America’s popular mortgage interest deduction is about to lose a lot of its punch.

The House Republican tax plan halves the cap on the deduction of mortgage debt for newly purchased homes to $500,000. It does, however, maintain the current deduction of up to $1 million in mortgage debt for current homeowners.

The plan also nearly doubles the standard deduction, meaning fewer taxpayers would itemize and take the mortgage interest deduction. Currently, about 21 percent of filers take the mortgage deduction, but under the new framework only about 4 percent would, according to recent estimates from the Tax Policy Center.

The Republican plan also allows state and local property tax deductions of up to $10,000.

This will hit the Northeast hard – New Jersey, New York and Connecticut have some of the highest property tax rates and the highest-priced homes. It will hurt less for states in the South, where tax rates and home prices are low. Hawaii does have the lowest property tax rate in the nation but the highest median home price. Washington, D.C., is much the same. California falls in the middle on property tax rates but has some of the highest home prices in the nation.

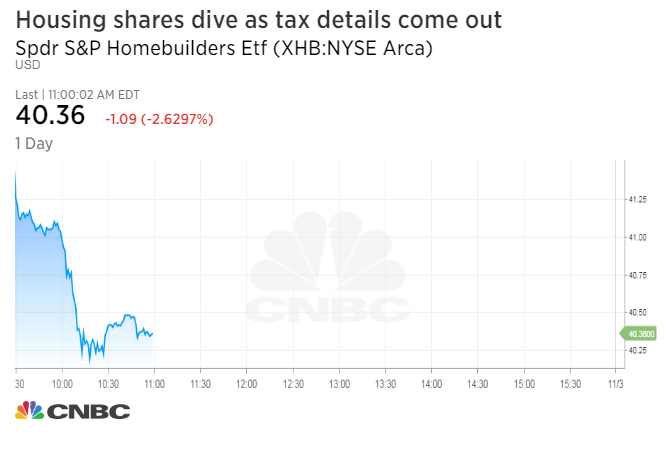

Homebuilder and overall housing stocks moved lower on the news and are now at their worst levels of the day.

The housing industry has been lobbying hard to keep homeowner incentives, and this is not what they were looking for.

“We are currently reviewing the details of the tax proposal released today, but at first glance it appears to confirm many of our biggest concerns about the Unified Framework,” said National Association of Realtors President William Brown, in a statement.

“Eliminating or nullifying the tax incentives for homeownership puts home values and middle-class homeowners at risk, and, from a cursory examination, this legislation appears to do just that.”

In a statement, the National Association of Homebuilders called the plan “particularly disappointing.”

“By sharply reducing the number of taxpayers who would itemize, what’s left is a tax bill that essentially eviscerates the mortgage interest deduction and strips the tax code of its most vital homeownership tax benefit,” said NAHB Chairman Granger MacDonald.

“Contrary to their assertions, the Republicans are picking winners and losers,” NAHB CEO Jerry Howard told The New York Times. “They are picking rich Americans and corporations over small businesses and the middle class.”