JPMorgan Chase on Friday posted second-quarter profit and revenue that topped analysts’ expectations as investment banking fees surged 52% from a year earlier.

Here’s what the company reported:

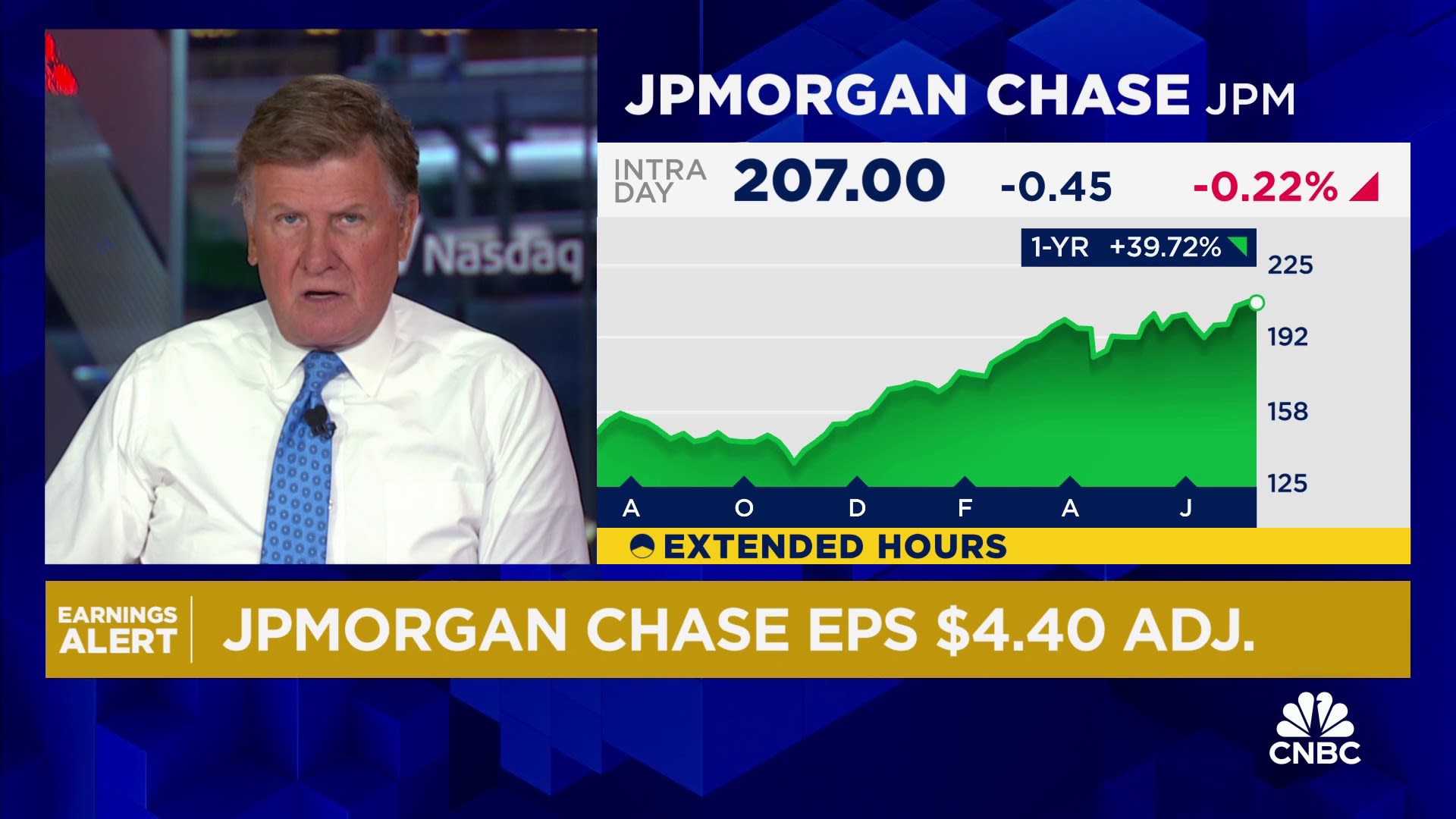

- Earnings: $4.26 per share adjusted vs. $4.19 estimate of analysts surveyed by LSEG

- Revenue: $50.99 billion vs. $49.87 billion estimate

The bank said earnings jumped 25% from the year-earlier period to $18.15 billion, or $6.12 per share. Excluding items related to the bank’s stake in Visa, profit was $4.26 per share.

Revenue rose 20% to $50.99 billion, topping the consensus estimate of analysts surveyed by LSEG, helped by better-than-expected investment banking fees and equities trading results.

CEO Jamie Dimon noted in the release that his firm was wary of potential future risks, including higher-than-expected inflation and interest rates, even while stock and bond valuations currently “reflect a rather benign economic outlook.”

“The geopolitical situation remains complex and potentially the most dangerous since World War II — though its outcome and effect on the global economy remain unknown,” Dimon said. “There has been some progress bringing inflation down, but there are still multiple inflationary forces in front of us: large fiscal deficits, infrastructure needs, restructuring of trade and remilitarization of the world.”

Shares of JPMorgan slipped 1% in premarket trading.

A rebound in Wall Street activity, especially on the advisory side, was expected to aid banks this quarter, and JPMorgan’s results bear that out.

JPMorgan reaped $2.3 billion in investment banking fees, exceeding the StreetAccount estimate by roughly $300 million.

Equities trading revenue jumped 21% to $3 billion, topping the estimate by $230 million, on strong derivatives results. Fixed income trading jumped 5% to $4.8 billion, matching the estimate.

But the bank had a $3.05 billion provision for credit losses in the quarter, exceeding the $2.78 billion estimate, which indicated that the bank expects more loan defaults in the future.

“JPMorgan has navigated a challenging interest rate environment very well,” said Octavio Marenzi, CEO of consulting firm Opimas.

Still, while banking and equities trading boosted results, “We see Main Street banking beginning to sputter,” Marenzi said. “Provisions for credit losses were up significantly, showing us that JPMorgan is expecting to see a rough patch in the US economy.”

Wells Fargo and Citigroup also report earnings Friday, while Goldman Sachs, Bank of America and Morgan Stanley report next week.

This story is developing. Please check back for updates.