Discipline trumps conviction. Those are perhaps the three most important words for Nvidia shareholders who are sitting on a grand slam. After more than tripling last year and more than doubling again so far in 2024, to say Nvidia and CEO Jensen Huang have been on a roll would be the understatement of the century. Riding the artificial intelligence wave sweeping Wall Street, the chip giant on Tuesday was knocking on the door of a $3 trillion market cap. Since its close on May 22, Nvidia’s three-session post-earnings winning streak added more than $500 billion in stock market value. That number is mindboggling when considering that it’s nearly $100 billion bigger than the entire combined market cap of rivals Advanced Micro Devices and Intel . Not only was the latest quarter amazing but so were the guidance and commentary Jensen shared on last week’s earnings conference call — sending clear signals that the demand for Nvidia chips and software solutions shows no sign of slowing. With the next-generation Blackwell chip platform on the near-term horizon — and as Jim Cramer said Tuesday many more iterations down the road — it’s easy to get caught up in the price action, and let your conviction drive your decision-making progress. NVDA 5Y mountain Nvidia 5 years That, however, is not our discipline. While acknowledging that conviction may reward you now and then with outsized gains, we firmly believe that it’s discipline that keeps you in the game. It’s staying in the game that allows you to ultimately realize the power of compound interest over the years. Last week, we explored the question: Can investors with little to no shares still buy Nvidia after these record runs? This week, we’re looking at the flipside. We aren’t saying run out and sell shares right now if you are sitting on huge paper profits. We can’t answer that question for you. However, here are three things to consider and questions to ask as you look at a monster gain in Nvidia and try to assess the appropriate course of action. 1. Have you booked a gain recently? With shares up nearly 130% year-to-date in 2024, on the back of a 239% gain in 2023, it can seem like gains will continue forever. However, we all know that isn’t the case. Through the years, Nvidia shares have hit pockets of turbulence. Knowing that, on the first trading day of 2024, the Club sold some shares of Nvidia — and seven other outsized winners from the prior year. I n our Jan. 2 trade alert to members , we wrote: “To be clear, we don’t envision exiting these names completely, which is why we are only making small sales across the board. The group above represents some of the greatest companies in the world. But discipline matters too because bulls make money, bears make money, and hogs get slaughtered. We’ve been feeling greedy during this historic stretch and refuse to be hogs after the great year these stocks have had.” Can we regret our move? Sure, looking back we should have bet the farm on Nvidia. But hindsight is 20/20, and it would be dishonest to pretend that the last five months of gains were so obvious back then. We had no idea that Nvidia would start 2024 with a continued rally; or foresee a 19% plunge from its March 25 intraday high to its most recent low on April 22; or the resumption of its run to current historic levels. Should we beat ourselves up for selling shares on Jan. 2, when the next top came in March? No. Because again, hindsight is 20/20. We can’t time the market consistently, so we don’t pretend like we can. Instead, we simply look to apply disciplined decision-making throughout the investing process. 2. Diversification matters. When a stock does what Nvidia has done, it can impact your exposure. After the small Jan 2. trim — which was more about the magnitude of the run than the position getting too big — Nvidia had a weighting of just over 2%. Adding another roughly 134% since then — which includes the aforementioned 19% swoon — we’re conscious that Nvidia now accounts for a little over 4.5% of the portfolio. It’s No. 2 — just behind our other “own it, don’t trade it” stock Apple at a 5% weighting. Since we don’t like any one position to be much bigger than 5%, we may need to do some selling if the Nvidia rally continues. If that were to happen, it would not be because anything has changed in our outlook — but rather, it would be smart portfolio management. As you think about your diversification profile, be sure to also keep in mind the correlation between positions. This Nvidia run is being driven by investments into AI infrastructure. That appears to be sustainable for now. But that theme is driving many stocks, including fellow Club name Broadcom , which is at a nearly 3.3% weighting. That means nearly 8% of the portfolio could be at risk to the downside if AI spending were to pause — and that’s before considering the less direct exposure we have through names like Eaton . Again, we don’t think that will happen anytime soon. But worrying about all eventualities is prudent. 3. Ask yourself: If I didn’t own any shares now, would I buy? This doesn’t address the issue of greed or diversification, however, by answering this question as objectively as possible, we can seek to be more honest with ourselves in terms of the current risk/reward being offered by the stock. Investing is all about making estimations of risk and reward and managing the risks while letting the winners take care of themselves. As you look at Nvidia, try to put the gains you see on paper aside and think about the stock from the perspective of new money. After all, it is new money coming in that will drive shares higher or the lack of new buyers that will result in a pullback. Shares are currently reading as overbought according to the relative strength indicator (RSI), a momentum-oriented technical analysis tool , which stands at 78. The threshold for overbought is 70. That doesn’t mean shares are going to pull back imminently. Overbought conditions can last a while. In fact, the last time we broke above 70, Nvidia shares were trading around $540 each and went on a $200 run to around $740, before pulling back sharply to around $663. However, it does mean shares have made a very strong move to the upside in a very short amount of time and the risk/reward isn’t quite what it was when shares were at $950 prior to this move and a bit more caution may be warranted when it comes to managing the position. Overbought conditions are generally worked off in one of two ways, either they pull back or they trade sideways and consolidate. When that happens is hard to say but the odds of it happening are higher when we’ve entered overbought territory. Bottom line As you look at your Nvidia position and think about what to do given the incredible run we’ve seen, keep these three considerations in mind. (1) Are you being greedy? (2) Has diversification suffered as a result of the run? (3) What does the risk/reward look like now, versus when you initially took your position? The answers should help you determine what move to make next, so long as you abide by the mantra that discipline trumps conviction. (Jim Cramer’s Charitable Trust is long NVDA, AAPL, AVGO, ETN. See here for a full list of the stocks.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

