Personal loan originations are expected to rise 11% in 2022 among non-prime borrowers with fair or bad credit scores, according to TransUnion. (iStock)

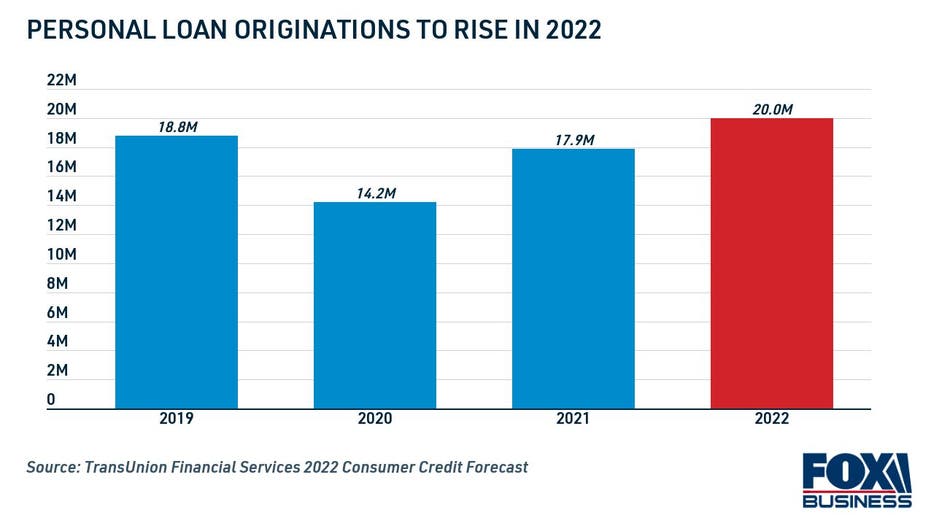

Personal loans offer fast, lump-sum funding that can be used to consolidate high-interest debt, pay for home improvements and finance large purchases. At the onset of the coronavirus pandemic, personal loan originations dropped off abruptly — but they’re expected to make a robust comeback in 2022.

Demand for personal loans is forecasted to rise to all-time highs in this year as consumers look for ways to pay off growing credit card balances, according to the 2022 Consumer Credit Forecast from the credit bureau TransUnion. Lenders are expected to increase personal loan originations to both prime borrowers with excellent credit and subprime borrowers with credit scores below 660.

“Lenders are eager to pursue growth, including expanding back into the non-prime consumer segment,” said TransUnion Senior Vice President Charlie Wise.

YOU COULD SEE A LOWER TAX REFUND THIS YEAR, AND THIS IS WHY

Personal loan originations are expected to exceed pre-pandemic levels, with TransUnion predicting 20 million originations in 2022. That’s up dramatically from 14.2 million originations in 2020.

“This growth will be boosted by an eventual return of demand for credit card consolidation loans as card balances grow,” said TransUnion Senior Vice President Liz Pagel.

Keep reading to learn more about TransUnion’s predictions for the unsecured lending market in 2022, and visit Credible to shop for personal loans across multiple lenders at once.

PERSONAL LOAN ORIGINATION FEES: ARE THEY WORTH THE COST?

Personal loan lenders will renew focus on subprime borrowers

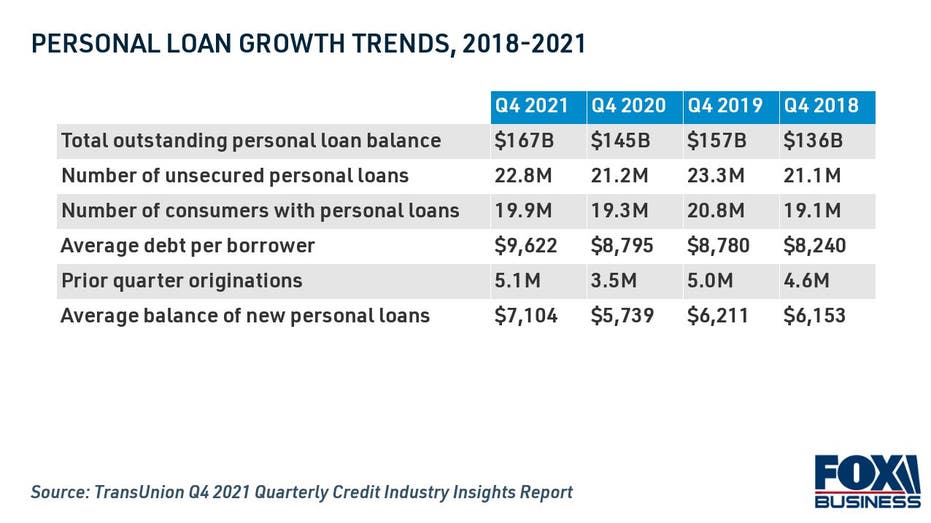

In the past year, the personal loan industry has seen significant growth among borrowers with credit scores between 300 and 660. In the fourth quarter of 2021, personal loan originations to non-prime borrowers skyrocketed 47% from a year earlier, according to TransUnion’s Q4 2021 Quarterly Credit Industry Insights Report.

TransUnion expects this trend to continue in 2022, with lenders continuing to increase short-term loan originations to borrowers with subprime credit histories.

“The economy is normalizing and continues to expand, and those signs of renewed strength are encouraging lenders to not just focus on the least risky consumers, but to provide greater access to those persons that may be viewed as higher credit risks,” Wise said.

