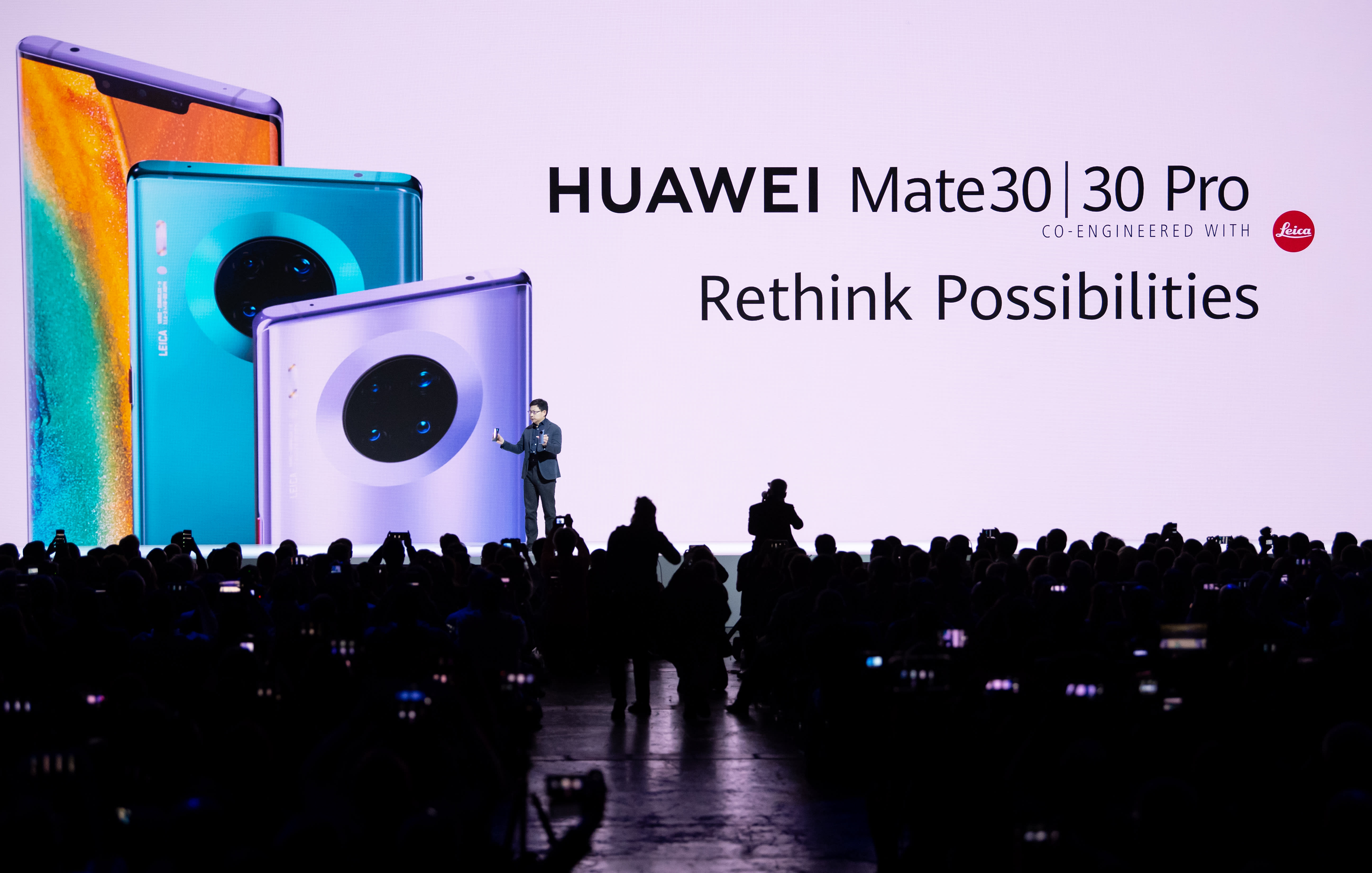

Richard Yu, head of Huawei’s consumer business, presents the Huawei Mate 30 / 30 Pro smartphone series during a press conference.

Sven Hoppe | DPA | picture alliance | Getty Images

Huawei laid out its ambition clearly in an interview with CNBC nearly two years ago: It wants to become world’s largest smartphone maker by 2020.

The year is not over — but that goal has not yet materialized, and the path ahead looks bumpy.

Since the head of its consumer business, Richard Yu, laid out his goal for the company in late 2018, the U.S. has upped its pressure on Huawei and threatened to cut off key components and software, a move that could have a big impact on Huawei’s business.

Despite having a relatively younger smartphone division than its closest rivals Samsung and Apple, Huawei has rapidly risen to become the second-largest smartphone player in the world. It still hasn’t managed to overtake Samsung, which sits at the top, as Yu had hoped.

A series of moves by the administration of President Donald Trump has hurt Huawei, according to analysts.

