Last week’s plunge in oil prices — the worst weekly decline for U.S. crude in two years — may herald a temporary reprieve for the battered commodity if historical trends hold up in the coming weeks.

U.S. West Texas Intermediate crude futures declined in every session last week, ultimately finishing last week down 9.6 percent at $59.20 a barrel. On Monday, it rebounded about 1 percent to trade around $60 a barrel.

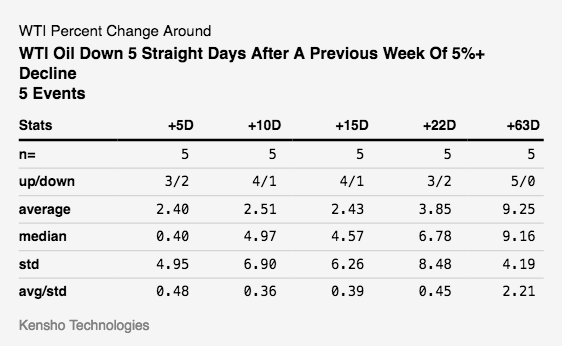

Historically, when oil falls for five straight days, posting a total weekly loss of 5 percent or more, U.S. crude futures typically have traded higher in the two- and three-week windows after the decline, according to hedge fund analytics tool Kensho.

Kensho found five recent instances that matched the decline the market saw last week. In four of the five cases, U.S. crude traded higher in the two weeks after the drop, with an average return of 2.5 percent. Over three weeks, the contract was also up four out of five times, posting an average return of 2.4 percent.

The performance begins to break down over a 22-day period, but improves over a roughly two-month stretch, according to Kensho.

About 60 days after a pullback on last week’s scale, U.S. crude was up in all five instances scouted by Kensho for an average return of 9.25 percent.

As with any historical trend, the conditions of the present moment are important to consider — and it’s certainly a unique period in the oil market’s history.

On the supply-demand side, American drillers are pumping more than 10 million barrels a day, likely surpassing the all-time high set in 1970 and topping output from Saudi Arabia, formerly the second-biggest producer. That threatens to offset an historic deal to cap output by OPEC, Russia and other producers that is now in its second year.

Investor positioning in crude oil futures is also a factor to consider. Net long positions — or bets that oil prices will keep rising — have recently hit an all time high. That positioning puts the market at risk of sudden sell-offs.

Disclosure: CNBC’s parent NBCUniversal is a minority investor in Kensho.