Here are your FOX Business Flash top headlines for April 13.

BlackRock Inc. plans to launch its first product in China’s $220 billion onshore exchange-traded fund (ETF) market later this year and has started hiring staff accordingly, two people with direct knowledge of the matter told Reuters.

The world’s largest money manager, which thrives on the rise of passive investing with 70% of its $10 trillion global portfolio in ETFs and index funds, will be the first wholly owned foreign fund manager to tap the onshore Chinese ETF market.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Currently, the U.S. firm manages overseas assets of a handful of China’s large state-backed investors such as the country’s sovereign wealth fund and national pension fund via offshore units, as all products sold are foreign-domiciled.

The first BlackRock ETF product launch is scheduled for the fourth quarter, said the people, which will add to 6.8 billion yuan ($1.07 billion) worth of assets BlackRock manages through two mutual funds with investments in Chinese and Hong Kong stocks.

The headquarters of Blackrock, Inc in New York City. (iStock)

Several index providers have started talks with BlackRock, but the fund manager is yet to decide which index to track for the first ETF product, the people said.

Options under consideration include a carbon neutrality-themed index composed by China Securities Index Co, one of the people said. China has seen dozens of environment-linked ETF launches in the last two years betting on buoyant new-energy stocks.

BLACKROCK DISMISSES 3 MANAGING DIRECTORS FOR ENGAGING IN ‘COORDINATED’ EFFORT TO QUIT

“BlackRock is committed to helping more Chinese investors achieve their financial goals by bringing them a broader suite of investment products and solutions, including ETF and index investments,” the company said in a statement to Reuters.

It said it is “investing in more local talent” to support its “growth priority”.

China Securities Index did not immediately respond to a request for comment.

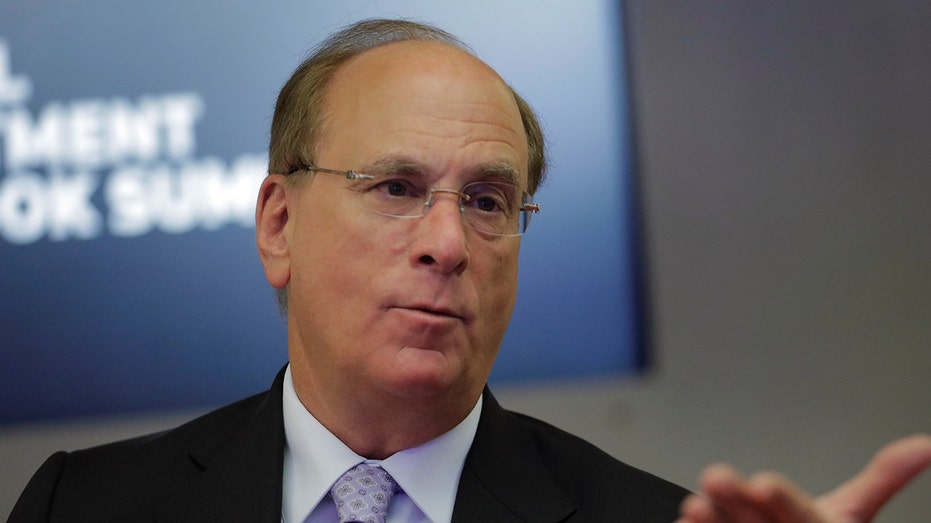

Laurence Fink, founder and chief executive officer of BlackRock, Inc. REUTERS/Lucas Jackson (REUTERS/Lucas Jackson / Reuters Photos)

BlackRock’s planned foray into the fast-growing Chinese ETF market comes against the backdrop of continued opening up of the financial market in the world’s second-largest economy.

The move will also bolster the fund manager’s presence in China, after it became the first global asset manager licensed to start a wholly owned onshore mutual fund business in the country last year.

CONSUMERS’ RESEARCH BLASTS BLACKROCK’S LARRY FINK FOR GOING ‘ALL-IN ON CHINA’

BlackRock’s ETF operation in China is set to open doors to local institutional as well as retail investors.

LUCRATIVE MARKET

China’s nascent $220 billion ETF market with over 600 products as at the end of 2021 has only in recent years started contributing meaningfully to a global passive fund boom that catapulted the sector beyond $10 trillion in value.

Assets in China’s onshore ETFs expanded 30.5% in 2021, almost on a par with the 31.9% growth rate of U.S. ETFs, but better than European peers’ 24.7% growth, showed data from the Shenzhen Stock Exchange.

BlackRock’s iShares, which “remained a significant growth driver” in 2021, according to Chairman and Chief Executive Larry Fink, drew in $306 billion assets last year, accounting for 57% of new money into all of the firm’s active and passive offerings.

BLACKROCK RESPONDS TO SOROS’ CRITICISM OF ITS CHINA INVESTMENTS

For its China ETF foray, BlackRock is recruiting for roles across ETF portfolio management, operations and focused marketing, said the two people. The firm initially plans to form a team of five to six employees, they said.

Measures to stop the spread of COVID-19 have largely curbed business activity in Shanghai, with candidate interviews being moved online, one of the people said.

BlackRock’s Shanghai office currently has at least 70 staff, showed fund association data, and is set to recruit over 15 more, excluding the ETF hires, company job adverts showed.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| BLK | BLACKROCK INC. | 714.82 | -1.94 | -0.27% |

Since China allowed fully foreign-owned fund units in 2019, a flurry of foreign fund houses, including U.S.-based ETF specialist VanEck, has applied for licences to operate in the local fund market.

CLICK HERE TO READ MORE ON FOX BUSINESS

Most of the equities ETFs in China charge a 0.5% management fee per annum, higher than 10 to 20 basis points charged by managers of such products in the U.S. and Europe, making it a lucrative market for foreigners.

The country’s 10 largest ETF providers, most of them local players, control over 80% of market share.

($1 = 6.3656 yuan)

(Reporting by Selena Li; Editing by Sumeet Chatterjee and Christopher Cushing)