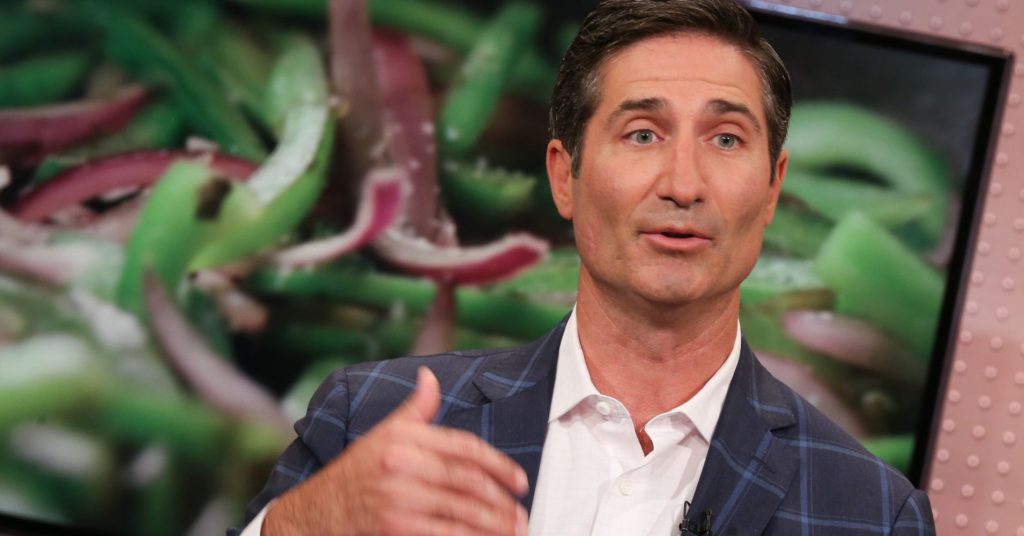

After years of struggling to compete with lower-cost Chinese counterparts, European telecommunications companies Nokia and Ericsson stand to win big from the U.S.-China trade war, CNBC’s Jim Cramer argued Wednesday.

“These once-beleaguered companies now have a chance to win the race for 5G supremacy,” he said on “Mad Money.” “Their equipment might be more expensive than what the Chinese can make. Sometimes I think a lot of people would say it’s even lower quality. Actually, I think the majority might say that. But you better believe neither Sweden nor Finland are pressuring their companies to spy on their customers.”

Cramer’s line of thinking stemmed from U.S. intelligence agencies’ crackdown on Chinese telecom players Huawei and ZTE, which have both been accused of having close relationships with the Chinese government and using their hardware to spy on U.S. consumers.

The flood of damaging news reports about the two companies — including stories about the White House considering an executive order to ban U.S. companies from purchasing their products and the criminal charges filed against Huawei’s chief financial officer — “hurts their ability to win new contracts,” Cramer explained.

“That’s where the opportunity comes in,” he said. “If you’re a telco carrier and you’ve been warned off of Huawei and ZTE, where are you going to go buy your 5G technology?”

Enter Nokia and Ericsson. After being “horrific underperformers” for years, their stocks have finally caught a two-pronged tailwind from their improving prospects in the 5G arena and the U.S. government’s China crackdown, the “Mad Money” host said.

Which stock wins out? Cramer thought both companies’ most recent earnings reports were solid, with Ericsson delivering strong sales and a bullish outlook for the year ahead and Nokia issuing good headline numbers. And even though Nokia’s stock dropped on what some saw as weak outlook for the first half of 2019, Cramer didn’t agree with the move.

“The truth is Nokia’s stock soared higher when Ericsson posted good numbers the week before, and stocks that run up into earnings tend to sell off even on strong numbers. Now, Nokia’s American shares are at $6.05, which, to me, is crazy,” he said. “I prefer Nokia here, both because it’s too cheap here and because it has a better portfolio of end-to-end solutions. I have not recommended Nokia since 1997.”

So while the U.S.-China trade dispute might be a hindrance to some industries, the global telecom space seems to be breathing a sigh of relief, Cramer concluded.

“For years, Nokia and Ericsson have been steamrolled by Huawei and ZTE. That’s over. Now, the U.S. government is doing everything it can to keep these companies out of 5G wireless, not just here, but worldwide, and that is a huge opportunity for Nokia and Ericsson,” he said. “I think they both work, although I do prefer Nokia, and I bet both stocks will get more attractive as our government keeps ratcheting up the pressure on well, our allies, to not use anything from these Chinese companies. Let’s be honest: convincing Europe to buy European? It isn’t really all that tough a sell.”

Questions for Cramer?

Call Cramer: 1-800-743-CNBCWant to take a deep dive into Cramer’s world? Hit him up!

Mad Money Twitter – Jim Cramer Twitter – Facebook – InstagramQuestions, comments, suggestions for the “Mad Money” website? madcap@cnbc.com