Financials have surged 7 percent in the last month, and Todd Gordon of TradingAnalysis.com says they’ll continue to rally into 2018.

According to Gordon, the current economic outlook seems to be in favor of bank stocks, thanks to recent moves in one area of the market: bonds.

“Bonds are pressing lower, and yields are in a pretty constructive pattern here on the back of the tax cuts,” he said Thursday on CNBC’s “Trading Nation.” “That indicates economic growth, and expansion should continue.”

Higher yields are seen as a positive for banks based on their business models, and Gordon says charts of the 10-year Treasury yield are suggesting that it’s about to bounce. More specifically, the 10-year has bounced from a key resistance level at 2.5 percent, and Gordon sees it running higher to above 3 percent.

“We have broken resistance, and when that happens in the world of technicals, it flips the script and goes from resistance into support,” he explained.

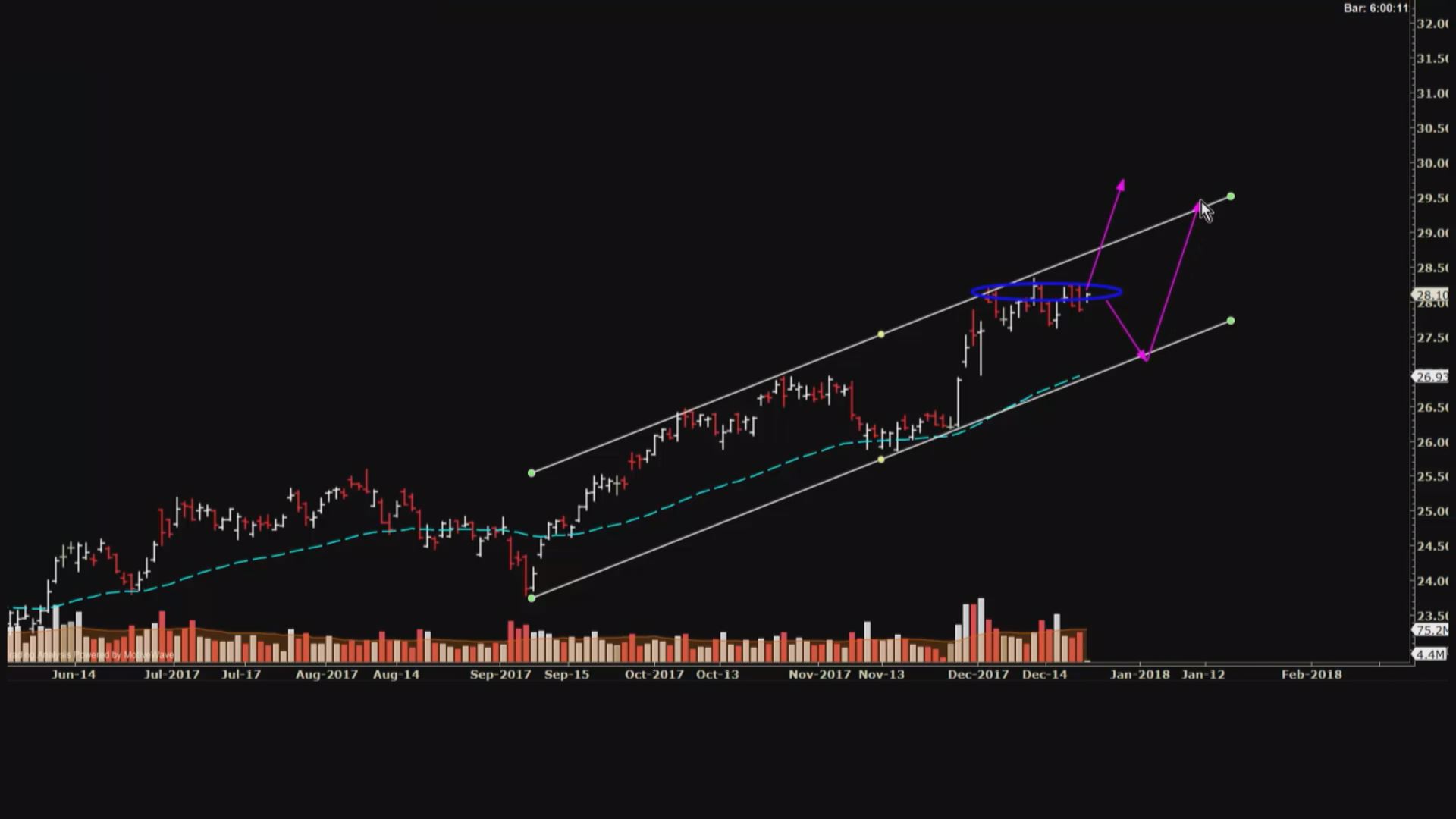

Looking at a chart of the financials-tracking ETF, the XLF, Gordon noted that it is running up against resistance at the top end of its trend channel. As a result, he expects that we could see a small pullback to support around $27, but any dip should be bought.

“If we can get a pullback to around $27, it’s going to be a value long on the back of a sell-the-fact post-tax cut and that should eventually get you up to around the $30 mark in 2018,” he said. That would put the ETF a hair below its 2007 all-time high.

The XLF is currently up 21 percent year to date, thanks to the rally in bank stocks over the past month.