Move over “FANG.” The next leg up for the bull market could be driven by a whole new group of market leaders, fueled by tax law changes.

Technology stocks took a hit Monday and have come under pressure lately, as investors game the anticipated reshaping of the tax law once the House and Senate combine their separate legislation into one bill. The details of a final tax bill are still unclear, but in the House and Senate plans, approved Friday, the corporate tax rate is reduced to 20 percent from the current 35 percent.

“It ought to mean a rotation in asset allocation given that equity investors up to now have concentrated their portfolios into a small group of ‘super-performers’ that benefited from the disinflationary environment,” wrote Jefferies analysts.

FANG stocks and several other big tech names, like Apple and Microsoft, are at the top of the list of “super performers” and they were all being slammed Monday. Facebook was down 2.1 percent; Amazon fell 2.4 percent; Netflix was off 1.5 percent; and Google parent Alphabet was down 1.1 percent.

FANG stocks had been big winners this year, and investors took profits in those names and other tech stocks as they searched for bargains among high tax paying companies.

“Broadening out this rally and changing leadership is always going to be healthy. It doesn’t mean tech isn’t going to be an important leader in 2018,” said Art Hogan, chief market strategist at B. Riley FBR. “There’s been concerns about the narrowness of this rally riding on five or 10 momentum names.”

The S&P 500 tech sector has a very low tax rate of 24 percent, and it stands to gain the least from tax law changes, according to Goldman Sachs. The winners are those companies that pay the highest taxes, including the industrials, consumer discretionary, telecom, financial and transportation sectors.

“Growth and momentum styles have outperformed for most of the year. But last week investors poured money into value sectors and those areas that may be poised to benefit from tax policy changes,” notes Bob Doll, chief equity strategist at Nuveen Asset Management. Doll said banks, brick-and-mortar retailers, capital goods, media companies and homebuilders were among those gaining.

The S&P technology sector was down 1.9 percent Monday, but is still up 34 percent for the year. But the consumer discretionary sector, up 1.2 percent Monday, has already risen nearly 20 percent for the year, slightly ahead of the S&P 500’s 18 percent gain. Telecom, up 1.6 percent, is down 9 percent year to date.

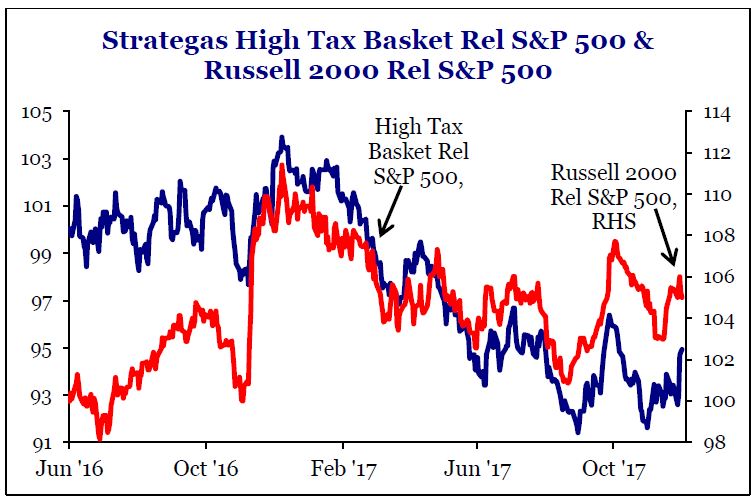

Source: Strategas Research

Keith Parker, UBS chief U.S. equity strategist, says the benefits of corporate tax reform should result in a continued broad-based rally. He is looking for the S&P 500 to end next year at 2,900, a healthy gain from its current 2,639 level, but with the right mix of tax law juice, a case can be made where it leaps ahead to 3,300. That would be a 25 percent gain from current levels, not unheard of in this bull market, he added.

Parker’s call for the S&P 500 at 2,900 is already at the high end of forecasts of 11 equity strategists surveyed by CNBC. The median forecast is 2,750 for year-end 2018.

“The prospect of a pretty big year is on the table. The upside risk is much higher,” said Parker, noting that the market could do quite well if consumer stays solid, corporate spending stays up and growth follows through.

“By our estimate, a tax cut is 20 to 40 percent priced, a little more after today,” Parker said separately Monday on CNBC’s “Halftime Report.”

For this year, Parker believes anticipation of the tax cut could also speed up or intensify the seasonal rotation. He remains overweight tech, even though it is getting knocked, and he likes industrials. Parker said he is recommending sectors that stand to win with lower tax rates, including health-care providers and services over pharmaceuticals and biotech. He also recommends retail over consumer services and food and staples retail over household products.

Within technology, he said software and services should do better than semiconductors, which have seen a sharp sell-off and are down about 6 percent in a week. “Semiconductors don’t benefit much from a lower tax rate,” he said. But services and software should see gains from improved corporate spending, spurred by tax law changes on capital spending expensing.

Some semiconductor companies also have very low tax rates. According to Credit Suisse, Analog Devices and Nvidia had tax rates of just about 12 percent, based on trailing three-year data.

The tax bill is not a done deal despite the market’s exuberant reaction. There is still confusion between the House and Senate bills and which features would remain. The Senate tax cut goes into effect a year later than the House, which would start in 2018. The Senate tax bill also includes retention of an alternative minimum tax, which would diminish the research and development tax credit.

Both bills include a low rate for repatriation of corporate profits held overseas and change the tax structure to a territorial one. That should encourage the return of hundreds of billions in foreign profits that could be used for share buybacks, mergers, or investment.

The Senate bill imposes a 12.5 percent tax on U.S. companies’ intangible income overseas, notes Strategas. It says companies that have high intangible income include Adobe, Microsoft, Amgen, VMWare and Netflix. Microsoft shares were down 3.8 percent Monday.

Source: Credit Suisse