WASHINGTON — The Federal Reserve is imposing more penalties on Wells Fargo, freezing the bank’s growth until it can prove it has improved its internal controls.

“Until the firm makes sufficient improvements, it will be restricted from growing any larger than its total asset size as of the end of 2017,” the Fed announced in a statement. “The Board’s consent cease and desist order with Wells Fargo requires the firm to improve its governance and risk management processes, including strengthening the effectiveness of oversight by its board of directors.”

In addition, the San Francisco-based bank agreed to replace three board members by April and a fourth by the end of this year.

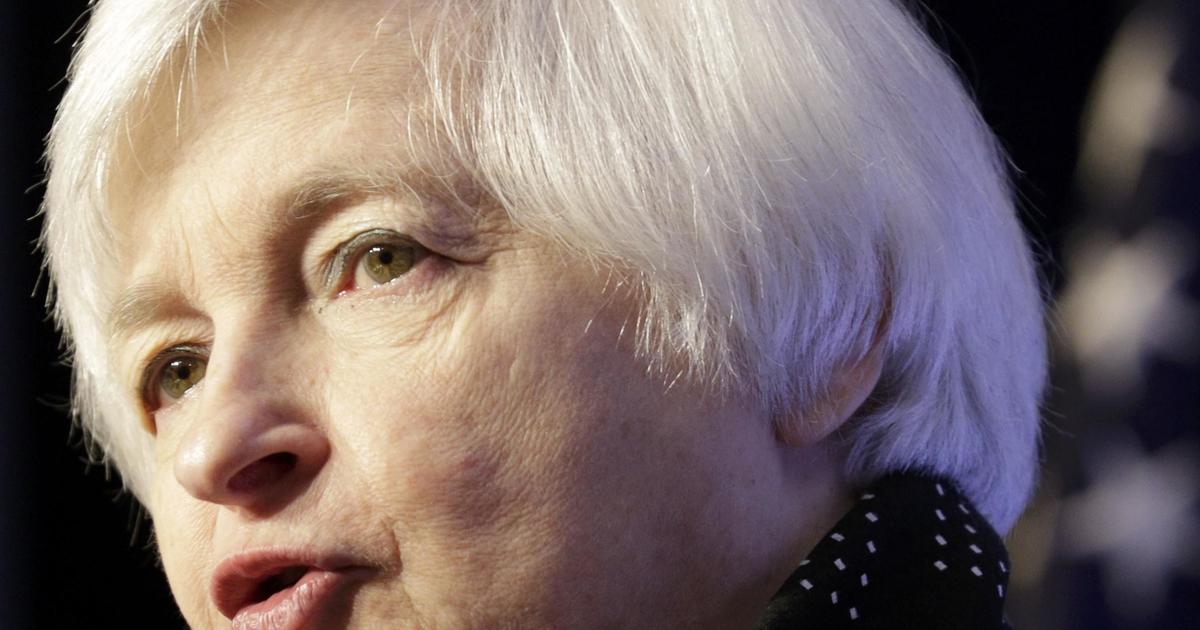

The new penalties were announced late Friday on Fed Chair Janet Yellen’s last day at the central bank. Yellen said in the statement that the Fed “cannot tolerate pervasive and persistent misconduct at any bank.”

Wells Fargo has admitted that employees opened more than 3 million fake accounts in order to meet sales quotas. It ended up paying $185 million to regulators and settled a class-action suit for $142 million.

In December, President Donald Trump weighed in on an investigation into scandal-plagued Wells Fargo, tweeting that the fines and penalties for the bank’s “bad acts against their customers … will not be dropped, as has incorrectly been reported, but will be pursued and, if anything, substantially increased.”

© 2018 CBS Interactive Inc. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. The Associated Press contributed to this report.