Europe’s tech start-up scene is giving Silicon Valley a run for its money.

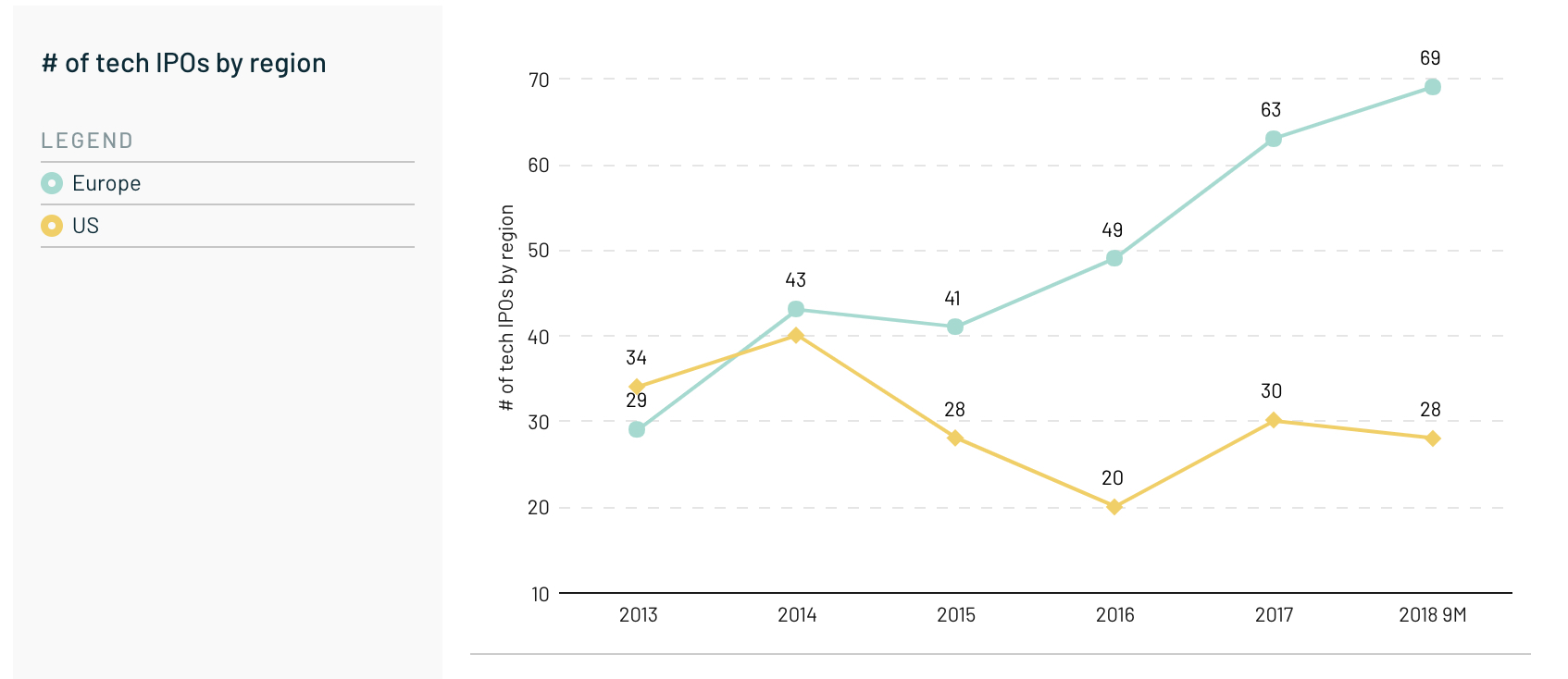

Europe is home to more than twice as many tech initial public offerings (IPOs) as the U.S. so far this year, while newly-listed European companies are outperforming their American counterparts, according to a report by venture capital firm Atomico.

The research, released Tuesday at the Slush tech conference in Helsinki, Finland, suggests investors could reap big returns from Europe’s technology start-ups. Citing data from the London Stock Exchange, it found 69 tech companies have gone public in Europe so far this year, compared to 28 in the U.S.

European tech companies that went public in 2018 saw their share price increase by an average of 222 percent. By contrast, U.S. tech IPOs had average gains of 42 percent.

“This year has been an incredible year for the European tech ecosystem,” Tom Wehmeier, partner and head of research at Atomico who authored the report, told CNBC.

The fourth annual report surveyed 5,000 respondents across Europe. It said one reason the continent outpaces the U.S. in the tech IPO market is that European exchanges are more supportive of smaller companies that want to go public. Sixty-two out of Europe’s 69 tech IPOs had a market cap below $1 billion.

