Former CKE Restaurants CEO Andy Puzder discusses how the market could be impacted if Republicans win big during the midterm elections on ‘Fox Business Tonight.’

Here are the key events taking place on Tuesday that could impact trading.

ELECTION DAY IS HERE: As Americans prepare for Tuesday’s midterm elections to determine which party controls Congress, investors are expecting the races to significantly impact the stock market.

With polls showing a strong lead by Republicans in Congressional races and a dead heat in many Senate races, some traders are preparing for a GOP win. If not, political gridlock caused by a split government is also generally seen as favorable to investors who want their equities to be unaffected by major policy moves.

With the S&P 500 declining nearly 21% in the past year, investors appear to bet on a Republican win. A basket of stocks and other assets tracked by advisory firm Strategas that would be expected to do well after a Republican victory have outperformed a counterpart Democrat portfolio, indicating a roughly 70% chance that Republicans win both the House and Senate.

A SIMPLE GUIDE TO MIDTERM ELECTIONS, HOW THEY AFFECT THE PRESIDENCY AND MORE

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| LMT | LOCKHEED MARTIN CORP. | 488.63 | +6.96 | +1.44% |

| RTX | RAYTHEON TECHNOLOGIES CORP. | 96.17 | +0.95 | +1.00% |

Defense spending is expected to rise regardless of which party takes power, signaling a positive future for shareholders. Experts say defense contractor shares such as Lockheed Martin or Raytheon Technologies would likely benefit significantly from a Republican sweep, as opposed to moderate growth with a Democratic majority.

Pharmaceutical and biotech stocks are also projected to benefit from a Republican victory, considering recent legislation from Democrats that aimed at lowering prescription drug prices. While the S&P 500 pharmaceuticals index is up about 1%, the S&P 500 healthcare sector is down roughly 7%.

Energy stocks have had an excellent year, with the S&P 500 energy sector skyrocketing over 60% in 2022. If Republicans control both the House and the Senate, policies that encourage domestic energy production could be favorable for shareholders of oil exploration and pipeline companies.

In this photo provided by the New York Stock Exchange, trader Edward McCarthy works on the floor, Friday, Feb. 25, 2022. (Courtney Crow/New York Stock Exchange via AP / AP Images)

Clean energy stocks, on the other hand, will fare well if Democrats clinch a surprise win. While Invesco Solar is down roughly 6%, legislation favoring solar and other alternatives would boost the clean energy sector.

Cannabis stocks would also likely benefit from a Democratic win, as they historically move on regulatory headlines. The AdvisorShares Pure US Cannabis ETF is down over 55% this year.

EARNINGS REPORTS: A busy day coming up for third-quarter earnings, with reports from Wall Street Journal parent News Corp. and media giant and Dow member Disney out Tuesday afternoon.

NEWS CORP.

Investors will weigh results from building products supplier Builders FirstSource, independent power producer Constellation Energy, specialty chemical maker Dupont, and Norwegian Cruise Lines in the morning.

MODERNA STOCK TUMBLES AFTER QUARTERLY EARNINGS SHOW REVENUE DECLINES

The Norwegian Gateway cruise ship is moored at PortMiami on January 07, 2022 in Miami, Florida. (Joe Raedle/Getty Images / Getty Images)

In the afternoon, Occidental Petroleum Corp., AMC Entertainment Holdings and NortonLifelock Inc are among the companies expected to report.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| DIS | THE WALT DISNEY CO. | 100.43 | +0.85 | +0.85% |

| BLDR | BUILDERS FIRSTSOURCE INC. | 57.91 | +1.23 | +2.17% |

| CEG | CONSTELLATION ENERGY CORP. | 93.50 | -0.82 | -0.87% |

| DD | DUPONT DE NEMOURS INC. | 61.74 | -0.19 | -0.31% |

| NCLH | NORWEGIAN CRUISE LINE HOLDINGS LTD. | 16.67 | -0.27 | -1.59% |

| OXY | OCCIDENTAL PETROLEUM CORP. | 75.97 | +2.70 | +3.69% |

| AMC | AMC ENTERTAINMENT | 5.33 | -0.32 | -5.66% |

| NLOK | n.a. | n.a. | n.a. | n.a. |

Nearly 90% of the S&P 500 (442 companies) has reported third-quarter numbers, and so far, the results are ahead of expectations.

MONDAY MARKET ROUNDUP: U.S. stocks rose Monday ahead of a crowded week of corporate earnings, inflation data and midterm elections that could see a shift to Republican control of one or both chambers of Congress.

The Dow Jones Industrial Average gained 423.78 points, or 1.3%, to 32827. The S&P 500 advanced 36.25 points, or 1%, to 3806.80, while the technology-heavy Nasdaq Composite rose 89.27 points, or 0.9%, to 10564.52.

Stocks finished last week with losses, with the S&P posting a weekly decline of more than 3% for the 10th time this year.

ALBERTSONS’ $4B DIVIDEND PAYOUT PUT ON HOLD BY COURT

Traders discuss moves on the floor of the New York Stock Exchange. (AP Photo/Richard Drew / AP Newsroom)

The slide came after the Federal Reserve disappointed investors by signaling that officials might raise borrowing costs next year more than they had projected.

