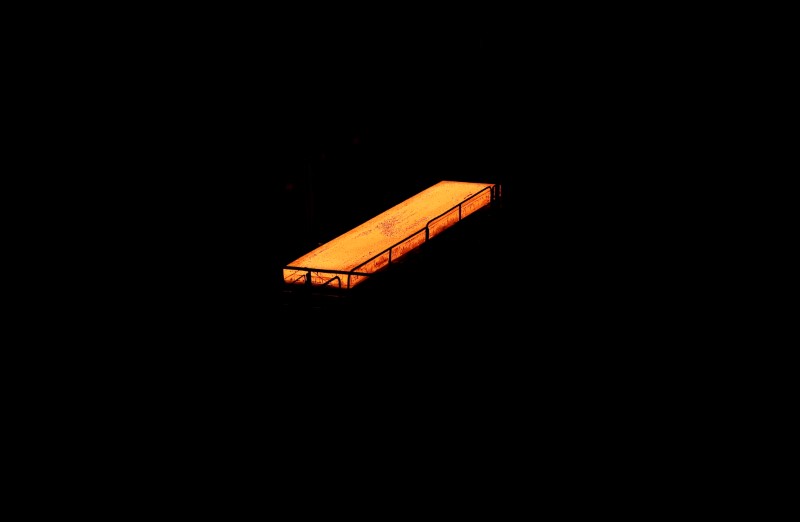

A production line of Nippon Steel & Sumitomo Metal Corp.’s Kimitsu steel plant is pictured in Kimitsu, Chiba Prefecture, Japan, May 31, 2018. REUTERS/Kim Kyung-Hoon

August 2, 2018

By Yuka Obayashi

TOKYO (Reuters) – Japanese steelmakers reported little fallout in their first-quarter earnings from the U.S. import tariffs on steel, but they all voiced growing concerns over possible U.S. duties on automobiles which could hurt a wide range of Japan’s industries.

U.S. President Donald Trump ordered a national security probe into imports of automobiles in May. Similar national security investigations were the precursor to the imposition of import tariffs of 25 percent on steel and 10 percent on aluminum in March.

Nippon Steel & Sumitomo Metal <5401.T>, Japan’s top steelmaker, on Thursday reported its recurring profit fell 19 percent in the April to June quarter from a year earlier, weighed down by lower appraisal gains in raw materials inventory and rising costs of secondary materials.

But it forecast a profit gain for the year to March 31 as it plans to boost steel output to meet local demand in automobiles and construction as well as raise product prices to pass on the rising costs of materials such as manganese and zinc.

“Demand for automobiles, including SUVs for North America and electric vehicles for Europe, are strong,” Nippon Steel Executive Vice President Katsuhiro Miyamoto said, adding that demand for industrial machinery and construction are also solid.

JFE Holdings <5411.T>, Japan’s second-largest steelmaker, logged a 41 percent jump in first-quarter recurring profit and raised its full-year forecast by 18 percent, on higher product prices.

Both companies shrugged off the U.S. steel tariffs in their quarterly earnings, but raised concerns of weakening demand linked with U.S. tariffs on autos.

“We had only limited impact from the U.S. duties so far,” JFE Executive Vice President Shinichi Okada said.

“But if U.S. tariffs expand into autos, we will have some impact as automakers are our major customers,” he said.

Nippon Steel has seen no major ramifications from the U.S. duties as its exports to the U.S. market are only 2 percent of its total shipments, Miyamoto said.

Rather, its U.S. units, which have an annual production capacity of 7.1 million tonnes, are benefiting from higher U.S. steel prices, he said.

“But our biggest concern is over autos,” he said, noting that Japanese steelmakers supply about 3.5 million tonnes of material a year for automobiles that are exported from Japan to North America.

“If it happens, the impact will be big,” he said.

(Reporting by Yuka Obayashi; Editing by Christian Schmollinger)