WHAT THE FED’S NEW ECONOMIC POLICY MEANS FOR MORTGAGE RATES

TransUnion expects personal loan originations to grow 11% for non-prime borrowers in 2022, which is marginally lower than the 14% growth expected among prime consumers. But as a result of more subprime lending, delinquencies are expected to increase somewhat.

“While the increase in subprime originations has led to a slight increase in delinquencies, they still remain well below pre-pandemic levels, and delinquencies by risk tier remain fairly stable,” Pagel said.

This renewed focus on subprime loans will give consumers with fair or poor credit a chance to borrow personal loans to pay off higher-interest debt and finance large expenses. Subprime borrowers with low credit scores who are considering taking out a personal loan should shop around with multiple lenders to avoid bad credit loans with high interest rates.

You can browse current personal loan rates in the table below, and visit Credible to see your estimated loan terms for free without impacting your credit score.

93% OF PAYDAY LOAN BORROWERS REGRET TAKING OUT THEIR LOANS

Credit card consolidation will drive personal loan growth in 2022

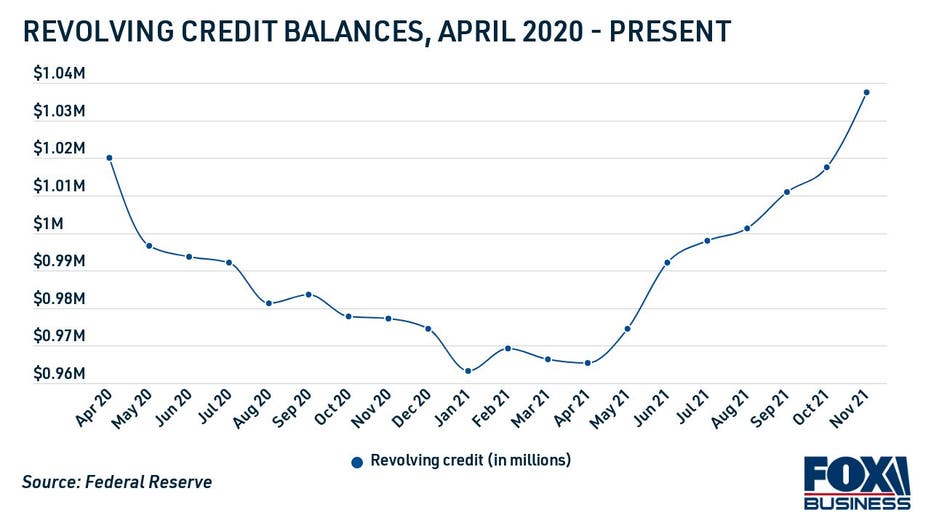

Demand for personal loans remained low through early 2021 as consumers received stimulus checks and decreased their spending. But amid economic recovery, consumer spending and revolving credit balances continue to rise — and many borrowers will be looking for unsecured loans to pay off credit card debt.

“With consumer spending expected to increase in 2022, TransUnion’s forecast projects this may lead to a continued rebound in the consumer lending market, especially as consumers resume seeking unsecured personal loans to consolidate growing card balances,” the report reads.

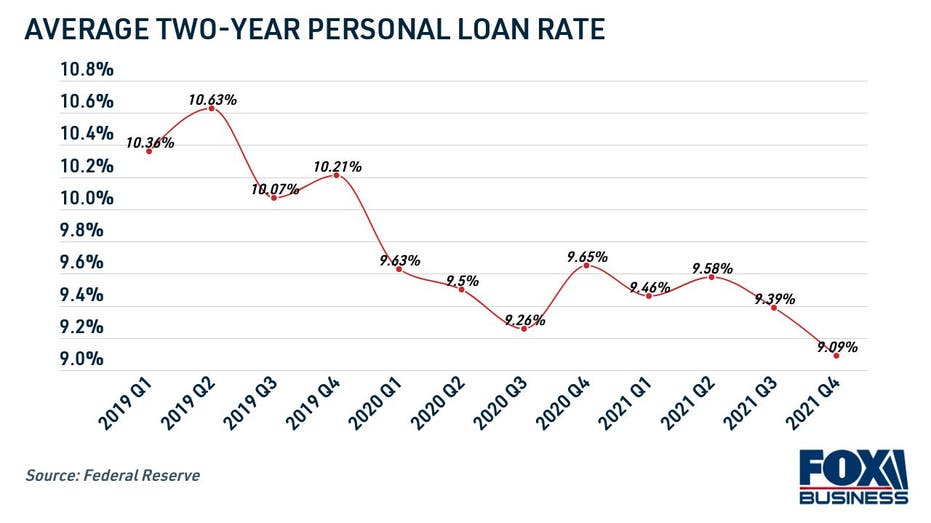

Unsecured personal loans give borrowers the opportunity to repay high-interest credit card debt at a low, fixed rate. Whereas the average credit card interest rate is 16.44%, according to the Federal Reserve, the average rate on a two-year personal loan is at a historic low of 9.09%.

Personal loans make it easier to repay revolving credit card balances, since they’re repaid in fixed monthly payments. Thanks to lower interest rates, well-qualified borrowers may be able to save nearly $2,400 in interest charges by consolidating credit card debt with this type of loan, according to a recent Credible analysis.

You can learn more about credit card consolidation loans by getting in touch with a knowledgeable loan officer at Credible. You can also use a personal loan repayment calculator to see if this debt payoff strategy is right for you.

CAN YOU USE A PERSONAL LOAN TO PAY OFF YOUR AUTO LOAN?

Have a finance-related question, but don’t know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.