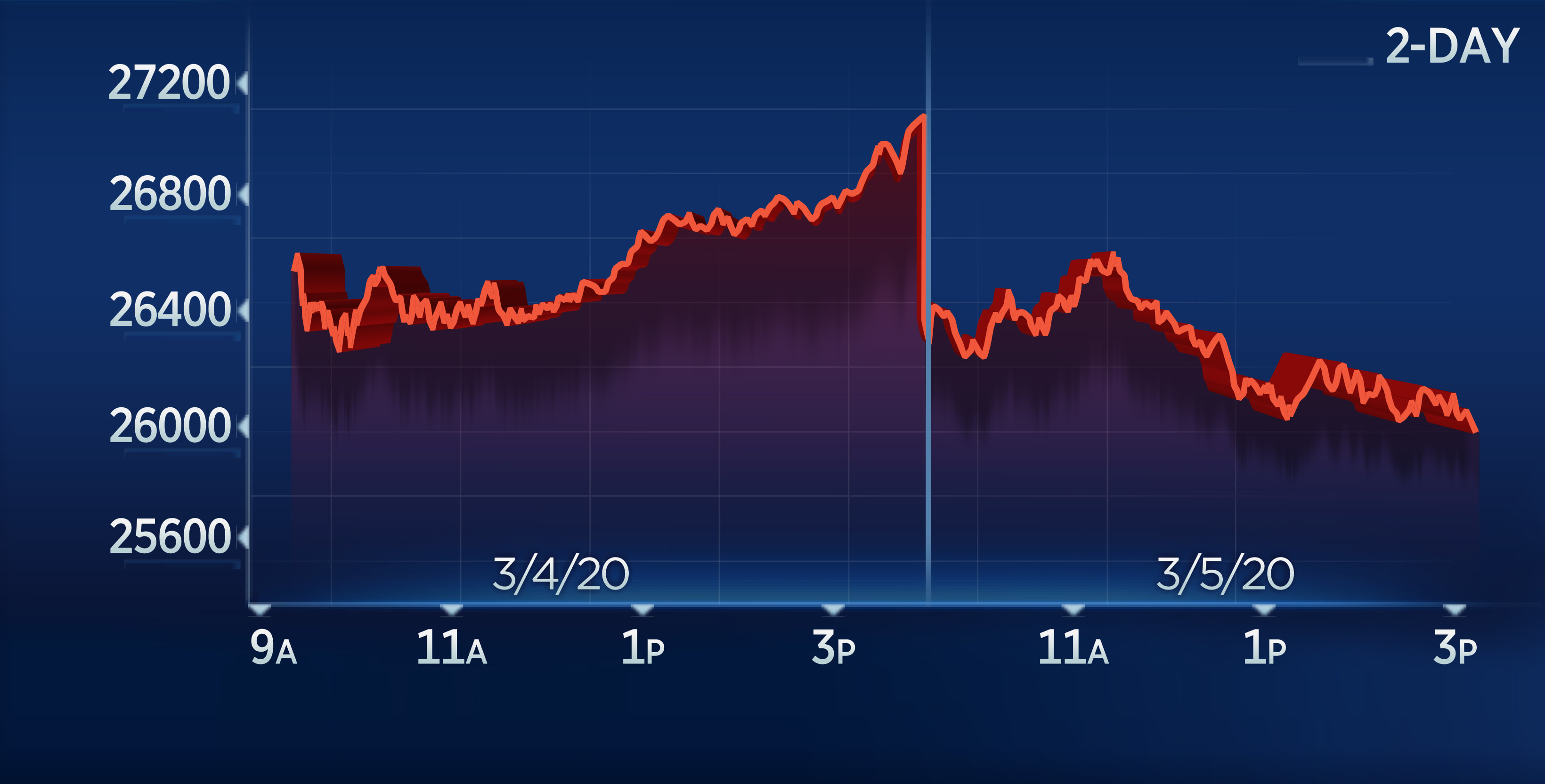

Stocks plunged on Thursday, erasing the steep gains in the previous session, as markets remained highly volatile in the face of the fast-spreading coronavirus.

The Dow Jones Industrial Average dropped 976 points, or 3.6%, in afternoon trading. The S&P 500 dropped 3.5% and the Nasdaq Composite fell 3.1%. Stocks hit their session lows as the rate on the 10-year Treasury note fell to an all-time low below 0.9%. All 11 S&P sectors and all 30 stocks in the Dow were in the red.

Fears about the coronavirus disrupting the global economy continued to grip Wall Street as countries around the world extended quarantines and travel restrictions. California declared a state of emergency after a coronavirus-related death and 53 confirmed cases in the state. The number of infections in New York also doubled overnight to 22 as the state ramps up its testing.

“The majority of this is just growing concern about the fallout from the virus because it’s spreading,” said Tom Essaye, founder of the Sevens Report. “For every hour, another group of people have it and it’s in another state. People are getting a bit nervous about this constant barrage of headlines.”

That angst fueled investor demand for safer assets like U.S. Treasurys and gold, which rose nearly 1%. The tumbling yields kept pressure on bank stocks, which led the major indexes lower. JPMorgan and Bank of America both dropped nearly 5%. M&T Bank fell 5.1% and Fifth Third sank 4.9%.

Airline stocks also took a huge beating, leading the declines in the Dow Jones Transportation Average, which hit bear market levels Thursday. United Airline cratered 9%, while American Airlines tanked more than 10%, on pace for its worst day since 2016.

The market moves came amid a roller-coaster week on Wall Street, which saw the 30-stock Dow swinging 1,000 points or higher twice in the past three days.

The Dow posted its second-biggest point gain on Wednesday as major wins from former Vice President Joe Biden during Super Tuesday sparked a relief rally, especially in the health-care sector. Investors also cheered signs of a global response to the outbreak, including a more than $8 billion in emergency funding from Congress.

“The optimism coming off Super Tuesday has come and gone and we reverted to being driven by fear over the containment of the virus and the impact it’s going to have on the global economy down the road,” said Mike Loewengart, managing director of investment strategy at E-Trade.

On Tuesday, the Federal Reserve cut its benchmark interest rate unexpectedly by 50 basis points, citing that coronavirus “poses evolving risks to economic activity.” It was the central bank’s first such emergency cut since the 2008 financial crisis.

The move failed to assuage stock market concerns about the potential economic impact of the coronavirus outbreak and triggered sharp movements in the markets.

“Despite the rally in stocks [Wednesday], Treasury yields and gold prices did not respond in-kind,” said Matt Maley, chief market strategist at Miller Tabak. “None of the other markets saw the kinds of moves yesterday that would indicate that we’re out of the woods on the negative impact of the coronavirus. In other words, many other markets are still sending up warning signals.”

Investors will monitor a key jobs report on Friday for signs of any negative impact on the labor market from the coronavirus.

The weekly jobless claims data on Thursday underscored the labor market strength despite the outbreak. Initial claims for state unemployment benefits slipped 3,000 to 216,000 for the week ended Feb. 29. Economists polled by Reuters had forecast claims would fall to 215,000 in the latest week.

—CNBC’s Thomas Franck and Fred Imbert contributed to this report.