Stocks are a hair away from record highs.

The S&P 500 is sitting less than 1% from its July peak on Friday, clawing its way back to record territory after a rocky August.

Todd Gordon, founder of TradingAnalysis.com, says one breadth indicator suggests new highs are around the corner.

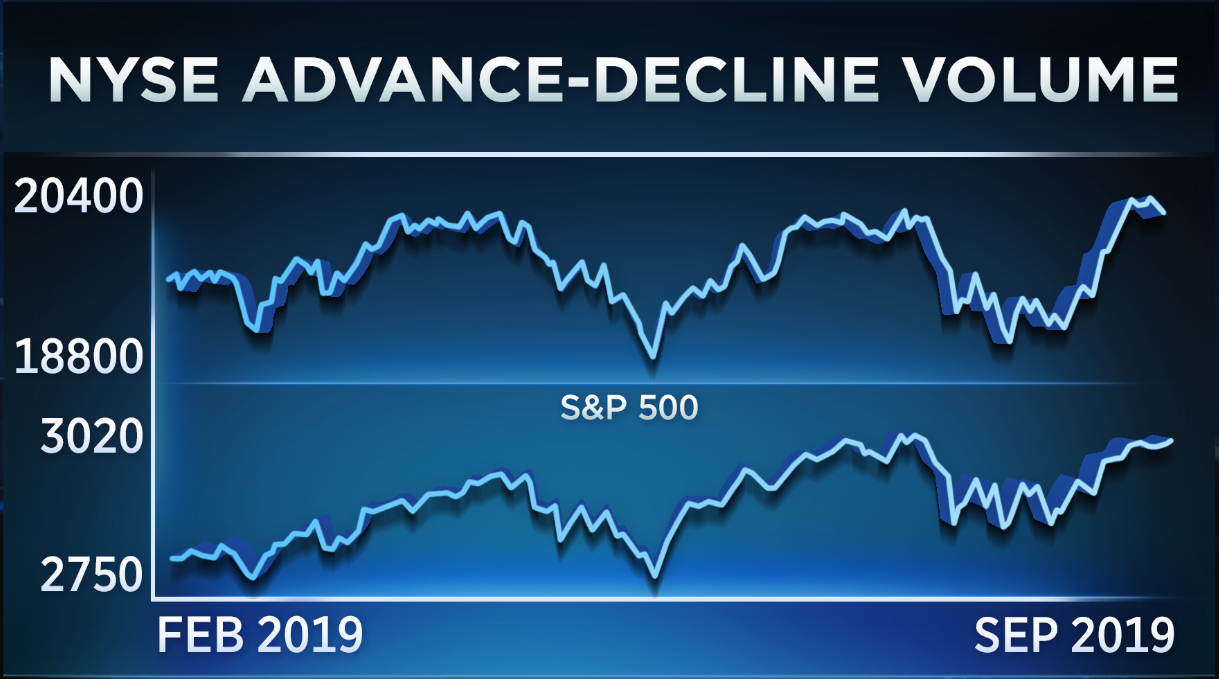

“This is the advance-decline line — the amount of advancing stocks minus declining stocks right here on the [New York Stock Exchange]. And what you’ll see here in blue is in early 2019, we made a new high in the advance-decline before the S&P did right back here. So, the advance-decline was a leading indicator of the S&P,” Gordon said on CNBC’s “Trading Nation” on Thursday.

Gordon now sees a similar setup with the advance-decline line making a new high, while the S&P 500 has fallen back. He predicts the index will soon catch up to the advance-decline line, pushing it through the old July 26 high. Trading volume on the NYSE advance-decline line also supports his theory — the volume has made a new high, while the S&P has not.

“So, we have volume increasing and advancing, the advancers minus the decliners decreasing. I think we will make new highs here in the S&P,” said Gordon.

Once the S&P 500 pushes through to new highs, Gordon says, he does not see overhead resistance until 3,800. He says it could take a year or two to get there but that the overall momentum supports moves higher.

Mark Tepper, president of Strategic Wealth Partners, agrees that the market appears likely to head higher.

“The market has been really resilient. September, historically, is one of the worst months of the year, yet the S&P is up about 100 points so far this month. So on one hand you continue to hear about slowing global growth, but on the other there’s really nothing pointing to a recession in the U.S. as long as the consumer stays strong,” Tepper said Thursday on “Trading Nation.”

However, for the market to break through with real force, he says, two things need to happen — the U.S. needs a trade deal to shore up investor, consumer and CEO confidence, and the political uncertainty tied to the 2020 election needs to subside.

“My take is the market trades sideways with an upward bias until we address those two headwinds,” said Tepper.