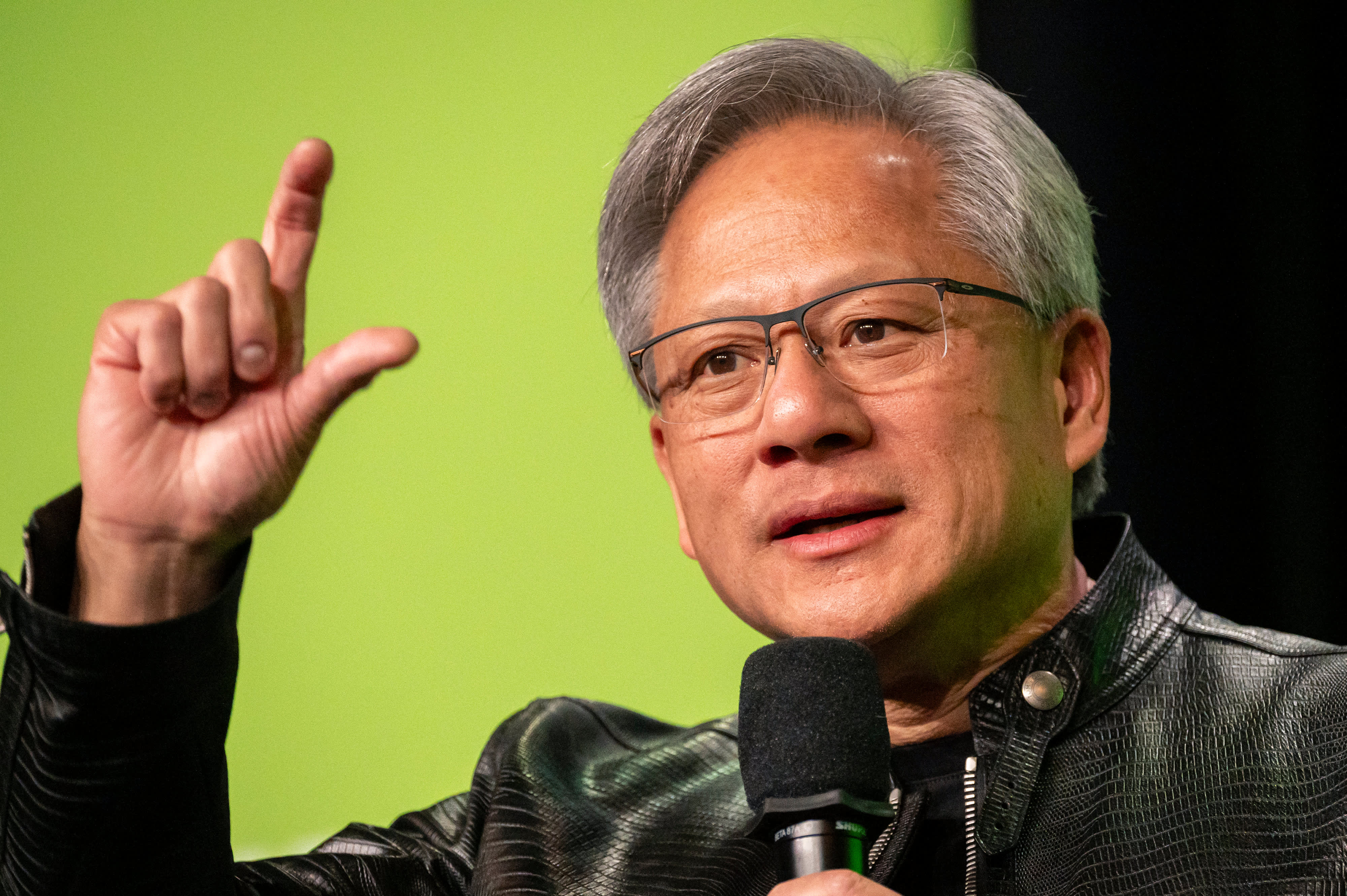

Jensen Huang, co-founder and chief executive officer of Nvidia Corp., during the Nvidia GPU Technology Conference (GTC) in San Jose, California, US, on Tuesday, March 19, 2024.

David Paul Morris | Bloomberg | Getty Images

Discipline trumps conviction. Those are perhaps the three most important words for Nvidia shareholders who are sitting on a grand slam.

After more than tripling last year and more than doubling again so far in 2024, to say Nvidia and CEO Jensen Huang have been on a roll would be the understatement of the century. Riding the artificial intelligence wave sweeping Wall Street, the chip giant on Tuesday was knocking on the door of a $3 trillion market cap. Since its close on May 22, Nvidia’s three-session post-earnings winning streak added more than $500 billion in stock market value. That number is mindboggling when considering that it’s nearly $100 billion bigger than the entire combined market cap of rivals Advanced Micro Devices and Intel.