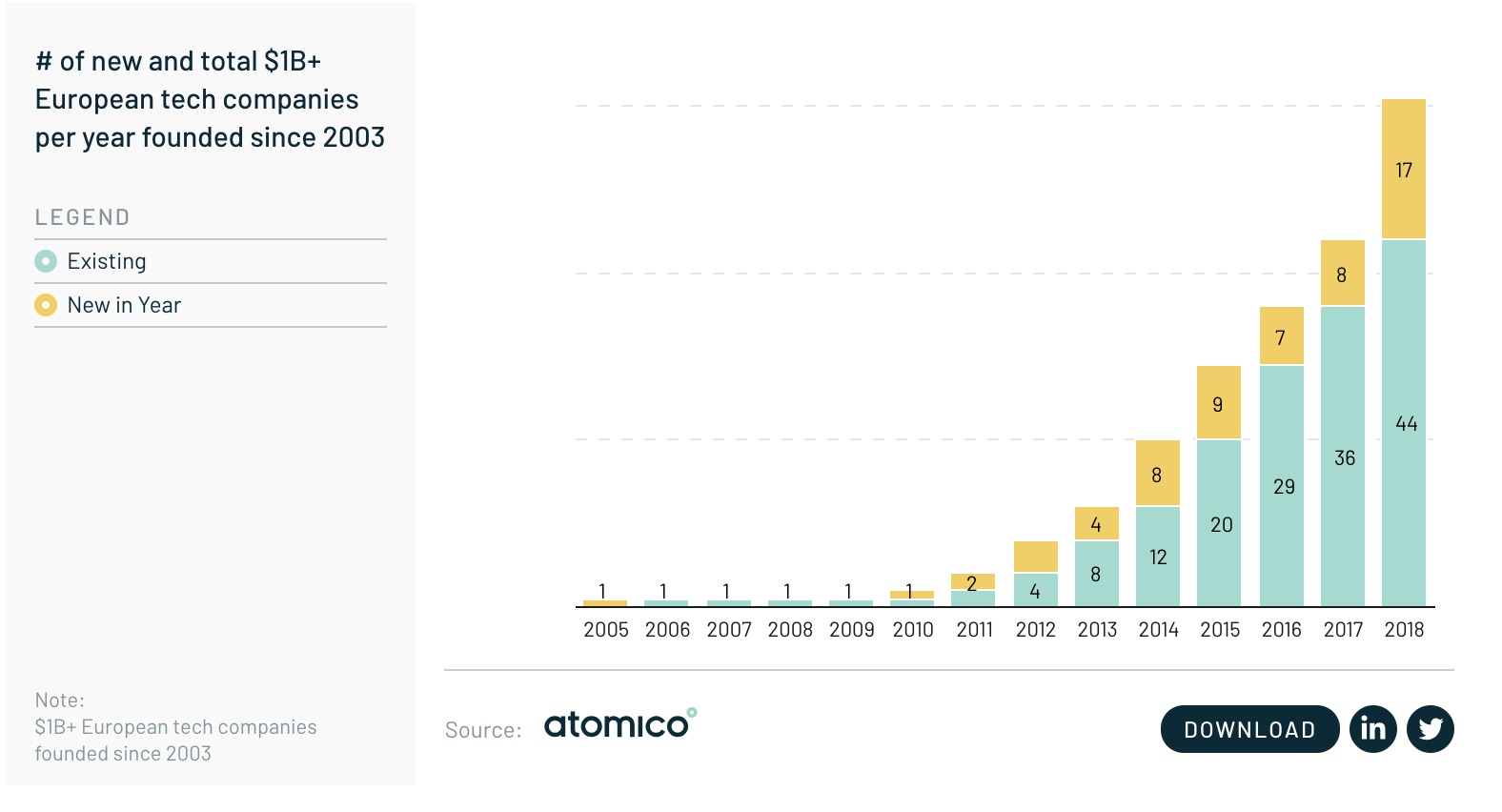

The research also highlighted a growing number of European unicorns, or companies valued at more than $1 billion. Atomico reported 17 new unicorns in Europe this year, double the number added last year. Among them were U.K. fintech companies Revolut and Monzo and Estonian ride-hailing start-up Taxify.

Wehmeier said Spotify‘s success put Europe’s unicorns in the spotlight. The Stockholm-based music streaming company listed on the New York Stock Exchange in April for $26 billion, the largest direct listing on record. A direct listing meant Spotify did not need to seek underwriters for its IPO and a price was not set in advance.

Spotify shares have dropped around 6 percent since going public, but a majority of analysts maintain buy ratings on the stock, according to Thomson Reuters.

“There’s a lot of talk sometimes that European founders can’t compete on the global stage, and I think Spotify has shown that… you can still come out on top if you start from the outset thinking big,” Wehmeier said.

Atomico estimates a record $23 billion will be invested in Europe’s tech sector in 2018, up from $5 billion five years ago. Wehmeier said that Europe, unlike the U.S., is seeing growth in the number of funding deals alongside the amount of investment.

One key source of capital in Europe is China, which participated in funding rounds worth more than $1 billion in European tech this year. China has been increasingly expanding its footprint in Europe as other countries like the U.S. have adopted more restrictive policies on trade and security.

“The influence of Asian investors in the European tech ecosystem has grown significantly in recent years,” Atomico’s report said.

The outlook for the European tech sector isn’t all rosy. The continent lags behind the U.S. and China in its market share of public internet and software companies, and Europe’s Stoxx 600 tech sector has underperformed the S&P tech sector this year.

Europe has also struggled to match its nearly 1.8 million researchers, a number that exceeds both the U.S. and China, with tech founders and engineers.

“Historically, Europe has not done a good job of commercializing that research effort,” Wehmeier said.

Europe’s regulatory environment is another hurdle. Respondents in Atomico’s report were split on whether European regulators are acting in the best interest of tech start-ups. Meanwhile, 49 percent of venture capitalists and founders said European regulation makes it harder to start and scale a technology business.

The European tech community took a broadly positive view on Europe’s sweeping new set of data privacy rules called the General Data Protection Regulation (GDPR). Sixty percent of respondents said the law has been a good thing for European consumers.

“European tech leaders and policymakers want to work more closely together, but they are still speaking across each other today,” the report said.