On a turbulent day for the stock market as trade war worries mounted, CNBC’s Jim Cramer took to the charts to get a technical take on the market layout.

“When the averages are falling apart, the thing to focus on is the CBOE Volatility Index, the VIX for short, also known as the fear gauge, which was so heavily tied to the big breakdown in February,” the “Mad Money” host said on Friday.

So Cramer called in RealMoney.com technician Mark Sebastian, the founder of OptionPit.com and “Mad Money’s” resident VIX expert, to see if the market was about to see another VIX-related breakdown.

For most investors, the VIX’s function is fairly simple. It serves as a proxy for the overall level of fear or anxiety in the market, surging during times of panic and dropping in times of calm.

But some traders prefer to short the VIX through highly volatile trading instruments, using borrowed money to make bullish bets that the market won’t see dramatic drops in the near term.

“Whenever the VIX spikes against them, they end up having to unwind their positions in the S&P [500] to meet their margin calls,” Cramer explained. “That’s what killed us … in early February, and while it’s no longer the main driver of the decline, it does act as a kind of accelerant.”

But after reviewing the charts, Sebastian thought the action in the VIX could be trending more positive than negative.

“He thinks the action in the VIX is signaling that we might be bottoming despite today’s horrendous action,” Cramer said.

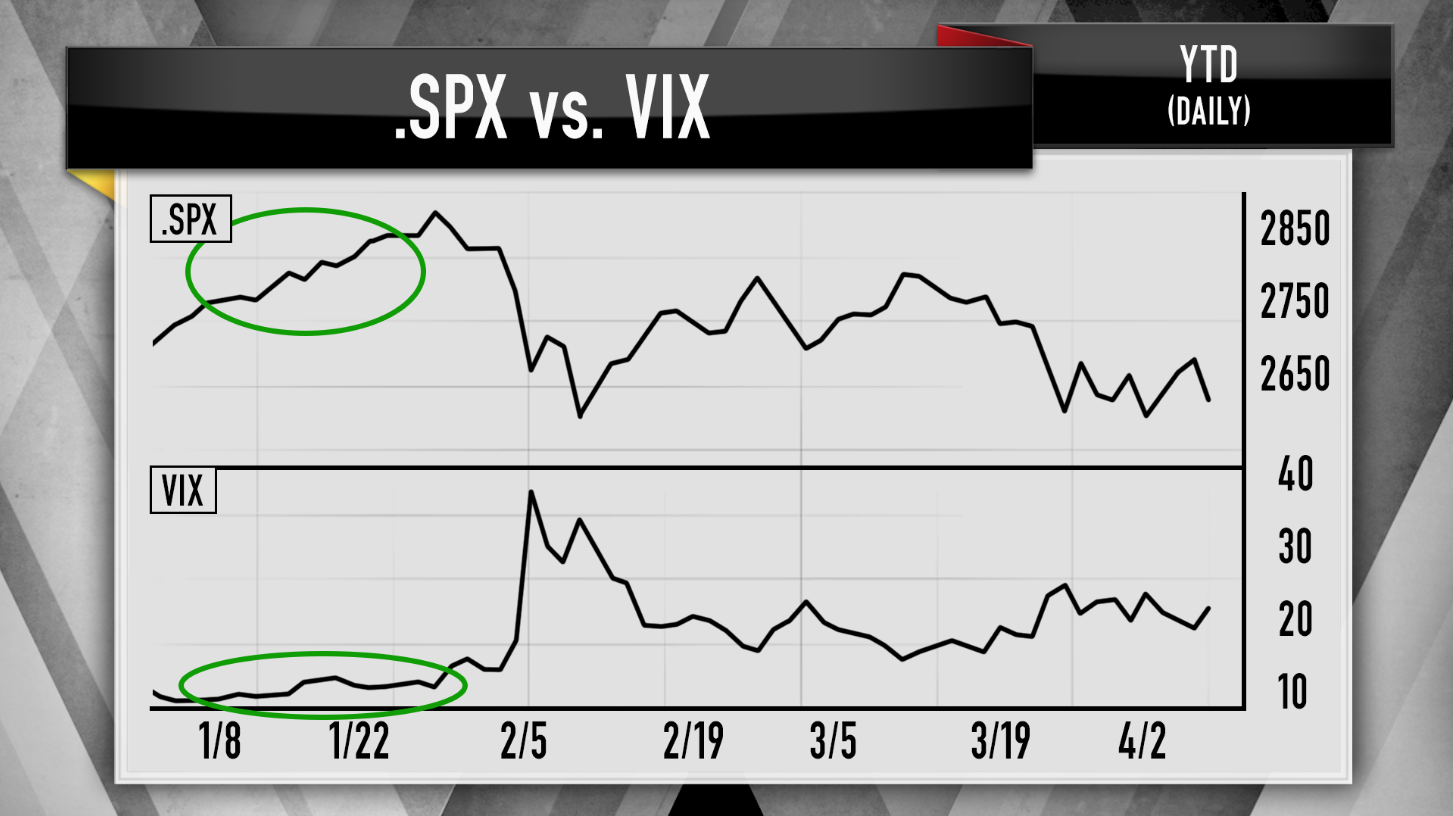

Sebastian pointed to the VIX’s moves going into the February sell-off, the first serious market-wide drop since 2015. As the S&P climbed, the VIX climbed with it — a major red flag that investors were getting antsy.

When the S&P fell apart in early February, the VIX soared to around 40. Since then, every time it seems like stocks are recovering, the market breaks down again and re-tests February’s lows.

But Sebastian noticed that each time the S&P tested those lows — four times in the last two weeks — the VIX didn’t come anywhere close to where it was in February, signaling that investors’ nerves have somewhat abated.

More important, Sebastian said the situation resembled the market hitting a bottom in 2015, when a currency crisis in China sent the VIX skyrocketing and the S&P tumbling.

“But two months later when the S&P retests those earlier lows off of a mini debt ceiling crisis in Washington, the VIX peaks at 30. After that, what happened? The S&P came roaring back. You had a monster run,” Cramer said. “If we follow that pattern from 2015, Sebastian wouldn’t be surprised if the S&P 500 can climb from its current level of 2,604 back to 2,800, at a minimum.”

Cramer continued: “In short, even with all of the sturm and drang lately, Sebastian believes we may have already bottomed and the recent pain is simply the market retesting its lows before working its way higher.”

Still, the “Mad Money” host remained cautious, saying that the market would need a resolution to 2018’s Washington-related concern — a potential trade war with China — to rally again.

“Here’s the bottom line: the charts, as interpreted by Mark Sebastian, suggest that you need to look past the vertigo-inducing day-to-day action and focus on the fact that the lows keep holding,” he concluded.

“Based on the calmer behavior of the volatility index, he thinks we may have already bottomed and a rally could be right around the corner,” Cramer said. “I think that’s important to keep in mind, even as I continue to recommend caution in the face of endless, torturous games of chutes and ladders, that stranger things have happened.”

Questions for Cramer?

Call Cramer: 1-800-743-CNBCWant to take a deep dive into Cramer’s world? Hit him up!

Mad Money Twitter – Jim Cramer Twitter – Facebook – Instagram – VineQuestions, comments, suggestions for the “Mad Money” website? madcap@cnbc.com