CME, the world’s largest futures exchange, launched its own bitcoin futures contract Sunday under the ticker “BTC.”

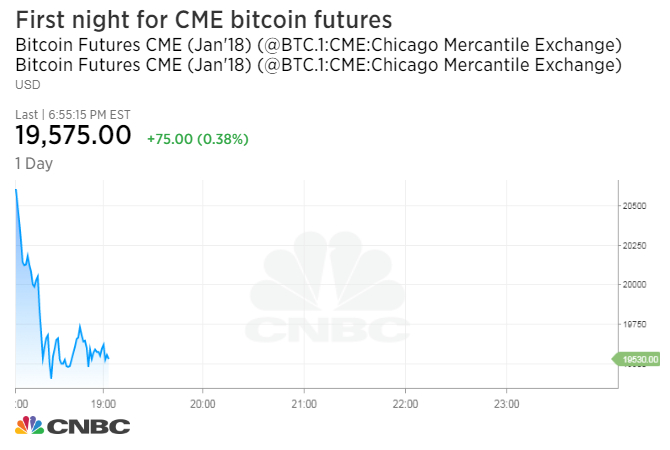

The futures fell more than 4 percent to $18,665 about two hours after opening at $20,650 and rising slightly.

The move lower was a stark contrast from the 19 percent surge in CBOE bitcoin futures during their first day of trading a week ago. The Cboe bitcoin futures, traded under the ticker “XBT,” rose more than 2 percent to $18,530 Sunday evening, ET.

To monitor both types of bitcoin futures on CNBC.com, type “Bitcoin futures” into the ticker search box at the top of the page.

Bitcoin itself fell about 4.8 percent at $18,161, according to the CoinDesk bitcoin price index. CoinDesk tracks prices from digital currency exchanges Bitstamp, Coinbase, itBit and Bitfinex.

Bobby Cho, head trader at major bitcoin trading company Cumberland, a subsidiary of DRW, pointed out that the CME futures were trading closer to the actual price of bitcoin than the Cboe contract had at launch last Sunday.

“There’s more people who are involved in the CME launch than there were at Cboe’s,” Cho said. “The spot market still dictates where futures are trading, just because of the sheer volume.”

Leading U.S. exchanges have raced to offer derivatives contracts for bitcoin, which has surged more than 1,600 percent this year on growing investor interest.

CME had made its announcement on Dec. 1 for bitcoin futures. But two days later Cboe Global Markets said it was launching its own futures contract on Dec. 10, a week before CME. Nasdaq and Cantor Fitzgerald are also planning their own bitcoin derivatives contracts.

Cboe’s bitcoin futures contract had a relatively smooth first week of trading, although volume was on the light side. The most popular contract, which expires in January, gained 17.1 percent in the first week of trading to settle Friday at $18,105.

About 20 firms participated, including Interactive Brokers and Wedbush Futures. TD Ameritrade announced late Friday afternoon it would allow certain clients to begin trading the Cboe bitcoin futures, but not the CME futures, on Monday.

Many see the launch of bitcoin futures as a step towards establishing the digital currency as a legitimate asset class. The derivatives allow institutional investors to buy into the cryptocurrency trend and could pave the way for a bitcoin exchange-traded fund.

In less than ten years, bitcoin has quickly evolved from being a fringe asset and the focus of tech nerds to a globally traded asset. More than 170 “cryptofunds” have launched to invest in cryptocurrencies and startups focused on the blockchain technology behind the digital currencies, according to financial research firm Autonomous Next.