Biotech is blazing higher.

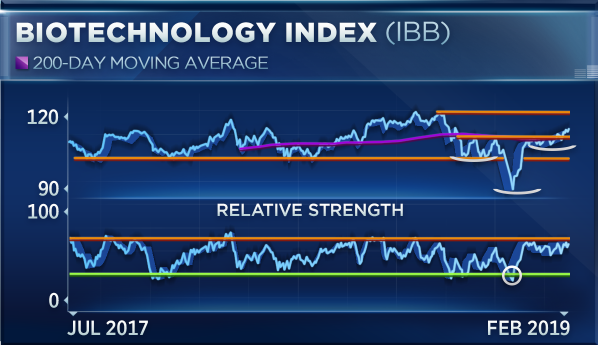

The IBB biotechnology ETF is on track for its best quarter in six years, adding 19 percent in a rally twice as steep as the gains on the XLV health care ETF.

Craig Johnson, chief market technician at Piper Jaffray, says biotech should continue to be a healthy trade.

“For a lot of investors, they’re trying to play catch-up at this point in time, and they’re going to continue to play these risk assets,” Johnson said Friday on CNBC’s “Trading Nation.” “We still see decent upside from here to go — perhaps about 6 percent higher from here, maybe as high as 13 percent higher.”

A move at the high end of that range would take the IBB back to levels not seen since August 2015.

“One of the names that looks pretty good to us is Regeneron,” Johnson said. “This stock has reversed the downtrend off the ’17 highs. It’s made a higher low and it looks like it’s a pretty good setup back to about $525, so a good setup and a good risk-reward.”

If Regeneron returned to $525, it would mark a 19 percent rally from Friday’s close. It last traded at those levels in mid-2017.

John Petrides, portfolio manager at Point View Wealth Manager, has a different pick for biotech stock ready to race higher.

“We like to play in the larger-cap space, particularly Gilead,” Petrides said on “Trading Nation” on Friday. “Gilead is about 40 percent off its peak from August 2015. The stock is really attractive from a valuation standpoint, trading at less than 10 times earnings. You have a 3.8 percent dividend yield which they have grown 20 percent per year over the last three years.”

It also has potential to grow even more, says Petrides.

“It has a war chest of a balance sheet with about $20 billion, $25 billion in cash. They’re making a play on oncology and they have more money to throw at future acquisitions to really buy their top-line growth,” said Petrides.

Gilead has underperformed the rest of the biotech space this year. Its stock has added 6 percent compared with a 19 percent move higher for the IBB and 18 percent gain in Regeneron shares.

Disclosure: Petrides and Point View hold shares of Gilead.