Friday’s jobs data, which showed that the labor market remains strong, further squelched some investors’ hopes that the Fed might slow its pace of interest-rate increases.

JAPANESE WARNING: Japan warned the United States over the weekend the latter’s electric vehicle tax credits could dissuade them from investing in the world’s largest economy.

The Japanese government sent a letter to U.S. Treasury Department on Saturday, complaining that the tax credits in the Inflation Reduction Act (IRA) put Japanese carmakers at a disadvantage in the U.S. market.

The Japanese government argued that the requirements for being eligible for the tax credit were “not consistent” with the shared policy between the two countries to build resilient supply chains with other allies and reduce exposure to China.

“It would be possible that Japanese automakers hesitate to make further investments towards electrification of vehicles,” the government said. “This could cause negative impacts on the expansion of investment and employment in the U.S.”

FIRST-TIME EV OWNER SHARES ‘CAUTIONARY TALE’ AFTER IT TOOK 15 HOURS TO DRIVE 178 MILES

The U.S. and Japan flags fly together outside the White House in Washington April 27, 2015. (REUTERS/Kevin Lamarque / Reuters Photos)

South Korea and European countries have also expressed concerns over the tax credits. Last Friday, South Korea said it was seeking a three-year grace period so that its automakers could continue receiving EV incentives in the U.S.

The new law introduces incentives to bring battery and EV manufacturing to the United States with the aim of ratcheting up domestic content over the next six years.

OIL INDUSTRY GROUPS BLAST BIDEN: Two of the nation’s most prominent oil industry groups slammed President Biden following his comments Sunday vowing to block all new fossil fuel drilling.

“No more drilling,” Biden said in response to a crowd member’s shouts during a campaign event in New York on Sunday. “There is no more drilling. I haven’t formed any new drilling.”

The comments appeared to be in reference to a five-year offshore drilling plan that the Department of the Interior (DOI) is expected to finalize in the near future. Interior Secretary Deb Haaland has opened the door to block all drilling in federal waters through 2028, but she is also weighing whether to schedule up to 11 lease sales in that time span.

Shortly after Biden took office in January 2021, he issued an executive order blocking all new oil and gas drilling on both federal lands and waters, following through on a 2020 campaign promise to “end fossil fuel.” However, in August, a federal judge delivered a fatal blow to the leasing moratorium, ruling that it was “beyond the authority” of the White House.

BIDEN ADMINISTRATION UNVEILS OIL AND GAS DRILLING PLANS, GUTTING TRUMP-ERA FRAMEWORK

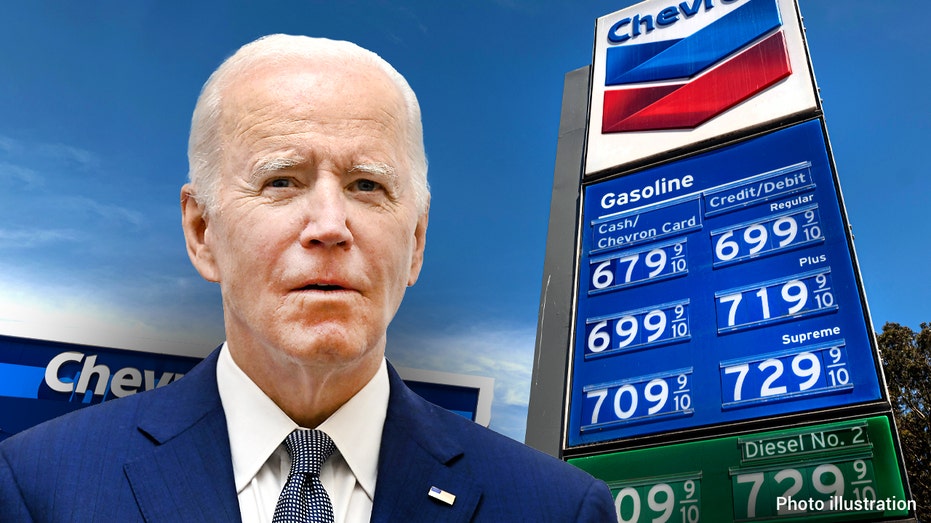

President Biden in a photo illustration that shows fuel prices at a Chevron station in San Francisco, California. (David Paul Morris/Bloomberg via Getty Images / Getty Images)

“The message is clear: Joe Biden is directly responsible for high gas prices, rising home heating costs, and high grocery prices that are crushing every American. The Biden administration is to blame for this self-inflicted energy crisis and the looming diesel shortage,” Matt Coday, the president and founder of the Oil & Gas Workers Association, told FOX Business. “This administration has slowed down federal permitting.”

“Treasury Secretary Janet Yellen asked banks to stop funding fossil fuels projects,” he said. “Biden nominated a Marxist comptroller of the currency who said she wanted fossil fuel companies ‘to go bankrupt.’”

CLICK HERE TO READ MORE ON FOX BUSINESS

Additionally, National Ocean Industries Association President Erik Milito slammed Biden for focusing on politics instead of measures that would boost U.S. energy security.