Shares of Intel fell 2 percent on Wednesday following reports that a security bug was present in the chip maker’s processors. According to one technician, who has been bullish Intel, the move presents the perfect opportunity for investors to buy the chip dip.

“Shares are still above rising 50 and 200-day moving averages,” Piper Jaffray chief market technician Craig Johnson wrote in an email to CNBC on Wednesday. “[Intel] would need to close below the December lows of $43 for the technical picture to change.”

With Intel trading at around $45.73 on Wednesday, the stock would have to fall another 5 or 6 percent in order for Johnson to get nervous.

“This stock has broken out of a huge base,” he said Tuesday in a “Trading Nation” segment on CNBC’s “Power Lunch.” “It looks a little bit extended … but I think we can continue to see this stock push a little bit higher, about another 9 percent or so.”

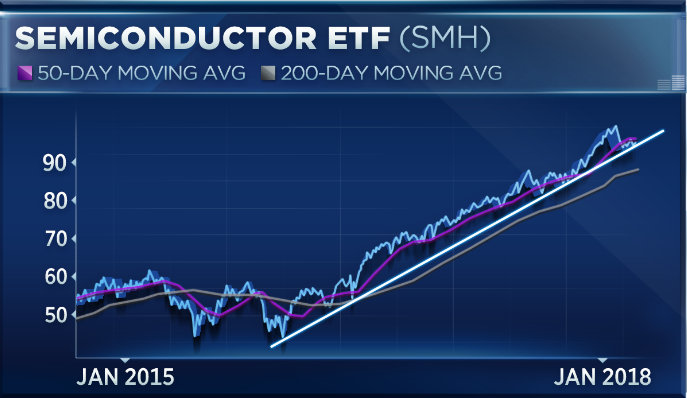

Additionally, Johnson also believes that the chip makers as a group are set for an even bigger rally. The semiconductor ETF (SMH) has started the year off strong, rallying more than 3 percent since Tuesday and bouncing back to levels unseen since the end of November.

Given the move, Johnson believes that SMH will have to break the $101 region around which the 50-day moving average sits for the recent jump to be meaningful.

“For now, you have to stick with this SMH trade to the long side, but you have to be watching that 50-day moving average,” he said.

On Wednesday, SMH was trading at $101.30, slightly above the 50-day moving average that Johnson said was key.

Chad Morganlander, a portfolio manager at Washington Crossing Advisors, remains overall bullish on the space and sees more upside ahead. He does, however, caution that there are fundamental factors that could derail the chip rally.

“In the long run, this … is hypersensitive to global growth, so if you start to see any kind of deceleration of investment spending, you have to not be quite complacent with this one,” he said on “Power Lunch.” “But we think in [the first quarter], you’re going to see an outperformance in relationship to the S&P 500.”

While Intel is one of the biggest components of SMH, the group as a whole continued to move higher on Wednesday as other names surged on the back of Intel’s processor issues.