China has made little progress on economic reform goals it laid out in 2013.

Out of 10 areas, Beijing has only made progress in one: increasing innovation. China is not reducing its economic reliance on state-owned enterprises or improving wages for migrant laborers.

That’s the finding of analysis using a new online data tool, The China Dashboard, introduced late Wednesday by the Asia Society Policy Institute and the Rhodium Group, a research and consulting firm.

Percentage of innovation value-add in China versus that of developed countries

Source: The China Dashboard

For five years, the team has gathered data on 10 areas of Beijing’s economic reform program: fiscal affairs, the financial system, trade, cross-border investment, innovation, competition, state-owned enterprise, entertainment, labor and land. The latest data on the dashboard is for the second quarter, and the analysts plan to update the database for at least the next two years.

China has set 2020 as a target for implementing the reforms it announced in 2013.

“Five-eighths of the time has run off the clock and we’re looking at progress on these reforms and we still have a long way to go,” Daniel Rosen, Rhodium’s founding partner, told CNBC in a phone interview. He said there was no major policy change at last month’s 19th National Communist Party Congress, except for a greater focus on quality over growth.

Rosen said the dashboard’s worst indicator on China’s economy was migrant worker wages.

For many years until the first quarter of 2016, migrant worker wages grew at a pace close to or far faster than China’s overall gross domestic product, The China Dashboard showed. But for more than a year, migrant worker wages have slumped to a ratio of 0.7 versus GDP, even as overall economic growth has slowed.

“Something’s going on that’s really hitting them quite hard,” Rosen said.

Ratio of migrant wage growth to real GDP growth

Source: The China Dashboard. Migrant wage growth is based on a price-adjusted, year-on-year figure.

China also doesn’t appear to be cutting back its reliance on state-owned enterprises, which are typically less efficient than privately owned corporations.

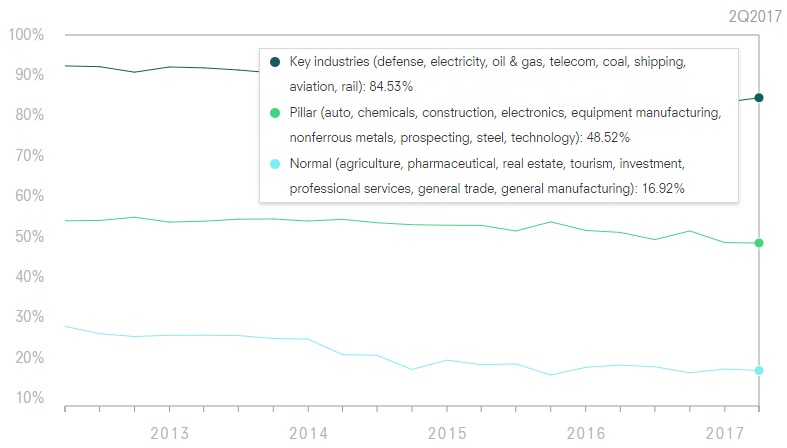

The China Dashboard divides Chinese industries into three kinds: “key” industries for which government involvement is reasonable, “pillar” industries such as equipment manufacturing, and “normal” industries such as tourism. The data showed little change over the last five years in the share of state-owned enterprise participation across all three divisions.

“Even in the most normal market, competitive-type industries, there’s no evidence of a reduction of state involvement and pressure,” Rosen said. State-owned enterprises accounted for nearly 17 percent of the “normal” industries.

Chinese state-owned enterprises’ share of revenue by industry division

Source: The China Dashboard

The China Beige Book, an independent survey of more than 3,300 companies in China, also said in its October report of the third quarter that China is not acting on stated reform efforts in key areas. China is not deleveraging, moving away from manufacturing-based industries or reducing oversupply in commodities industries, the analysis said.