There is one stock during this explosive bull market working for the shorts.

A day after Greenlight Capital’s David Einhorn lamented over his losing in his short positions against Amazon and Tesla, some hedge fund investors are winning big from their bearish bets on Chipotle.

Shorting is a trading strategy where investors borrow and sell shares in hopes of buying them back at a profit after a drop. This kind of trading is mostly done by sophisticated hedge funds.

Bets against Chipotle increased by $238 million in size this month, according to S3 Partners estimates in a note sent to clients Wednesday.

“Chipotle is the largest short in the U.S. Restaurant sector at $1.76 billion. Short sellers were active in October, ahead of the earnings report,” Ihor Dusaniwsky, head of research at S3, wrote. “Shorts were rewarded for their conviction.”

Chipotle dropped 15 percent Wednesday, a day after the company reported disappointing third-quarter earnings results.

The stock’s short sellers are up $261 million in mark-to-market profits midday Wednesday and up $303 million for the year, according to S3 estimates.

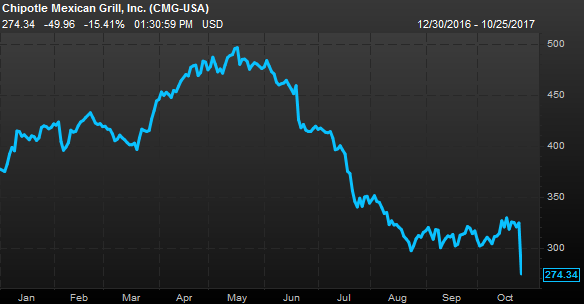

Chipotle year-to-date stock chart

Source: FactSet

The restaurant chain is one of the worst-performing stocks in the market year to date. Its shares are down 27 percent through midday Wednesday compared with the S&P 500’s 14 percent gain.

One hedge fund manager that is not enjoying the stock price move is Pershing Square’s Bill Ackman. His firm owned 2.9 million shares of Chipotle as of the end of June, according to FactSet. The stake lost nearly $140 million of value midday Wednesday.