Twitter has finally gotten its wings back, and one market watcher says the good times are yet to come.

Shares of the social media giant soared Tuesday after Morgan Stanley upgraded the stock to equal weight and put a $29 price target on it. The firm cited a “more compelling risk/reward” on better user growth and positive feedback from advertisers.

For Matt Maley of Miller Tabak, after a more than 32 percent run this year, “this chart looks quite good.”

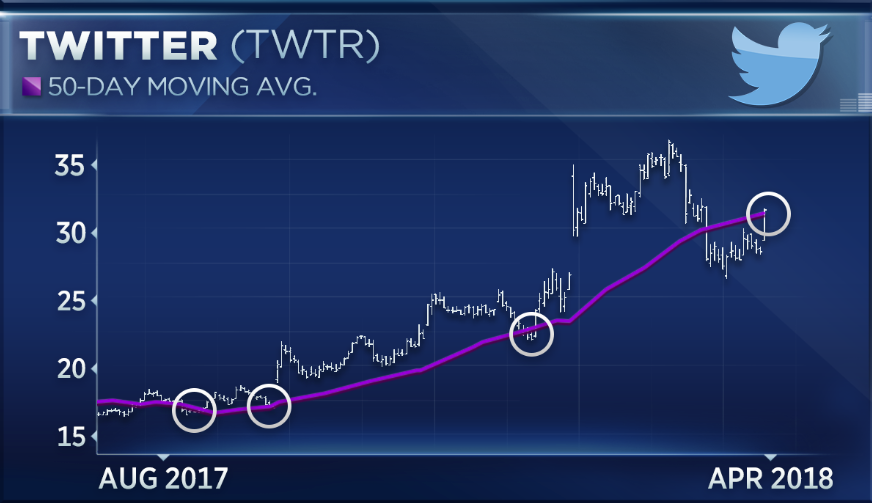

The social network’s move toward its 50-day moving average sets up a positive trend in the short term, Maley said Tuesday on CNBC’s “Trading Nation.”

“That had been key support in 2017,” said Maley. “Old support becomes new resistance and we’re bumping right up against that level now. If we can break above that, that’s going to be positive.”

Twitter shares held close to their 50-day moving average through the back half of 2017, but broke firmly below in early March. Until Tuesday’s session, its stock had not closed above the level.

Its shares surged more than 11 percent on Tuesday, closing at $31.84 and putting it above its 50-day moving average of $31.68. Maley says it could dip back below after Tuesday’s rally as investors consolidate gains, but a lengthier stretch above its 50-day level would be a positive development.

“On a longer-term basis, the stock is now breaking out. It’s been in a tight sideways range for two years now, creating a nice base,” said Maley. “But in late 2017, it broke above its trendline going back to 2013, and then broke above its sideways trend channel, so we’ve got a nice base, two breakouts to the upside plus a nice lower high.”

Twitter showed signs of stabilization that formed a base as it trended sideways from early 2016 to late 2017, Maley says. Its shares broke out of a sideways trading range earlier this year.

“We didn’t fall back into that trend, into that sideways channel, when the stock and the group sold off in February,” said Maley. “You’ve got a lot of nice things boding well for the stock at least on a technical basis.”

Larry McDonald, editor of the Bear Traps Report, is bullish on Twitter, but less so on the broader sector. He is underweight on technology, a group he says has the highest price-to-sales ratio at around a four times multiple. The S&P 500 trades at roughly half that multiple.

“I think you want to be very careful here with technology,” McDonald said on CNBC’s “Trading Nation” on Tuesday. “I would be lightening up on tech and moving toward energy and commodities here.”

The information technology sector has added more than 7 percent this year, the best performer on the S&P 500. The benchmark index is up around 1 percent.