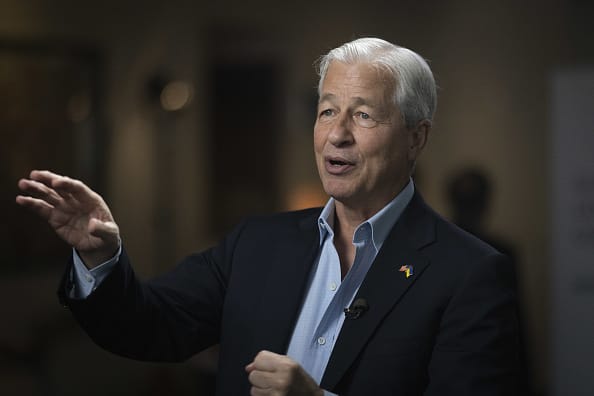

Jamie Dimon, chairman and chief executive officer of JPMorgan Chase & Co., during a Bloomberg Television interview at the JPMorgan Global High Yield and Leveraged Finance Conference in Miami, Florida, US, on Monday, March 6, 2023.

Marco Bello | Bloomberg | Getty Images

JPMorgan Chase posted record first-quarter revenue on Friday that topped analysts’ expectations as net interest income surged almost 50% from a year ago on higher rates.

Here’s what the company reported:

- Adjusted earnings: $4.32 per share vs. $3.41 per share Refinitiv estimate

- Revenue: $39.34 billion, vs. $36.19 billion

The bank said profit jumped 52% to $12.62 billion, or $4.10 per share, in the first three months of the year. That figure includes $868 million in losses on securities; excluding those losses lifts earnings by 22 cents per share, resulting in adjusted profit of $4.32 per share.

Companywide revenue rose 25% to $39.34 billion, driven by a 49% rise in net interest income to $20.8 billion, thanks to the Federal Reserve’s most aggressive rate-hiking campaign in decades.

Shares of the bank popped 6.1% in premarket trading.

“The U.S. economy continues to be on generally healthy footings —consumers are still spending and have strong balance sheets, and businesses are in good shape,” CEO Jamie Dimon said in the release.

“However, the storm clouds that we have been monitoring for the past year remain on the horizon, and the banking industry turmoil adds to these risks,” he said, adding that the industry could rein in lending as banks become more conservative ahead of a possible downturn.

JPMorgan, the biggest U.S. bank by assets, is watched closely for clues on how the industry fared after the collapse of two regional lenders last month. Analysts had expected JPMorgan to benefit from an influx of deposits after Silicon Valley Bank and Signature Bank experienced fatal bank runs.

At the same time, customers have been pulling money out of the regulating banking system as they realize they can earn higher yields in places like money market funds.

That appeared to take place at JPMorgan, which saw a 7% decrease in total deposits from a year ago to $2.38 trillion, slightly better than the $2.31 trillion estimate of analysts surveyed by StreetAccount.

While commercial clients have been pulling deposits for the past year as rates rose, retail customers have been far slower to act. Retail deposits climbed 3% at JPMorgan in the fourth quarter, for instance.

Now, it looks like Main Street customers have been seeking higher yields; deposits in the bank’s giant retail banking division dropped 4% in the first quarter.

Banks have also begun setting aside more loan loss provisions on expectations for a slowing economy later this year. JPMorgan posted credit costs of $2.3 billion, roughly in line with the StreetAccount estimate, as it built reserves by a net $1.1 billion and booked $1.1 billion in net loan chargeoffs.

JPMorgan’s fixed income trading business also helped the bank beat expectations, posting $5.7 billion in revenue, which topped expectations by about $400 million. Equities trading revenue of $2.7 billion was below the $2.86 billion estimate.

CFO Jeremy Barnum said in February that investment banking revenue was headed for a 20% decline from a year earlier, and that trading was trending “a little bit worse” as well.

Finally, analysts will want to hear what Dimon has to say about the economy and his expectations for how the regional banking crisis will develop. JPMorgan has played a central role in propping up a client bank, First Republic, which teetered last month, in part by leading efforts to inject it with $30 billion in deposits.

Another key question will be whether JPMorgan and others are tightening lending standards ahead of an expected U.S. recession, which could constrict economic growth this year by making it harder for consumers and businesses to borrow money.

Shares of JPMorgan are down about 4% this year before Friday, outperforming the 31% decline of the KBW Bank Index.

Wells Fargo and Citigroup also released results Friday, while Goldman Sachs and Bank of America report Tuesday and Morgan Stanley discloses results Wednesday.

This story is developing. Please check back for updates.