The stock market’s nearly 3% plunge Monday, the worst trading day of the year, did not shake the resolve of one of Wall Street’s top investment firms.

Goldman Sachs is holding its year-end price target for the S&P 500 at 3,100, which would represent a 9% advance from Monday’s close and a gain of 23% for all of 2019.

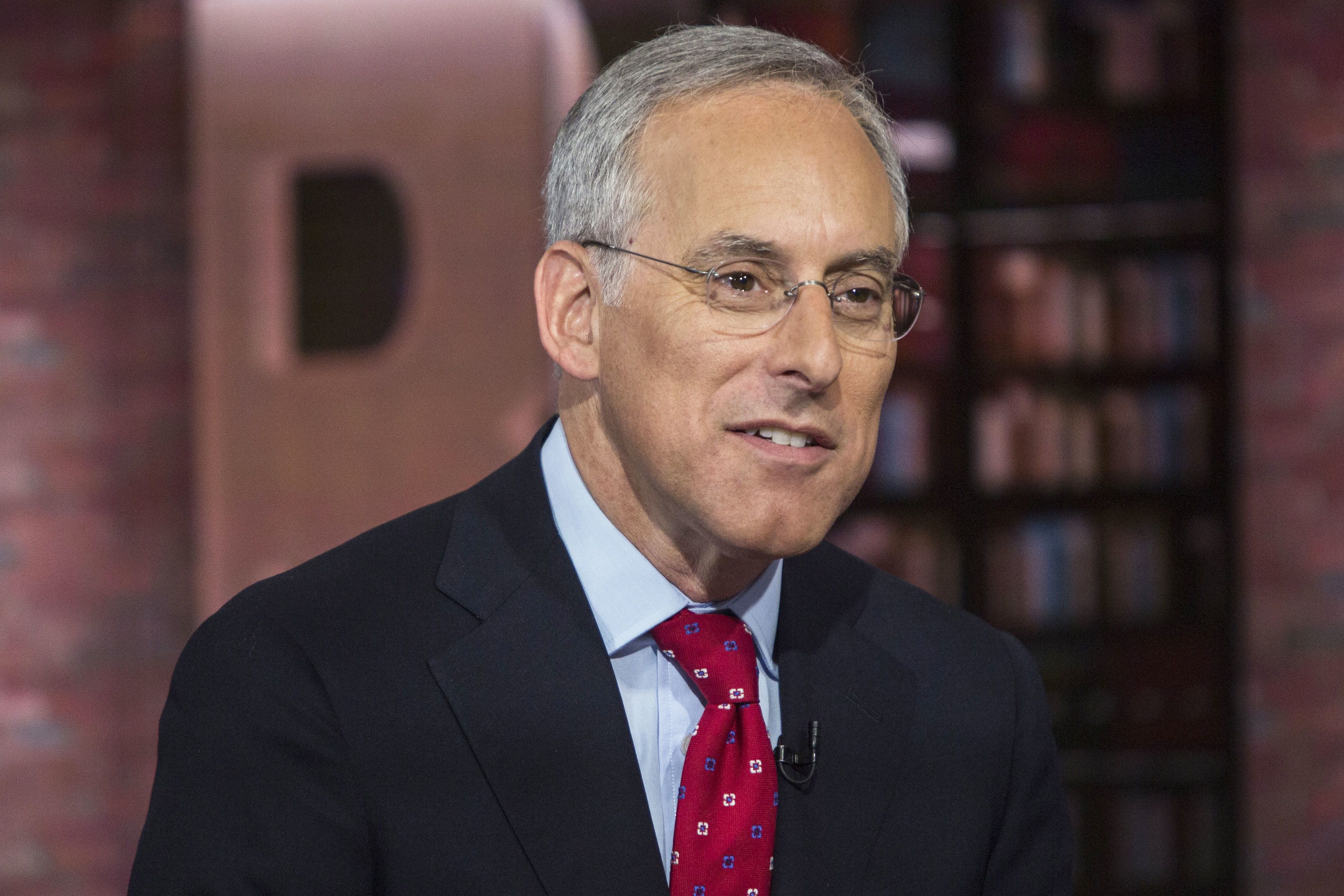

“There’s definitely a risk on the tariffs and the trade” dispute between the U.S. and China, Goldman Chief U.S. Equity Strategist David Kostin told CNBC on Tuesday. However, against of a backdrop of a 10-year Treasury yield below 2% and a stable economy, he said, “The general thrust of what’s taking place fundamentally is still pretty much in line.”

Kostin said on “Squawk on the Street” that much of the damage in the stock market, measured by the roughly 6% decline in the S&P 500 from last month’s all-time highs, has been multiple compression.

“The start of the year, the market was trading around 14 times forward earnings, peaked last month at 18 around times forward earnings,” he noted. “Almost all, 95%, of the return of the market this year was driven by valuation expansion as opposed to something more fundamental.”

Kostin did acknowledge the difficulty in managing the shifting priorities of the White House.

“I would say to clients it’s difficult to model President Trump, ” he said, pointing out that the market-friendly interest rate cut by the Federal Reserve last Wednesday was followed less than 24 hours by a Trump tweet threatening to put tariffs on the rest of the imports from China, starting Sept. 1.

The S&P 500’s six-session losing streak culminated in Monday’s nosedive on concerns about the U.S.-China trade war also becoming a currency war. The index was slightly positive early Tuesday afternoon.

Investors were encouraged by China allowing its currency to rise Tuesday, setting it below the key 7-yuan-per-dollar level, after letting it to drop Monday to its lowest level in more than a decade.

That devaluation led to the Treasury late Monday labeling China a “currency manipulator,” the first such designation in 25 years, all the way back to the Bill Clinton presidency.

On Tuesday, China’s state newspaper accused the U.S. of “deliberately destroying international order.” An editorial by the People’s Daily said, “A country without integrity will be lonely,” according to CNBC’s translation.