While the firm has managed to hold on to its number two ranking worldwide, it has done so by focusing on China and other emerging markets, while losing share in some critical regions around the world, data provided to CNBC showed. Its global ambitions have been hurt in the process.

Huawei has yet to respond to a request for comment by CNBC.

Google impact

In May last year, Huawei was put on a blacklist in the U.S. known as the Entity List, which restricted American firms’ ability to do business with the Chinese tech giant. Huawei relies heavily on components and software from U.S. companies.

The smartphone-maker has managed to get around some of the component issues, but it is no longer allowed to use the licensed Google Android operating system on its mobile devices.

Restricting Huawei’s access to Google’s operating system and apps has been the greatest impact felt by the company.

Huawei’s rotating chairman, Eric Xu, told CNBC in March that the company fell short of its own internal revenue target for 2019 by $12 billion with most of that coming from the consumer division, which accounts for over half of the Chinese firm’s total sales.

Data from research firms, International Data Corporation (IDC) and Counterpoint Research, show how the U.S. sanctions have hurt Huawei’s performance globally.

In the first quarter of 2019, before the U.S. blacklisting, Huawei’s global market share stood at 18.9% — standing in second place behind Samsung and ahead of Apple, according to IDC.

But as the effect of the blacklist took hold, Huawei’s market share dipped to 15.2% in the fourth quarter and fell to third place behind Apple.

In the first quarter of 2020, Huawei has regained second place again, but its market share stood at 17.8%, off its peak before the blacklist.

While the global figures appear to show Huawei has remained fairly resilient, they do obscure what is happening in critical international markets. That resilience has come down to Huawei’s efforts to double down on China but also shift large units of older phone models in other emerging markets.

In mature markets outside of China, the lack of Google services is a big problem for its flagship phone ambitions.

Bryan Ma

International Data Corporation

Because China is a huge smartphone market, success there usually helps vendors in the global market. In the world’s second-largest economy, Huawei’s share has jumped from 35.5% in the first quarter of 2019 to 42.6% in the same quarter this year, IDC said.

The fact that two flagship Huawei phones — the Mate 30 and P40 — were released without licensed Android and the related apps is not a big issue in China where Google services are blocked anyway. Chinese smartphone users are not used to using such apps.

But it becomes an issue in international markets where consumers rely on many of Google’s services, such as Gmail, maps and its search engine. In comparison, other smartphones makers such as Xiaomi or Samsung are offering flagship handsets with Android.

Short-term success

Huawei has found short-term success with its strategy to push older devices in many emerging markets in order to shore up its global share. The smartphones that were released before the blacklisting still have Android.

For example, in central and eastern Europe, Huawei’s market share stood at 26.4% in the first quarter of this year, higher than in the same period in 2019, according to Counterpoint Research. Meanwhile, its share in Asia, excluding China and India, is also higher.

IDC said that Huawei’s share in Latin America is also up in the March quarter of 2020 compared to the same time last year. That focus on shifting large units of older and cheaper handsets has helped Huawei’s global share remain resilient but analysts warned it is not sustainable.

“In mature markets outside of China, the lack of Google services is a big problem for its flagship phone ambitions,” Bryan Ma, vice president of devices research at IDC, told CNBC. “Huawei can temporarily get around it by focusing on older, lower-end models in selected developing markets, but that can only go so far.”

And Huawei’s Chinese competitors such as OPPO and Xiaomi have still been able to release handsets with Google. That has hurt Huawei in more developed markets already, which is a big concern.

“This is already happening in Western Europe where Xiaomi and OPPO are offering more competent and newer offerings than Huawei’s older models which did well up to a point,” Neil Shah, research director at Counterpoint Research said.

Huawei’s share in western Europe has fallen sharply from 24.3% in the first quarter of 2019 to 18.2% in the same period this year.

Similarly in India, Huawei’s market share was 0.4% in the March quarter, down from 3.4% in the same period last year.

Uncertain future

After last year’s blacklisting, Huawei launched its own operating system called HarmonyOS to replace the void left by not having access to Android. HarmonyOS comes with Huawei’s own app store and other services and the company has started to load its new devices with this software.

Huawei executives recently talked up the operating system’s ability to be “on par” with Google and Apple’s, but analysts cast doubts on its ability to find success in international markets given that it lacks some major apps.

On top of that, Washington’s campaign against Huawei has continued.

A new rule passed last month requires foreign manufacturers using U.S. chipmaking equipment to get a license before being able to sell semiconductors to Huawei. The move aims to cut off Huawei’s supply of chips from TSMC, the Taiwanese firm that manufactures most of those components for the Chinese company. Analysts previously told CNBC that this could be another big blow for the company.

That, coupled with the Google ban, makes the road ahead very difficult for Huawei.

“With more restrictions on chipsets now from TSMC, it hits Hauwei’s hardware-level competitiveness making it more difficult in the future to ship competitive products even without GMS (Google Mobile Services) or older versions of Android,” Shah said.