Autodesk shares jumped as much as 13 percent on Wednesday after the maker of design software reported better-than-expected quarterly results.

The stock climbed $12.41 to $135.46 as of mid-afternoon after reaching as high as $139.40. Even with today’s rally, the shares are down more than 12 percent since the end of August amid a broader slump in technology stocks.

Like Adobe, Microsoft and other software companies that focus on selling to big clients, Autodesk has been transitioning to a subscription model in recent years. After markets closed on Tuesday, the company reported 28 percent revenue growth to $660.9 million in its fiscal third quarter, topping the $640 million average analyst estimate, according to Refinitiv. Earnings of 29 cents a share, excluding certain items, beat analysts’ average estimate of 27 cents.

Annual recurring revenue, which consists mostly of subscriptions to products used by architects, engineers, and visual artists, reached $2.53 billion, above the FactSet consensus estimate of $2.46 billion.

“The strong ARR growth in the quarter adds confidence to the company’s FY20 and FY23 targets in our view,” wrote KeyBanc Capital Markets analysts Monika Garg and Jason Celino, in a note to clients on Tuesday.

Autodesk’s guidance for the fourth quarter also came in ahead of estimates. The company predicted it would generate 40 cents to 44 cents in earnings per share, excluding certain items, on $700 million to $710 million in revenue. Analysts polled by Refinitiv expected earnings of 40 cents per share on $688.9 million in revenue.

Along with its earnings report, Autodesk also announced its acquisition of construction software provider PlanGrid for $875 million. Autodesk said PlanGrid will contribute around $100 million in ARR in its 2020 fiscal year even as it will be somewhat dilutive to the company’s profit over that stretch.

“We view the acquisition very positively, and this strengthens Autodesk’s competitive position and opportunities in construction,” wrote Garg and Celino, who have an “overweight” rating and $158 price target on the stock.

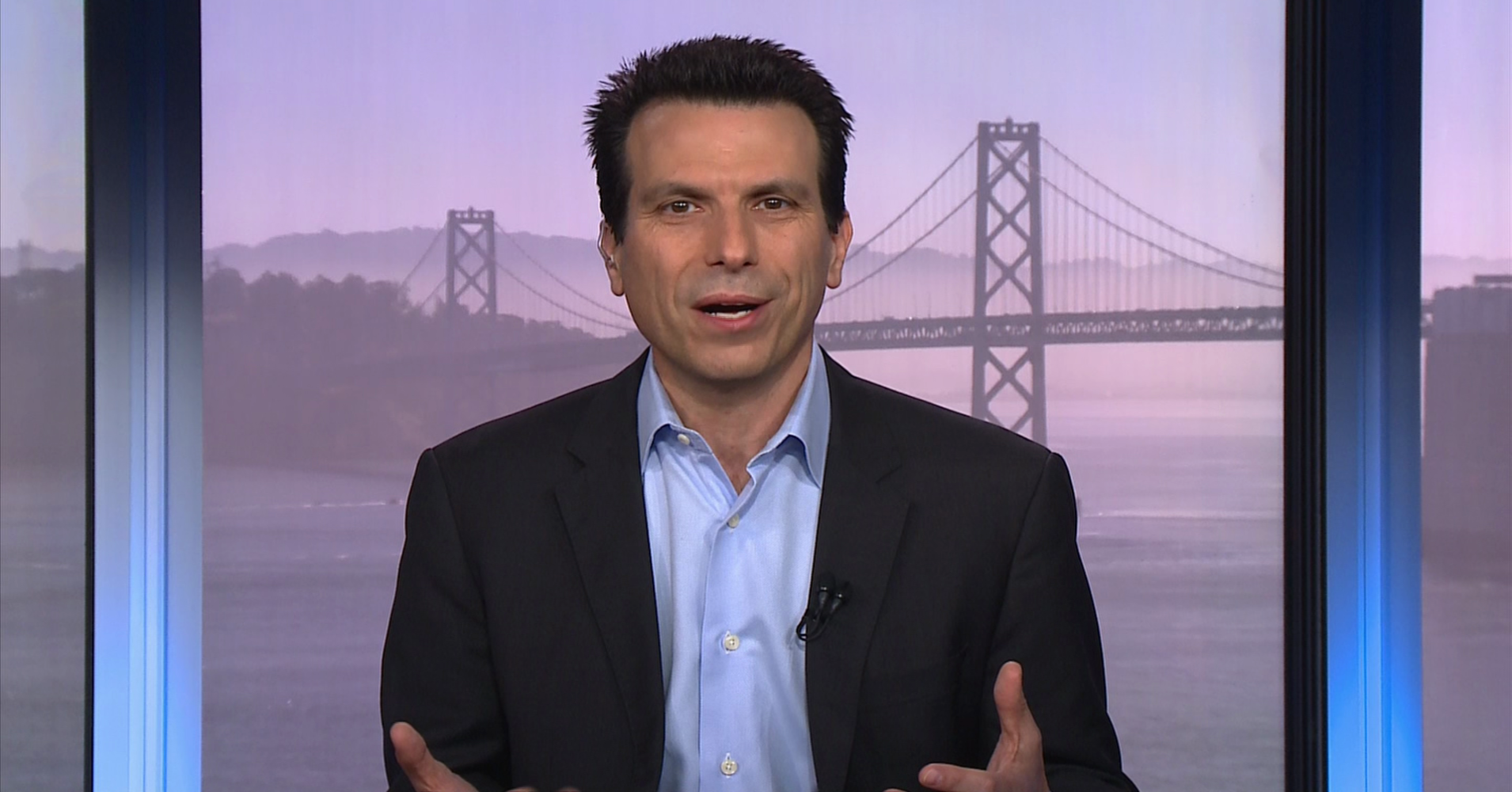

Autodesk CEO Andrew Anagnost said on the earnings call that the company already has some customer overlap with PlanGrid.

“PlanGrid has built a go-to-market machine that’s very good at selling on a project-by-project basis,” Anagnost said. “There’s a really great complement between their project-centric go-to-market approach and our IT or top-of-the-market go-to-market approach.”