, and its accounts were picked up by Aidvantage.)

You can find out which servicer is handling your loans by logging into your account at the Federal Student Aid website and looking at the “My Loan Servicers” link. Next, make sure you can log into your account with the servicer.

I moved. Should I update my information?

Yes, you need to update your information with your loan servicer, according to experts. Log into your servicer account — or set up a new account if you don’t have one — to check your personal contact information. Since it’s been more than three years, your information may need to be updated.

How can I find my loan interest rate and amount due?

Log into your account with your servicer — your servicer will tell you how much you owe and the date the payment is due, according to the National Association of Student Financial Aid Administrators.

“Make note of this information to ensure you either proactively make a payment by the deadline, or are prepared for the funds to be drawn down by auto debit,” according to the nonprofit, which represents financial aid professionals at colleges and universities.

Do I need to update my bank information?

Every borrower — including those who had direct payments set up prior to the pandemic — must update their bank information if they are paying through direct debit, noted Farrington of The College Investor.

“If you had direct debit before the pandemic, guess what, all those were canceled during the pandemic,” he said.

Farrington added, “It won’t resume — you have to re-sign up. I worry that people will think no big deal” and miss a payment because of that.

What student loan repayment plans are available?

Borrowers are automatically enrolled in the standard repayment plan — a 10-year schedule to pay down their balances. But that’s also the most expensive plan, and some borrowers may get sticker shock at seeing their payments due in October.

Farrington underscores that other repayment plans are available. New and existing borrowers should make a point to review the other repayment options, such as a new income-based repayment plan called the Saving on a Valuable Education, or (SAVE), plan, which recently became available for applicants, he noted.

The first step is to use the loan simulator at the Federal Student Aid site to figure out which plan is best for you, experts say. Income-driven repayment plans, or IDRs, can be helpful because they peg borrowers’ payments to their monthly income. About a third of all borrowers are enrolled in an IDR, according to Pew Research.

What is the SAVE plan?

The SAVE plan is the new income-based repayment plan from the Biden administration. It could lower, or even eliminate, monthly loan payments for more than 20 million borrowers.

The plan is open to borrowers with direct subsidized and unsubsidized loans, as well as Direct PLUS loans for graduate and professional students, and for direct consolidation loans, Biden officials said earlier this month.

Although people may apply for SAVE now, the plan won’t go fully into effect until next year. For instance, under SAVE borrowers with undergraduate loans will have their monthly payments reduced from 10% to 5% of their discretionary income. But the 5% rate won’t begin until mid-2024, according to the Education Department.

Other elements of SAVE will offer immediate relief, including eliminating negative amortization, which allowed interest on student loans to snowball and often left borrowers owing more than they had initially borrowed (You can apply for SAVE at this Education Department site.)

What is the average amount of student loan debt?

On average, the typical student borrower has federal student debt of about $38,000, according Education Data Initiative. But about 54% of borrowers owe less than $20,000, the College Board said. Roughly 45% of the outstanding federal education loan debt was held by the 1 in 10 borrowers with balances of more than $80,000, according to the group.

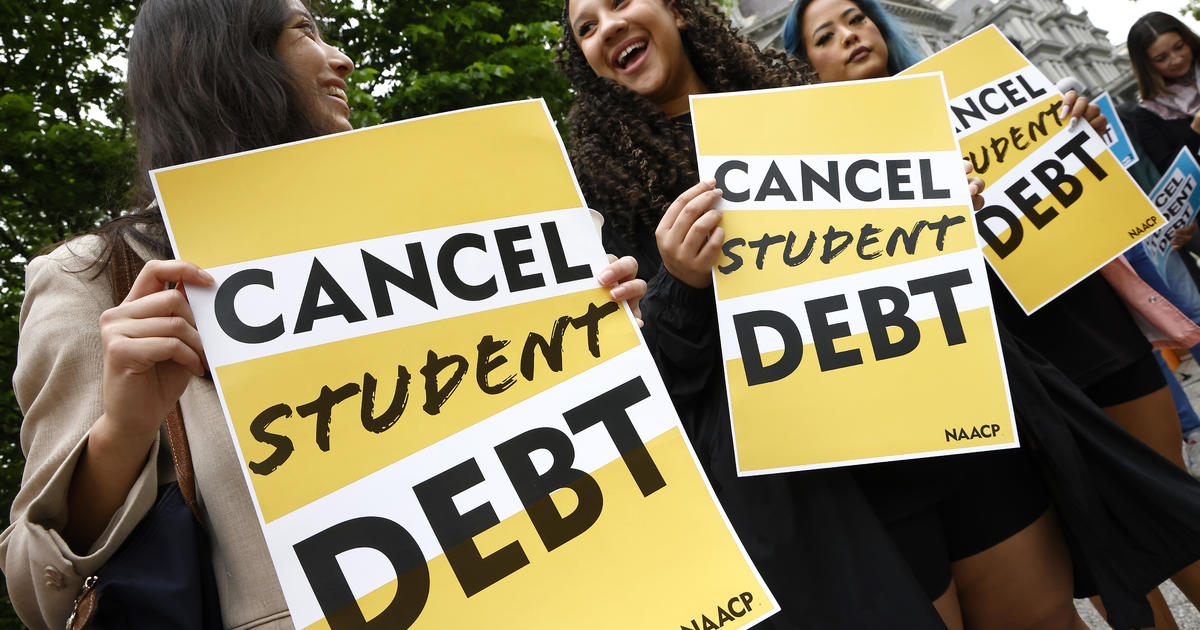

What about erasing my student debt?

In June, the Supreme Court struck down President Biden’s plan for student debt relief, which would have forgiven up to $20,000 of federal student loans for eligible borrowers.

Hours after the decision, Mr. Biden announced that he had directed Education Secretary Miguel Cardona to start a process under a law known as the Higher Education Act to compromise, waive or release loans “under certain circumstances.”

While that process is in the works, any loan forgiveness that occurs under the HEA will take time to materialize. Any changes must go through negotiated rule-making, a process that could take a year or longer. And even after that, the plan could still face legal challenges, Farrington said.

“People should not be holding their breath for any kind of blanket student loan forgiveness program,” he added.