CNBC’s Jim Cramer advises investors not to let potential trade war escalation scare them away from one of the most important segments in the technology industry. The “Mad Money” host pays Salesforce.com co-CEO Marc Benioff at the company’s annual Dreamforce software conference to learn about the cloud firm’s Customer 360 Truth platform. In the show, he sits down with executives of luxury furniture retailer RH and payments company Square to get more insight in their businesses.

Hold on to software-as-a-play stocks

Traders and financial professionals work ahead of the opening bell on the floor of the New York Stock Exchange.

Drew Angerer | Getty Images

Don’t give up on the entire technology sector of the market, according to CNBC’s .

The “Mad Money” host advised that selling off would be a poor miscalculation, urging investors to “ask yourself what you’re selling.”

“If you’re dumping an ETF, be my guest — those are just moronic amalgamations of stocks slapped together by people who make a living by convincing you that the tech sector is still a real, cohesive thing,” he said. “But if you’re dumping the kind of tech stocks that are working here — especially the better run software-as-a-service names — I think you’re making a big mistake.”

RH: Endorsed by Warren Buffett

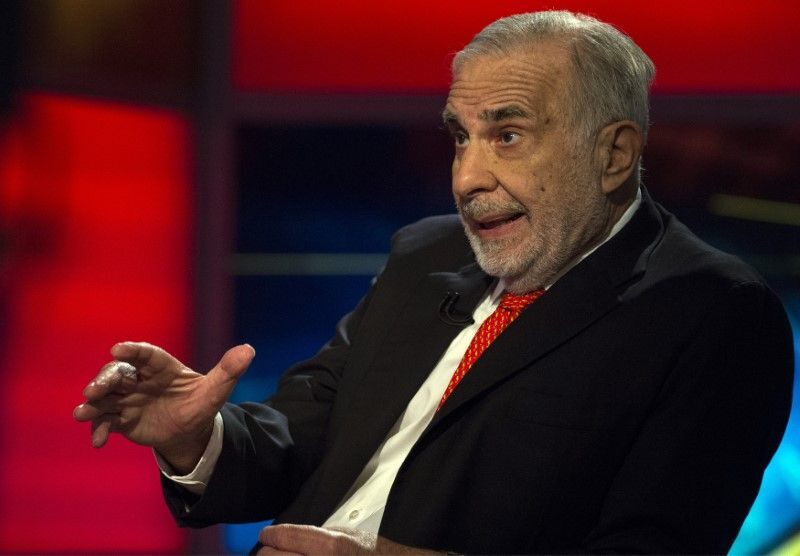

Gary Friedman, CEO, Restoration Hardware

Scott Mlyn | CNBC

Last week, Warren Buffett’s Berkshire Hathaway announced that it owned more than 1 million in shares of high-end furniture retailer RH, sending the stock up nearly 8% in one day.

Gary Friedman, the chief of the retailer formerly known as Restoration Hardware, counts Berkshire Hathaway among three companies, including Apple and Louis Vuitton-parent LVMH, that his company has modeled itself after.

“When ‘The Oracle [of Omaha] somehow finds your company in all the companies in the world,” he explained to Cramer, “I never got so many people call or text me about an event ever in the history of my career.”

Salesforce launches ‘single source of truth’ software

Marc Benioff, CEO of SalesForce at DreamForce in San Francisco on Sept. 25th, 2018.

CNBC

Salesforce founder Marc Benioff announced Tuesday that the newest wave of computing, known as single source of truth, is now on the market.

The co-CEO said in a “Mad Money” appearance that $22 billion worth of recent headline-grabbing acquisitions enabled the company to introduce Customer 360 Truth at Salesforce’s annual Dreamforce software conference.

“Now we’re entering the fourth stage of computing,” Benioff explained in an interview with Cramer. “It’s the pursuit of single source of truth, and we’ve built that into our platform.”

Mapping Square payments’ three pillars of growth

Square app for smartphone credit card swipe.

Jin Lee | Bloomberg | Getty Images

Square, the digital payments company widely known for the popular Cash App money transfer platform, has expanded its small businesses services from the credit card reader to more than 20 products in its decade of existence, Chief Financial Officer Amrita Ahuja told Cramer in an interview.

Now valued at $28.5 billion on the market, the firm is counting on “three horizons of growth” to power its future, she said. The strategies include scaling the customer base in Square’s buyer and seller ecosystems, boosting cross-sell functions and connecting the two ecosystems.

“What are the things that we can do uniquely at Square now that we see both sides of the counter the buyer and the seller – these are powerful and profound opportunities for us to explore in the coming years,” Ahuja said.

Square closed Tuesday at $66 per share, up 18% this year but nearly $17 off its early August highs.

Cramer’s lightning round

In Cramer’s lightning round, the “Mad Money” host zips through his thoughts about callers’ favorite stock picks of the day.

Ford: “Ford … we care about the dividend and I need to be sure they can pay it. Right now I’m saying be careful.”

: “Lightning struck once and that was good enough, and I would not stick around too long.”

: “I’m a little more conservative, which is why I like Novartis for that situation.”

Disclosure: Cramer’s charitable trust own shares of Novartis, Apple and Salesforce.com.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer’s world? Hit him up!

Mad Money Twitter – Jim Cramer Twitter – Facebook – Instagram

Questions, comments, suggestions for the “Mad Money” website? madcap@cnbc.com