The global economy is watching and waiting — nervously — to see whether President Donald Trump abrogates the North American Free Trade Agreement, something he threatened to do just last week while in Davos.

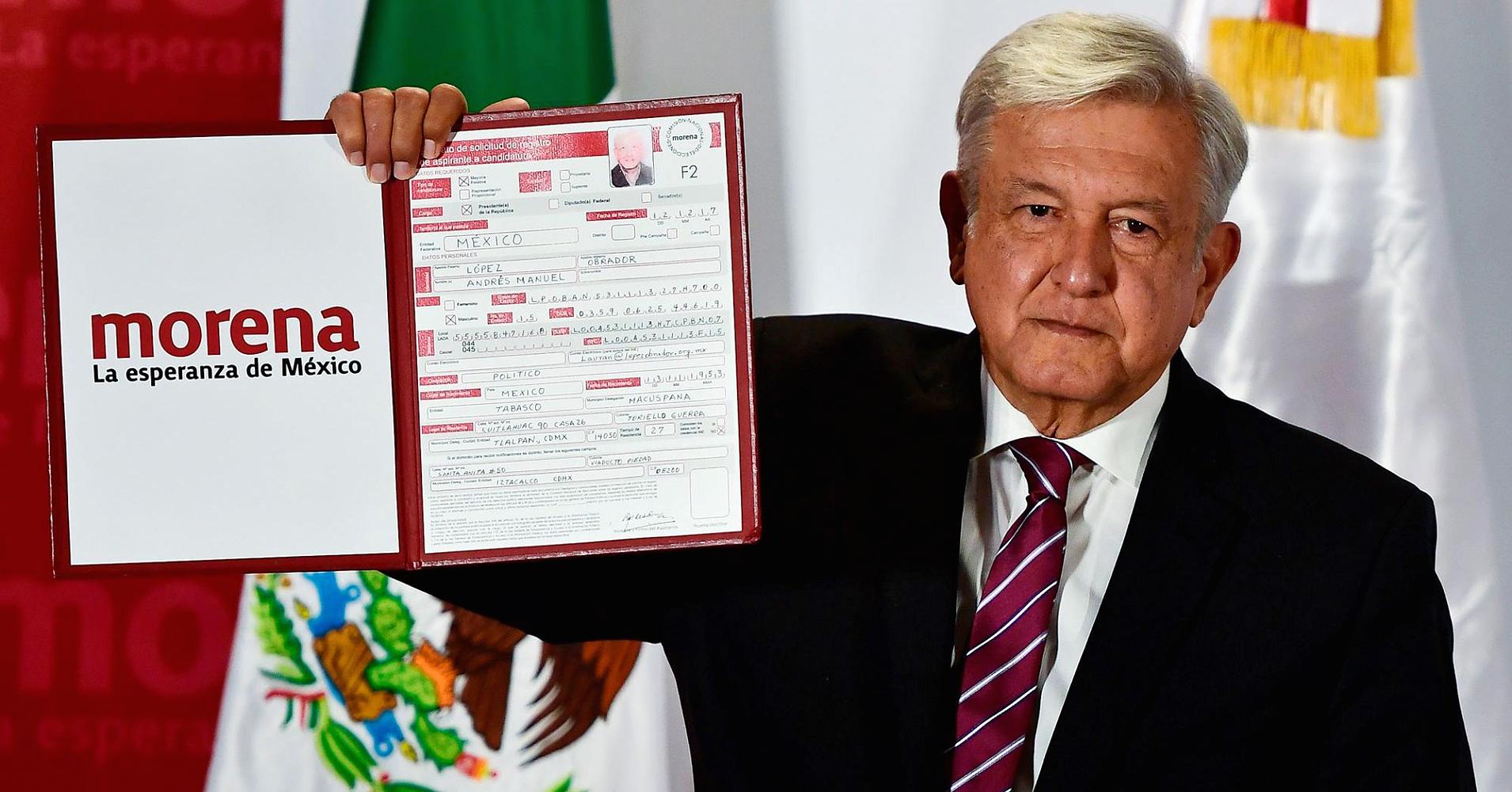

Yet according to analysts and investors, there’s another acute risk haunting Mexico, in the form of its upcoming presidential election. Andrés Manuel Lopez Obrador (also known as AMLO), a firebrand populist, is now leading in the country’s polls as the country gears up for a July vote that could have big implications for U.S.-Mexico relations.

A veteran politician who was once the mayor of Mexico City, Lopez-Obrador is making his third attempt at securing presidential power. Now, global investors are viewing his rise as a key risk ahead of the election, which could shake up the already tenuous state of NAFTA renegotiations.

Until now, the trade pact talks have been mostly viewed through the prism of domestic concerns in the U.S. — but popular opinion in Mexico is now becoming more of a factor.

“The market is not priced for this,” said Jim Barrineau, portfolio manager and co-head of emerging market debt with Schroders Investment Management said, noting that the Mexican peso has performed strongly in recent weeks.

“Since last year when the earliest polls showed [Lopez Obrador] with a lead, he has been a concern to investors,” Barrineau said. “The resonance of the corruption issue, which is the cornerstone of his campaign, suggests his lead may have staying power as the race heats up.”

The commodities sector, one of the country’s most prolific performers, the state owned oil company PEMEX—and its recent reform efforts — is being viewed as vulnerable if Lopez Obrador decides to “audit” the oil sector, analysts say.

“Even without explicitly rolling back the original reform, halting further oil sector opening would be seen as very negative,” said Barrineau.

As the Trump administration pushes ahead with its proposed reboot of the NAFTA negotiations, talks this month entered their sixth round of talks. Even as Trump suggested the U.S. could withdraw completely, both Canada and Mexico have hardened their positions.

“We think investors are likely to continue to be cautious about Mexico relative to other emerging markets. Even if NAFTA negotiations go smoother than anticipated, the election will trigger more market angst the closer it gets,” said Barrineau.

A Mexico without NAFTA would likely grow more slowly, and growth is already likely to be sluggish for the next few years. The U.S. economy’s strong growth is not translating into much faster Mexican growth, as has traditionally been the case.

Part of the country’s slow growth is due to high consumer prices. Mexico ended 2017 with inflation at 6.69 percent, which has pressured the central bank to keep borrowing costs high.

In recent years, local activity [in Mexico] has been resilient against a backdrop of volatile economic growth performance in the region. Nevertheless, Mexico’s economic growth has remained rather stable around 2 percent.

“Monetary policy action and central bank credibility have managed to maintain medium-and long-term inflation expectations well anchored despite the recent hump in actual inflation,” Marcelo Carvalho, head of emerging market research, Latin America, with BNP Paribas told CNBC.

NAFTA talks, however, remain a big wild card. Under the increasing risk of a dismantled trade pact, the short-term impact on Mexico might be significantly negative — especially if a populist president takes the helm of the economy. This scenario could mean investors flee Mexican assets, along with slower job creation sluggish business activity, analysts say.

In the medium and long-term, however, there is a potential silver lining if the end of NAFTA were to trigger a constructive effort to diversify Mexico’s trade towards other trade partners. Along with its having forged investment pacts within Latin America, analysts pointed out that Mexico has already signed free trade agreements with 46 countries.

“In fact, the strongest source of dynamism in Mexican exports recently has come from Asia and Europe,” Carvalho said.