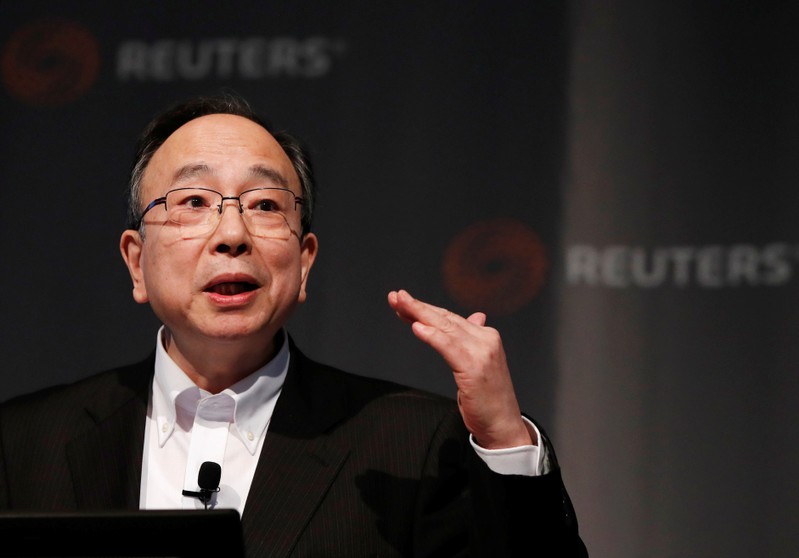

Bank of Japan Deputy Governor Masayoshi Amamiya speaks during a Reuters Newsmaker event in Tokyo, Japan July 5, 2019. REUTERS/Issei Kato

July 5, 2019

TOKYO (Reuters) – Bank of Japan Deputy Governor Masayoshi Amamiya on Friday brushed aside the idea that central banks can boost the effectiveness of negative interest rate policies by issuing digital currencies.

If central banks issue digital currencies and apply negative rates on them, households and companies will hold cash instead to avoid being charged for holding digital currencies, he said.

“To overcome the nominal zero lower bound, central banks would need to eliminate cash,” Amamiya said. “Eliminating cash would make settlement infrastructure inconvenient for the public, so no central bank would do this,” he said in a speech delivered at a Reuters Newsmaker event.

(Reporting by Leika Kihara; Editing by Chris Gallagher)