The gold rally hasn’t lost its shine.

Investors flocked to the precious metal this week, pushing prices to $1,552 an ounce, as the yield curve inversion deepened and again set off recession alarm bells. Deutsche Bank analysts said in a note Tuesday that global central banks’ move to gold investments and away from the U.S. dollar should also continue to support prices.

Miller Tabak equity strategist Matt Maley says this is just one leg of a broader shift in the gold market.

“One of the things that 2019 will be known for is the end of the eight-year bear market in gold and the beginning of a new bull market,” Maley said Tuesday on CNBC’s “Trading Nation. “

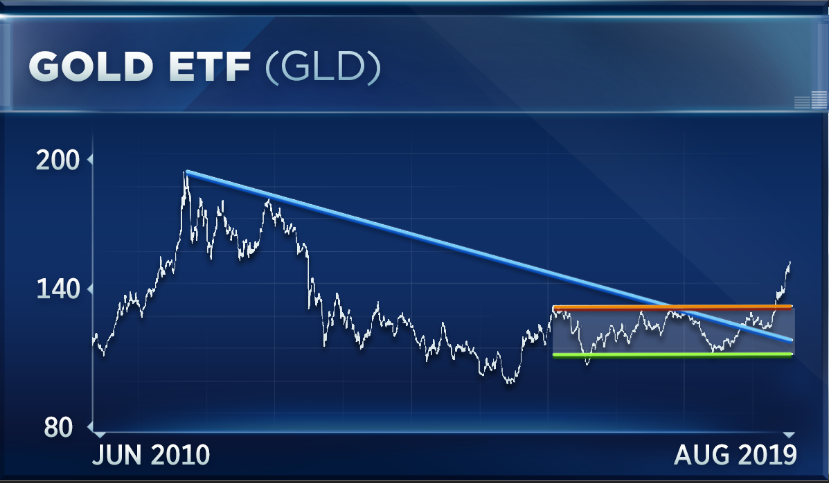

The GLD gold ETF this year broke above an eight-year trend line stretching to a 2011 peak, and recently snapped above a long-term sideways range, says Maley. This, he says, backs up the long-term bull case for gold.

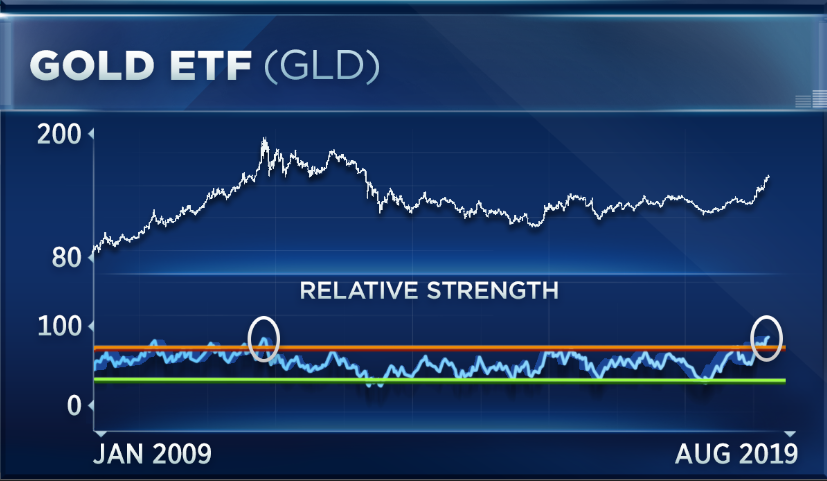

“However, on a shorter-term basis, if you look at the GLD, you look at its weekly RSI chart, it’s more overbought than it even was back at the 2011 highs. You got to go back to 2006 to see a time when it was more overbought,” said Maley.

Gold’s relative strength index, a momentum indicator, has spiked above 80 on a weekly basis. It briefly traded at this level eight years ago but has not traded well above it in 13 years. This, he says, could lead to a near-term drawdown in prices.

“I’d wait for a pullback. It may not come back for several weeks or even a month or two, but we should see a better opportunity to be more aggressive on gold,” said Maley.

Chad Morganlander, portfolio manager at Washington Crossing Advisors, says global headwinds make the case for gold exposure in a well-rounded portfolio.

“It should represent about 5% or 10% of one’s portfolio. We think that overall, you can get a 5% to 7% return in gold over the course of the next six, nine or 12 months with this escalation of trade concerns, as well as global growth concerns,” said Morganlander.

The GLD ETF has surged 20% in the past three months, dwarfing the 2% gain on the S&P 500, as trade tensions and global recession fears picked up.

“Overall, it’s a good stabilizer and a noncorrelated asset class in a retail account,” said Morganlander. “It’s a good hedge, it’s [a] good protection asset in one’s portfolio.”

Disclosure: Washington Crossing Advisors is overweight gold.