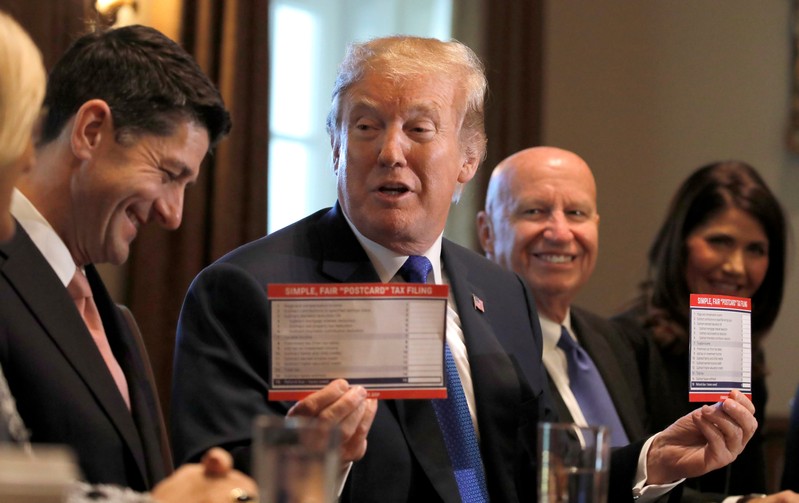

U.S. President Donald Trump holds sample tax forms as he promotes a newly unveiled Republican tax plan with House Republican leaders in the Cabinet Room of the White House in Washington, U.S., November 2, 2017. REUTERS/Carlos Barria

November 10, 2017

By Tanya Agrawal

(Reuters) – U.S. stock index futures were trading lower on Friday on concerns that a delay in corporate tax cut till 2019 may stall the stock market rally that was powered in part by Donald Trump’s election win.

* A Republican tax-cut bill could be delayed after Senate Republicans unveiled a plan that would push a corporate rate cuts to 20 percent by a year and provide small-business owners with a deduction rather than a special business rate.

* The Senate Republicans version of the bill differs markedly on corporate, business and individual tax cuts from legislation detailed by their counterparts in the House of Representatives.

* The S&P 500 index has surged more than 20 percent since the election of President Donald Trump, fueled by his promises to cut corporate taxes and other business-friendly measures.

* All three major indexes were on track to end lower for the week, with the S&P and the Dow on track to post weekly losses after eight straight weeks of gains.

* The S&P 500 is trading at 18 times expected earnings, expensive compared with its 10-year average of 14.3, according to Thomson Reuters Datastream. Cutting corporate taxes would boost earnings and make stocks relatively less expensive.

* With third-quarter earnings winding down and stocks still trading at record levels, investors are also looking to book profits.

* Earnings for the quarter are expected to have climbed 8 percent, compared with expectations of a 5.9 percent rise at the start of October, according to Thomson Reuters I/B/E/S.

* Shares of Nvidia <NVDA.O> were up 4.7 percent after the chipmaker’s revenue forecast for the current quarter topped estimates.

* Hertz Global Holdings <HTZ.N> jumped 9.5 percent as the car rental company reported a better-than-expected net profit.

* Nordstrom <JWN.N> fell 1.1 percent after its quarterly same-store sales came in below expectations.

Futures snapshot at 7:12 a.m. ET:

* Dow e-minis <1YMc1> were down 63 points, or 0.27 percent, with 32,085 contracts changing hands.

* S&P 500 e-minis <ESc1> were down 11 points, or 0.43 percent, with 219,085 contracts traded.

* Nasdaq 100 e-minis <NQc1> were down 24.75 points, or 0.39 percent, on volume of 38,292 contracts.

(Reporting by Tanya Agrawal; Editing by Arun Koyyur)