Citigroup strategists now see the S&P 500 ending 2018 a modest 4 percent above current levels without much more help from tax cuts.

Tobias Levkovich, Citigroup’s chief U.S. equity strategist, had previously based his forecast on a corporate tax rate cut to 25 percent, but he has updated it because the tax bill that is nearing completion slashes the corporate rate to 21 percent.

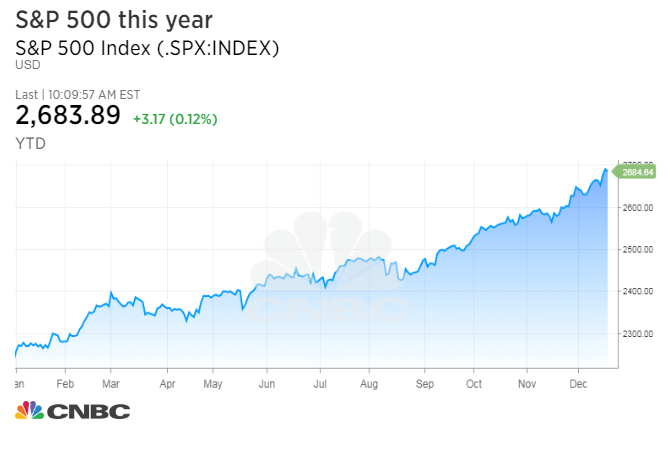

His year-end S&P target of 2,800 is just shy of the median 2,825 forecast of 13 other equity strategists surveyed by CNBC. The forecasted 4 percent gain for 2018, though, appears conservative when compared to the market’s 20 percent climb this year.

The adjustments stem largely from a clearer view of the Republican tax overhaul.

The strategist noted that while he would normally forecast an $8 increase in earnings per share given the bigger than expected tax cut, companies may choose to spend that money rather than pass it along. So, he is only adding $5 to his new 2018 earnings per share estimate of $146.

“We have noted for various weeks that the strength in the S&P 500 and particularly in domestically-oriented industries’ stock prices have reflected the earlier than previously anticipated tax reform developments in D.C.,” wrote Levkovich. “Nonetheless, we have become convinced that many companies may use some of the ‘found money’ from the tax benefit to fund marketing expenses or discounts such that the full bottom-line contribution will not be seen by investors.”

The strategist also offered comment on sectors he believes investors will benefit from most given the Republican tax effort.

“Several industries will be challenged to not pass this along to consumers including Utilities and Retailing versus Railroads and Tobacco that probably hold on to the tax savings,” he explained. “A few banks also are suggesting that a portion of the money may be used to provide better loan terms to gain or retain market share.”

Levkovich’s latest comments come just days after the strategist explained his market outlook on CNBC’s “Squawk Box.”

“Our primary sentiment metric, for example, our Panic/Euphoria model is edging close to euphoria, which is already indicating about a 70 percent chance the market will be down this time next year,” he said on Monday, adding he isn’t advising investors to “run away” from equities.

“The key is earnings growth and the question is: how much of this earnings growth is baked in. I think a fair amount is.”