LOS ANGELES — An escalation of trade tensions between the U.S. and China, including President Donald Trump‘s threat to punish Beijing with additional tariffs, could deal a severe blow to California’s ports and economy, potentially putting at risk thousands of jobs, according to experts.

They say the major California ports, which serve as a gateway to trade with China, have already been hit on the export side due to Beijing’s retaliatory tariffs on U.S. agricultural and other products. For one, China represents about 60% of the trade volumes at the Port of Los Angeles, the busiest container port in the nation.

On Sunday, Trump tweeted he was prepared to increase tariffs from 10% to up to 25% on $200 billion of Chinese goods this week. In February, Trump announced he would delay an increase in Chinese tariffs, citing progress in talks — and then in early April the president indicated a deal was “very close.”

“On the export side, we’ve been hammered,” said Gene Seroka, executive director of the Port of Los Angeles. “We call for a negotiated settlement so we can get moving in the direction that we need to.”

Seroka said exports to China last year declined by about 25%, and as a region and port declined on exports to China by about 22%. He said cargo that goes through the port includes items not only produced in California but coming via rail from Midwestern states, including soybeans.

“We imported a heck of a lot more last year than we exported,” he said.

Besides food and agricultural items, Seroka said other sectors already hit by the trade war on the export side are electronic products, household goods and recyclables. He said many were down double-digit percentage levels in 2018 from the prior year.

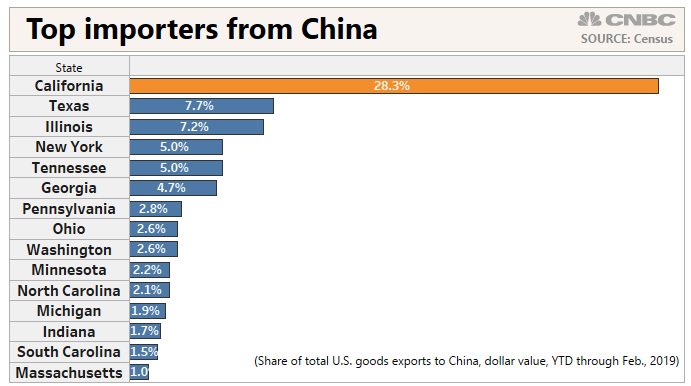

Overall, California represented a 15.4% share of total U.S. exports to China in the year-to-date period through February, according to U.S. Census Bureau data. The Golden State also accounted for nearly 30% of all imports from China, which includes goods received at seaports and airports.

Experts warn California ports could see a further slowdown in volumes of trade between the U.S. and China from new tariffs.

“The impact of that will be felt most directly at the ports of LA and Long Beach, and all of the tens of thousands of people whose livelihoods are directly tied to the fluid movement of containers through those two maritime gateways,” said Jock O’Connell, a Sacramento, California-based international trade advisor for Beacon Economics, a research and consulting firm. “That in itself could have a very dramatic effect on employment in Southern California.”

Jobs at risk include dock workers and truckers, as well as rail and other trade-related jobs.

According to Los Angeles County Economic Development Corp. estimates, the international trade sector is responsible for over 160,000 jobs in that county alone. Other estimates indicate the twin LA and Long Beach ports represent more than 500,000 jobs when including the five-county Southern California region.

“We’re concerned about the potential impact, not only with regard to the tariff as it applies to Chinese imports but of course the expected action by China — some form of retaliation on American exporters,” said Mario Cordero, executive director of California’s Port of Long Beach, the nation’s second-largest container port. “Any time you have market uncertainty by way of tariff applications, I think that does put an additional factor that could impact the economy.”

Also, on the import side, experts say the uncertainty of not knowing how long the trading war will last and where it will go is a headache for U.S. retailers and others. Last year, some importers rushed to beat increased tariffs of 25% that the administration had previously threatened would go into effect Jan. 1, 2019.

So far, observers say expansion of tariffs will likely impact everything from clothing and footwear to consumer electronics.

“The public will definitely begin to feel the impact of the tariffs,” said O’Connell. “That will happen nationally, but to the extent that California consumers are sensitive to higher prices because of other high costs of living here, that will have a particularly egregious effect.”

Moreover, O’Connell said he expects Beijing will likely retaliate if they can’t work things out in Washington.

O’Connell said China could impose new tariffs on electronic components and chips, including items made by companies such as San Diego-based Qualcomm. The economist added that Boeing commercial aircraft also could face tariffs from China and noted that up to 2,600 vendors in California supply components on those planes.

China’s foreign ministry indicated Monday that a trade delegation still plans to visit Washington later this week. However, the ministry didn’t say whether the delegation would be headed by a high-level trade official, such as Vice Premier Liu He.

“It is concerning in terms of the length of the trade war and tariff discussions,” said Cordero. “However, we remain optimistic that there will be some resolution.”

— Graphics by CNBC’s John Schoen.