The Federal Reserve will continue to take interest rates higher as long as the mini-banking crisis drags on, CNBC’s Jim Cramer said Monday. But if a larger bank fails, Cramer said the end to rate hikes would arrive faster, along with “a lot more pain.”

First Citizens Bancshares took over the failed Silicon Valley Bank’s branches, loans, and deposits in what Cramer called a “sweetheart deal,” since it’s buying $72 billion in loans at a $16.5 billion discount. Citizens’ stock soared 53% Monday, but Cramer said the deal does not necessarily act as a solution for the bank run problem.

“This kind of thing only can happen in receivership, after a bank has already failed, because that can eliminate a lot of risk for the buyer,” he said. “Our system simply isn’t ready for a wave of bank failures—that’s not an ideal solution.”

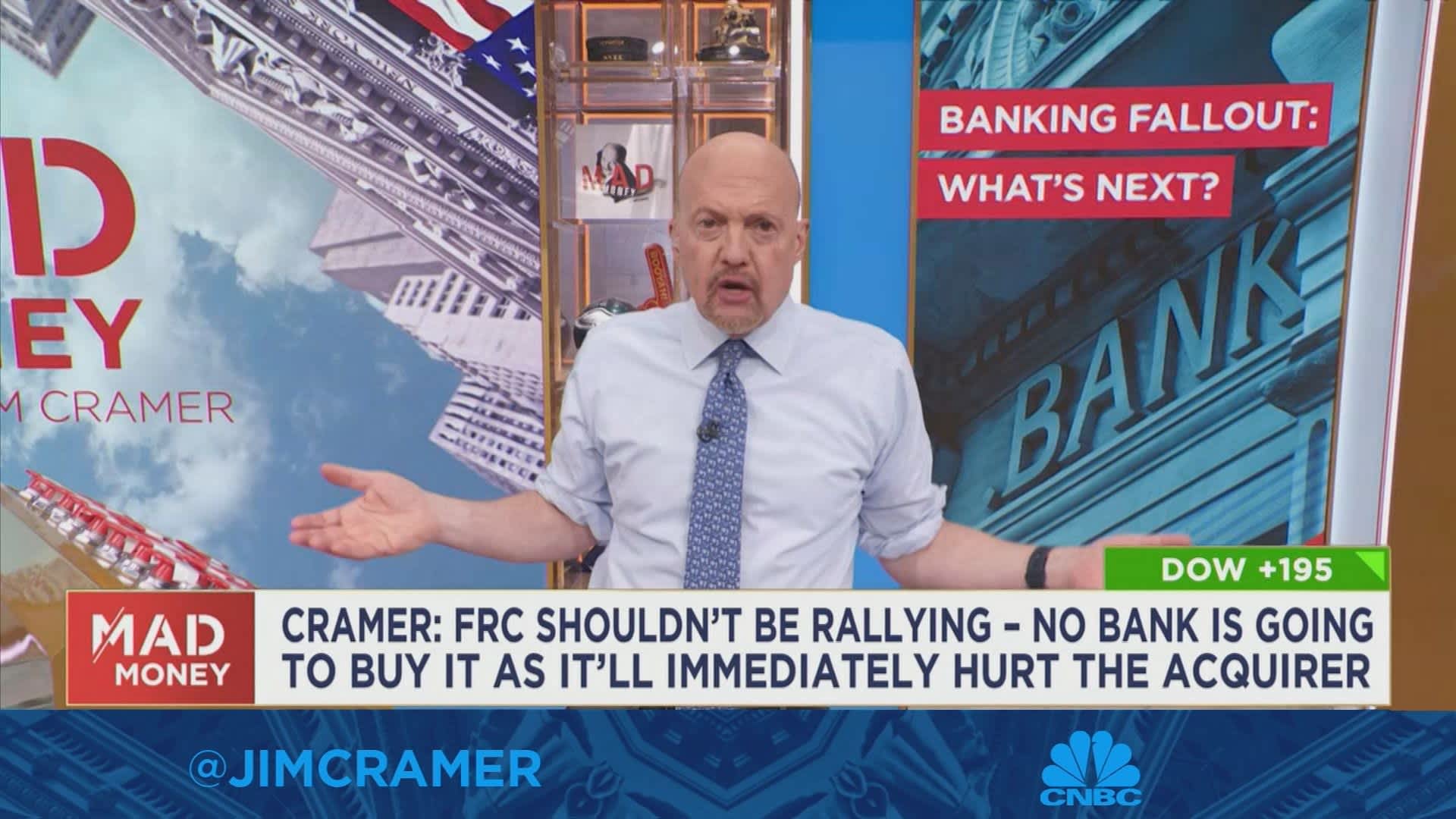

Cramer pointed to First Republic Bank, which rallied on the SVB news. He said banks are not going to step up to buy First Republic since it would hurt the acquirer in the short term, so First Republic would have to fall hard before a strong deal could be worked out.

After depositors’ confidence was shaken by the collapse of SVB, the Fed raised interest rates by 25 basis points last week. Cramer said the Fed will continue with rate hikes until wage inflation cools off, but that if another large bank like First Republic collapses, “it’ll definitely do the job.”

Cramer said he thinks the bank crisis equates to about 100 basis points of tightening if it continues, and he noted that it is likely the most deflationary event that can happen in an economy.

“It’s more shocking than endless rate hikes, but it gets the darned process over with, even with collateral damage that tends to be a lot worse,” he said.

Though it remains unclear what will happen to First Republic’s deposit base, Cramer said First Citizens’ “shotgun wedding” to SVB shows that some banks are ready to take on troubled entities after they’re wiped out.