The federal government should expand its guarantee to all bank deposits regardless of size in order to slow bank runs, but it should charge customers for that insurance, hedge-fund manager Nelson Peltz said Monday.

The Trian Fund Management founding partner told CNBC that customers pulling money out of smaller banks is a “dangerous situation” and that he has talked to elected officials about expanding the deposit insurance program that is currently capped at $250,000 per account. The change would involve paying insurance premiums to the Federal Reserve.

“I would put together a plan that applies only to U.S. banks in that the Fed gets an insurance premium for any money you leave in a U.S.-accredited bank over $250,000. So you’re creating income for the Fed, and in exchange for that they insure the overage,” Peltz said on CNBC’s “Squawk on the Street.”

Peltz’s idea comes in the aftermath of massive deposit outflows from U.S. regional banks in recent weeks. The failure of Silicon Valley Bank appeared to be caused by a bank run after customers with large accounts noticed issues with the bank’s balance sheet. Banks have been tapping the Fed’s crisis lending programs to handle those outflows.

The additional insurance premium could, for example, come out of the CD interest payments on large deposits, Peltz said. He added that he thinks it would be better if the fees were consciously paid by the consumers rather than just being built into the interest rates by banks. There could also be limits for how much deposits certain banks could take.

“You would have money flowing in here from all over the world. People would feel safe,” Peltz said.

Federal regulators did step in and guarantee uninsured deposits at SVB and Signature Bank after they failed earlier this month, though federal officials have said that protection does not extend to other banks. Peltz argued that this implicit guarantee for deposits should be made official.

“They do it anyway. Let’s create some income for them; let’s have the system smoothed out and give people peace of mind,” Peltz said.

The hedge-fund manager is not the only person calling for raising the insurance threshold. Former Goldman Sachs executive and Trump administration advisor Gary Cohn said on CBS’ “Face the Nation” on Sunday that regulators should consider raising the insurance cap dramatically and implementing a tiered pricing system to pay for it.

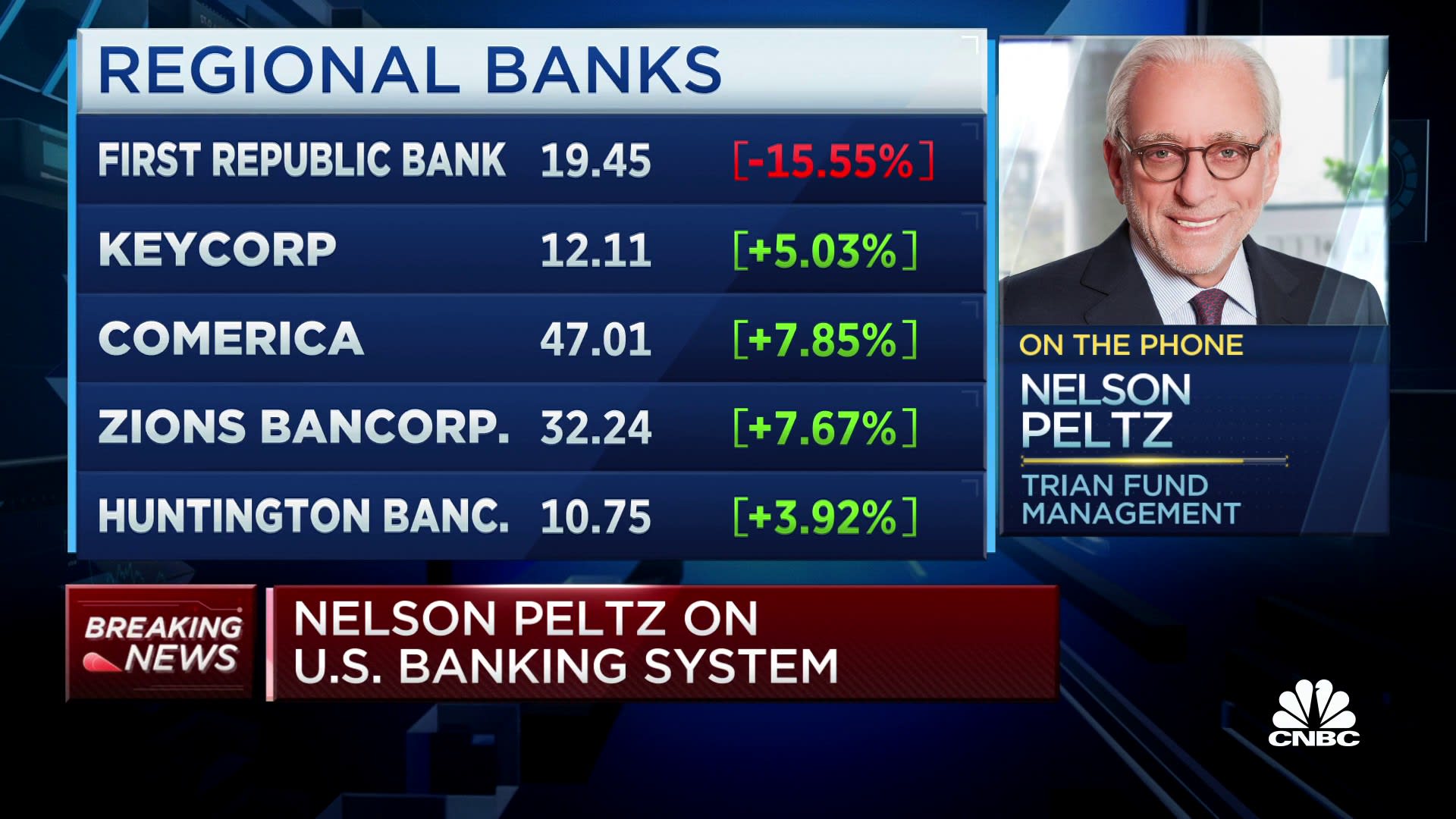

Regional bank stocks were largely rebounding Monday, though First Republic was still under pressure despite receiving $30 billion in deposits from other banks.

Peltz said it was important to make changes to the deposit insurance program even if the current situation stabilizes.

“The peak of the panic is probably behind us, but that doesn’t stop the next one from coming,” Peltz said.