Chief financial officers at large companies see a U.S. economy and equities market that can continue to grow, even as fears about sticky inflation and a potentially overextended, and concentrated, bull run in stocks weigh on investors.

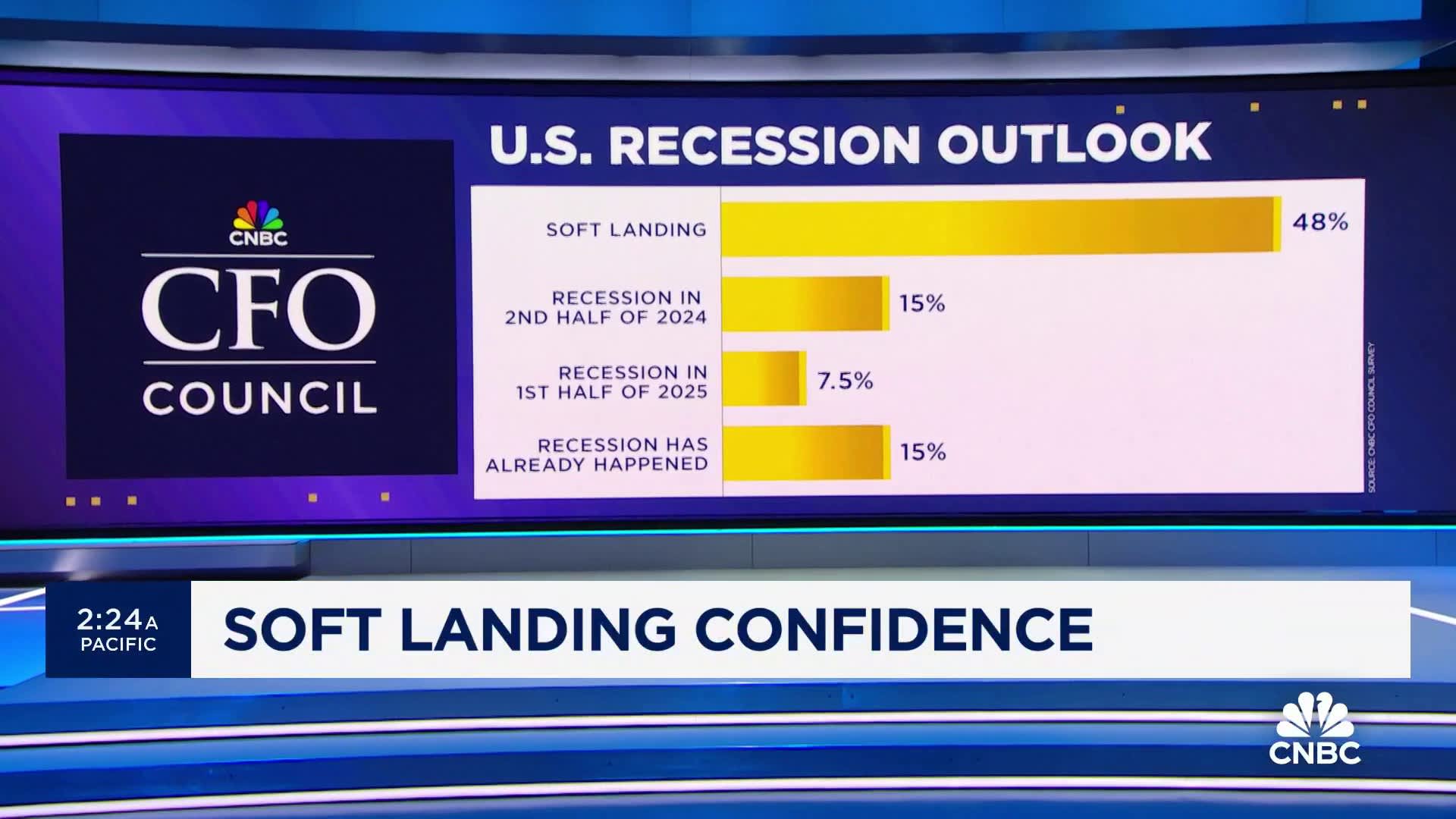

That’s according to the CNBC CFO Council Survey for the first quarter, which shows a dramatic year-over-year change in the view from CFOs about the Federal Reserve’s inflation battle. The percentage of CFOs who think the Fed will be able to achieve a soft landing has reached a five-quarter high, at 48%. It’s a marked change from where CFOs were a year ago in Q1 2023, with expectations of a soft landing tripling since the first quarter of last year.

For the first time in five quarters, not a single CFO rated the Fed’s efforts to bring inflation down as “poor,” while those who described the central bank’s policy as “good” edged higher again quarter over quarter to 55%.

The latest forecast of long-term inflation expectations came in higher than expected this week, but the market reacted positively to Tuesday’s CPI reading, and stocks closed at a new record after some days of selling. This bullishness despite continued jitters on inflation lines up with the view from CFOs on the council.

CFOs have been consistent across our surveying in their view that inflation will not return to 2% any time soon, and that’s the case again in the Q1 survey, with nearly 80% of CFOs saying inflation won’t hit the Fed’s 2% target before 2025 at the earliest.

This view of inflation remaining above the Fed’s target for considerably longer plays into a CFO outlook that the Fed will not move as quickly as the market thinks to cut interest rates. In recent months, the market has gotten the Fed’s message that March is out of the picture for the start of rate cuts, but CFOs remain more cautious on the Fed. According to the Q1 survey, the largest percentage of CFO respondents (44%) do not expect a rate cut until September. The CME FedWatch tool shows a majority of traders still betting on June as a likely target. In the Q1 CFO survey, equal groups of just under 25% of CFO respondents think the cuts will begin in June or July.

Despite CFOs expecting a slower moving Fed than traders, the latest quarterly view represents an increase in dovish expectations. The greatest swing in the survey’s interest rate outlook comes from CFOs who in the previous quarterly survey had not expected rate cuts to begin before November 2024 at the earliest.

Jerome Powell, chairman of the U.S. Federal Reserve, smiles during a press conference following the Federal Open Market Committee (FOMC) meeting in Washington, D.C., U.S. on Wednesday, May 1, 2019.

Anna Moneymaker | Bloomberg | Getty Images

CFOs don’t see rate anxiety as being a major short-term hurdle for stocks. Over 80% of CFOs believe the Dow Jones Industrial Average is more likely to continue its run up to the 40,000-point mark, with technology continuing to lead the way among sectors, than slip into a bear market.

The quarterly CFO survey is a snapshot of views from a select number of chief financial officers at large companies comprising the 100 member-plus council, with 27 members providing responses in Q1.

Some of the C-suite economic confidence may be playing into plans for corporate cash. Buybacks are booming again in 2024 and could reach $1 trillion next year, but there is also evidence of more appetite for deal making to start the year, despite the significant regulatory headwinds and antitrust stance of the Biden administration. Nearly one-third of CFO respondents say strategic M&A will be the top capital spending priority this year, which was the most popular response among CFOs for 2024 capex planning.

The Q1 CFO survey doesn’t come without warning signs for an economy and market that have proven more resilient than many, including CFOs, expected throughout the last year. But the biggest risk cited by CFOs this quarter is also a perennial one for major corporations. Throughout the history of the CFO polling, consumer demand has most consistently ranked as the No. 1 external risk to business, and it is back at the top of the list now (37%), and at its highest level among risk factors in five quarters.