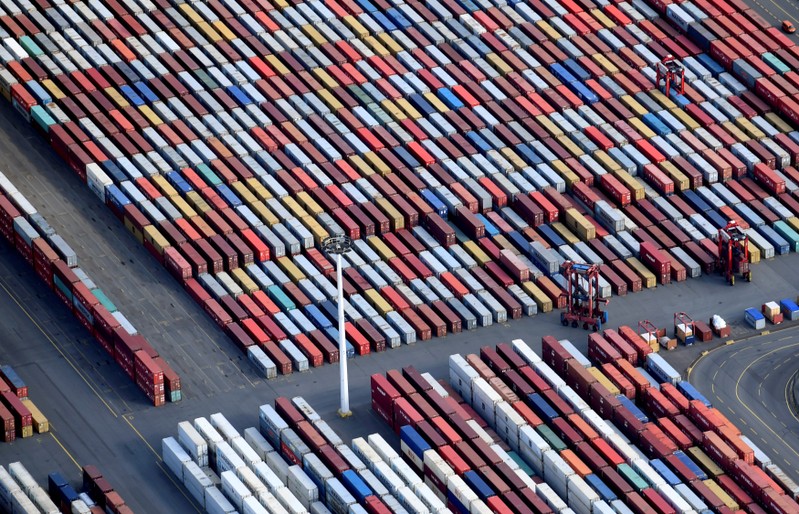

FILE PHOTO: Aerial view of containers at a loading terminal in the port of Hamburg, Germany August 1, 2018. REUTERS/Fabian Bimmer/File Photo

October 10, 2019

BERLIN (Reuters) – German exports fell by more than expected in August, data showed on Thursday, reinforcing expectations that a manufacturing slump is pushing Europe’s largest economy into recession.

The Federal Statistics Office said seasonally adjusted exports fell 1.8% on the month while imports rose 0.5 %. The trade surplus narrowed to 18.1 billion euros ($19.88 billion)after an upwardly revised 20.5 billion euros in the prior month.

August’s drop in exports was the steepest since April.

A Reuters poll of economists had pointed to a 1.0% drop in exports and a 0.2% fall in imports. The trade surplus was expected to come in at 19.1 billion euros.

Germany’s export-reliant manufacturers are suffering from a slowing world economy and business uncertainty linked to a trade dispute between the United States and China as well as Britain’s planned but delayed exit from the European Union.

Data published on Monday showed German industrial orders fell more than expected in August on weaker domestic demand.

Last Wednesday, leading economic institutes slashed their growth forecasts for the economy for this year and next, blaming weaker global demand for manufacturing goods and increased business uncertainty linked to trade disputes.

The institutes also called on Chancellor Angela Merkel’s coalition government to ditch its budget policy of incurring no new debt if the growth outlook deteriorates. It has so far refused to do so.

Merkel’s government has managed to raise public spending without incurring new debt since 2014, thanks to an unusually long growth cycle, record-high employment, buoyant tax revenues and the European Central Bank’s bond-buying plan.

But with the economy slowing and tax revenues waning, the fiscal room to counter a recession is getting smaller. At the same time, Germany’s borrowing costs have turned into premiums, which means investors are actually willing to pay the state a bonus for being able to lend it billions of euros.

(Writing by Paul Carrel; Editing by Michelle Martin)