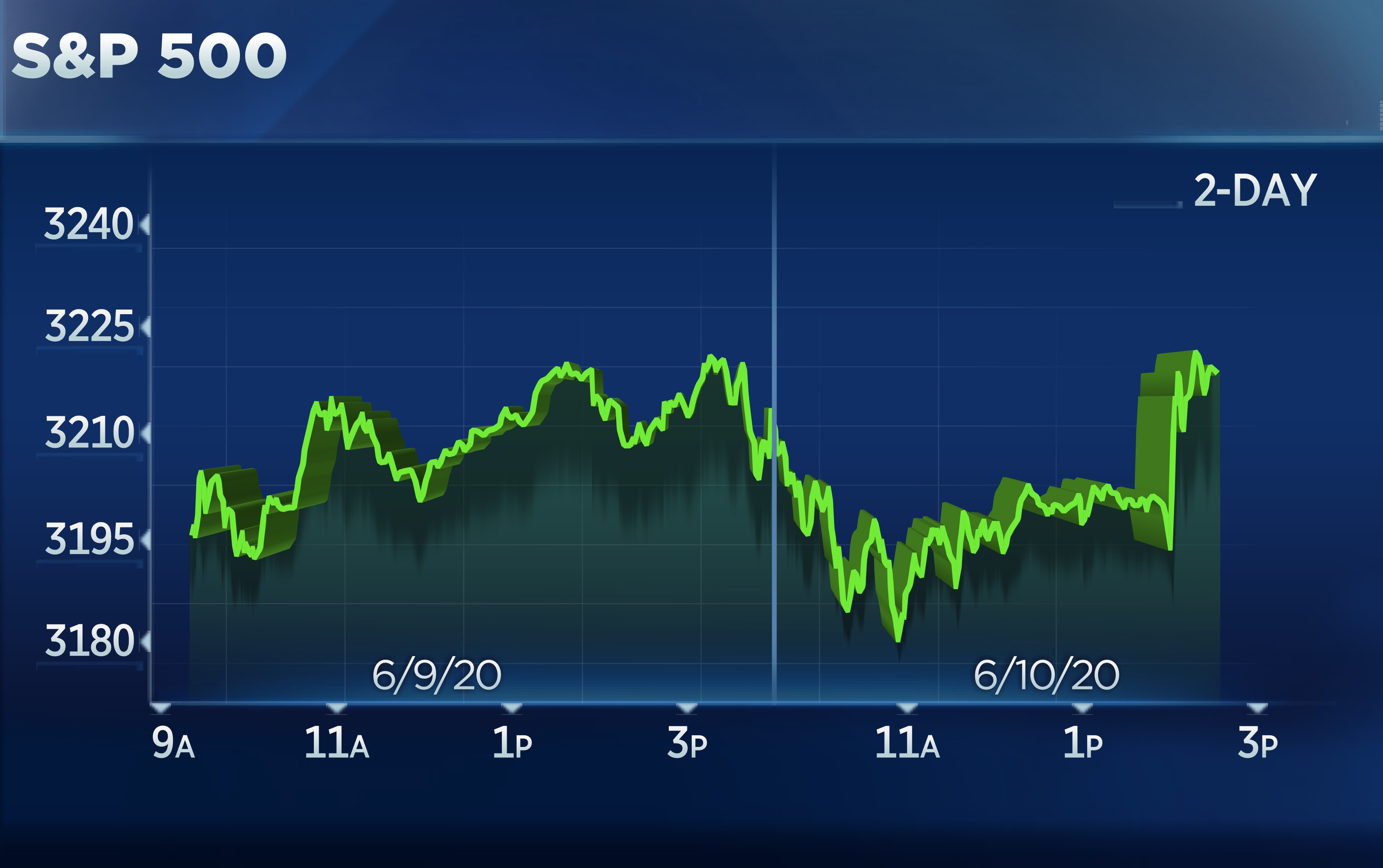

The S&P 500 and Dow Jones Industrial Average gyrated between gains and losses on Wednesday as traders pored through the Federal Reserve’s latest decision on monetary policy.

As of 2:43 p.m. ET, the S&P 500 traded 0.1% lower. The Dow was down 123 points, or 0.5%. The tech-heavy Nasdaq Composite rose 0.9% higher.

The Fed’s policymaking committee kept rates near zero and stated it “expects to maintain this target range until it is confident that the economy has weathered recent events and is on track to achieve its maximum employment and price stability goals.” The committee added it will increase its bond holdings by buying $80 billion per month in Treasurys and $40 billion per month in mortgage backed securities. The central bank indicated it expects to keep rates at currently low levels through 2022.

The Fed also expects the U.S. economy to contract by 6.5% in 2020 before expanding by 5% in 2021.

“I don’t think the Fed is going to back off at all here,” said Gregory Faranello, head of U.S. rates trading at AmeriVet Securities. “This is a longer-term endeavor. We think rates are going to be hon hold here for a long period of time. And, when you look at some of their programs, they’re just getting these lending facilities up and running.”

Fed Chairman Jerome Powell is expected to answer questions at 2:30 p.m.

Shares of Amazon and Apple gained more than 2% each and hit all-time highs. Alphabet and Netflix rose 0.6% and 0.2%, respectively. Stocks that would benefit from the economy reopening — which have outperformed in recent weeks — fell broadly. American Airlines, United and JetBlue all dropped more than 6%. Wells Fargo slid about 6% while Citigroup lost 3.7%. JPMorgan Chase traded about 2% lower.

“A large shift is occurring as investors cycle out of value/cyclical stocks for a second day and pour money into growth,” said Adam Crisafulli of Vital Knowledge, in a note. “Keep in mind: investors never left growth/momentum. There was a brief flirtation w/cyclical-value over the last couple of weeks, but this was just rental positions held by tourists (growth is still home base for the majority of people in this market).”

Wednesday’s moves come as Texas reports consecutive record surges in coronavirus-related hospitalizations while Arizona’s hospitalization rate is also rising.

The Dow and S&P 500 were under pressure on Tuesday as stocks benefiting from the economic reopening fell broadly. The Dow fell 300 points or 1.1%, snapping a 6-day winning streak. The 30-stock average was dragged down by a 5.9% drop in Boeing. The S&P 500 lost 0.8% on Tuesday. The index briefly turned positive for the year on Monday.

“After such a ferocious run in recent weeks, the stock market was overdue for a correction or at least a pause,” Jim Paulsen, chief investment strategist at the Leuthold Group, told CNBC. “Upside price momentum was becoming extreme and sentiment indicators a bit too bullish. Profit-taking won over [Tuesday], particularly in those economically sensitive area which have done the best in recent weeks.”

“Being overweight stocks most sensitive to an economic revival worked well in recent weeks but not earlier in the year and not today,” added Paulsen. “Alternatively, owning high-growth, new-era stocks worked well earlier in the year and did very well today but not in the last couple weeks.”

—CNBC’s Jeff Cox contributed to this report.

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.